A Complete Guide to Understand Initial Public Offerings (IPOs)

In the dynamic arena of finance, few events stir as much excitement and speculation as Initial Public Offerings (IPOs). An IPO marks a significant milestone in a company’s journey, symbolizing its transition from a privately held entity to a publicly traded powerhouse.

However, behind the allure of IPOs lie complexities, risks, and opportunities that savvy investors must navigate with care. In this comprehensive guide, we delve into the intricacies of IPO investing, uncovering the strategies, considerations, and insights that can help you unlock the wealth-building potential of this intriguing market.

Also read: Why Is Financial Advisory Important?

Also, read Blogs for Fintoos recommendations on several IPOs that emerged in 2024.

How does an IPO work?

Step 1: Hiring an Underwriter or Investment Bank:

The company initiates the IPO process by engaging financial experts, typically investment banks or underwriters, who facilitate the offering and assure capital raising. An underwriting agreement is signed, detailing deal specifics and the amount to be raised.

Step 2: Registration for the IPO:

The company prepares a registration statement along with a draft prospectus (Red Herring Prospectus – RHP), disclosing vital information as per regulatory requirements. This document, submitted to the registrar of companies, includes definitions, risk factors, business descriptions, financial statements, and legal information.

Step 3: Verification by SEBI:

SEBI verifies the disclosed information for compliance with regulations. Upon approval, the company can announce the IPO date.

Step 4: Making an Application to the Stock Exchange:

The company applies to the stock exchange to list its initial issue.

Step 5: Creating Buzz by Roadshows:

Roadshows are conducted to generate investor interest and awareness about the IPO. Executives conduct presentations, Q&A sessions, and multimedia presentations to showcase the company’s highlights.

Step 6: Pricing of the IPO:

The company sets the IPO price either through a Price Offering or Book Building Offering. Investors bid within the price range, and after the bidding process, the final price (cut-off price) is determined.

Step 7: Allotment of Shares:

Shares are allotted to investors based on their bids, with partial allotments in cases of oversubscription. Allotment typically occurs within 10 working days of the last bidding date.

Types of IPOs: Decoding the Offerings

IPOs come in various shapes and forms, each with its own set of characteristics and implications for investors. Two primary types of IPO offerings dominate the market:

Fixed Price Offering:

In this traditional approach, the company sets a fixed price for its shares, allowing investors to subscribe at a predetermined rate. This method provides clarity and certainty regarding the offer price but may limit investor participation based on market demand.

Book Building Offering:

Contrasting with the fixed price model, the book-building process offers a more dynamic and market-driven approach. Here, the company provides a price range within which investors can bid for shares, with the final offer price determined based on investor demand. This method fosters price discovery and may result in more accurate valuation outcomes.

SME IPO:

SME IPO is referred to as Small and Medium Enterprise Initial Public Offering. It is a customary IPO conducted by small and medium-sized businesses. When a small or medium-sized private business chooses to list its stock for public trading, there is a procedure involved.

SME capital costs are minimal. Through SME IPOs, small and medium-sized businesses can raise money from the market for working capital, company growth, expansion, and other purposes.

Let’s learn more about it:

SMEs contribute significantly to the nations’ economic expansion and job creation. In 2022, there will be 66 lakh newly registered enterprises.

For SME businesses, obtaining financing can be difficult, which restricts their ability to grow. Companies can raise money from the public through SME IPOs.

Prospecting for Profit: Evaluating the Pros and Cons

As with any investment opportunity, IPOs present a spectrum of potential benefits and pitfalls that investors must carefully weigh:

Pros:

Capital Access:

IPOs offer companies access to a vast pool of capital, enabling them to fuel growth initiatives, expand operations, and pursue strategic acquisitions.

Enhanced Visibility:

Going public elevates a company’s profile, fostering brand recognition, credibility, and market visibility, which can attract customers, partners, and talent.

Liquidity and Exit Opportunities:

For early investors and employees, an IPO provides a path to liquidity, allowing them to monetize their holdings and realize gains.

Cons:

Regulatory Burdens:

Public companies face heightened regulatory scrutiny, compliance obligations, and reporting requirements, which can entail significant administrative overhead and costs.

