Markets extend gains in a festive week; Nifty to cross the 18,000 mark

Top global market updates for the week

Equity markets remained upbeat on a holiday-shortened week as sentiments improved on positive global cues and on growing expectations of smaller-than-expected rate hikes. A strengthening rupee further aided the sentiments.

Global markets too traded positively after U.S Q3 GDP grew faster than expected and hinted at weakening inflation. Inflation in the U.S too rose by 2%, down sharply from 7.3%, according to a gauge the Federal Reserve uses which fanned expectations that major central banks could start slowing the pace of rate hikes.