Market Volatility:

The public markets are subject to fluctuations and sentiment shifts, exposing IPO investors to price volatility and potential short-term losses.

Pressure to Perform:

Publicly traded companies are under constant pressure to meet investor expectations, maintain stock performance, and deliver consistent financial results, which may necessitate short-term decision-making over long-term strategic vision.

Navigating the IPO Maze: Key Considerations for Investors

For investors eyeing IPO opportunities, a comprehensive due diligence process is paramount. Here are key factors to consider before diving into the IPO pool:

1. Financial Health:

Scrutinize the company’s financial statements, revenue growth trajectory, profitability metrics, and debt levels to gauge its financial stability and growth potential.

2. Management Team:

Assess the experience, track record, and alignment of interests of the company’s management team and key stakeholders, as strong leadership is instrumental in navigating the challenges of public markets.

3. Market Dynamics:

Evaluate broader market conditions, industry trends, and competitive landscapes to gauge the company’s positioning and growth prospects within its sector.

4. Valuation:

Conduct a thorough valuation analysis, comparing the IPO price to industry peers, earnings multiples, and growth projections to assess whether the offering is priced attractively relative to its intrinsic value.

5. Long-Term Outlook:

Consider the company’s long-term strategic vision, competitive advantages, and growth catalysts to determine its potential for sustained success beyond the IPO.

Charting the Course: IPO Returns and Notable Offerings

As we reflect on the past five years, the IPO market has witnessed a myriad of success stories, from groundbreaking tech unicorns to disruptive startups. Notable IPOs have captured headlines, generated substantial returns for investors, and reshaped industries, underscoring the transformative power of public markets.

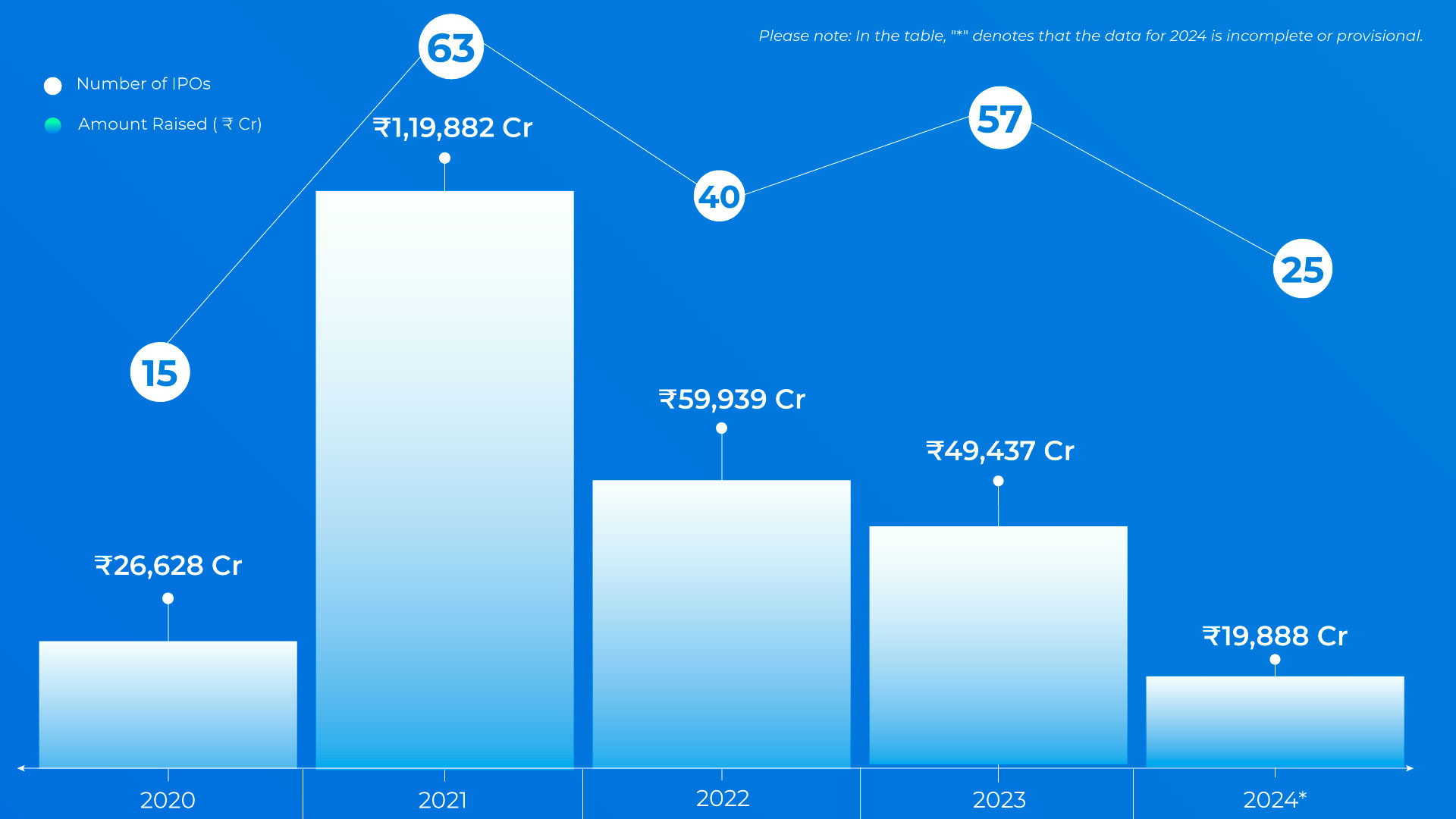

Here is an annual chart displaying the number of IPOs listed and the total funds raised over the past five years up to the present date.

In the fiscal year 2024-25, several notable IPOs have emerged, capturing investor attention and reshaping market dynamics. From innovative tech startups to established industry leaders, these offerings have showcased the diverse range of opportunities available in the IPO market.

| # | Issue Name | Offer Price (Rs) | Listing Day – Close Price (Rs) | Listing Day Gain / Loss (%) | Listing Date | Issue Size (Rs Cr) | Total Subscription (Rs in Crores) | Oversubscribed (x) |

| 1 | Vibhor Steel Tubes Limited | 151 | 442.00 | 192.72 | Feb 20, 2024 | 72.17 | 23097.88 | 320.05 |

| 2 | BLS E-Services Limited | 135 | 370.75 | 174.63 | Feb 06, 2024 | 310.91 | 50484.75 | 162.38 |

| 3 | JNK India Limited | 415 | 693.95 | 67.22 | Apr 30, 2024 | 649.47 | 18484.02 | 28.46 |

| 4 | Exicom Tele-Systems Limited | 142 | 225.65 | 58.91 | Mar 05, 2024 | 429.00 | 57297.14 | 133.56 |

| 5 | Mukka Proteins Limited | 28 | 42.26 | 50.93 | Mar 07, 2024 | 224.00 | 30685.76 | 136.99 |

| 6 | Nova AgriTech Limited | 41 | 58.79 | 43.39 | Jan 31, 2024 | 143.81 | 16280.77 | 113.21 |

| 7 | Bharti Hexacom Limited | 570 | 813.75 | 42.76 | Apr 12, 2024 | 4275.00 | 127737.00 | 29.88 |

| 8 | Apeejay Surrendra Park Hotels Limited | 155 | 203.45 | 31.26 | Feb 12, 2024 | 920.00 | 57877.20 | 62.91 |

| 9 | Jyoti CNC Automation Limited | 331 | 433.15 | 30.86 | Jan 16, 2024 | 1000.00 | 40490.00 | 40.49 |

| 10 | Platinum Industries Limited | 171 | 220.90 | 29.18 | Mar 05, 2024 | 235.32 | 23294.02 | 98.99 |

Conclusion: Seizing the IPO Opportunity

IPO investing, with its promise of wealth creation and growth, can be a thrilling journey. Yet, it’s not without its challenges. That’s where a trusted financial advisory firm like Fintoo, can be your guiding light. With their expertise, they help navigate the intricacies of IPOs, offering tailored advice and strategies. By conducting thorough due diligence and adopting a disciplined approach under their guidance, investors can effectively tap into the potential of IPOs while mitigating risks, paving the way for financial success.

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Investing using the app is the sole decision of the investor and the company or any of its communications cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.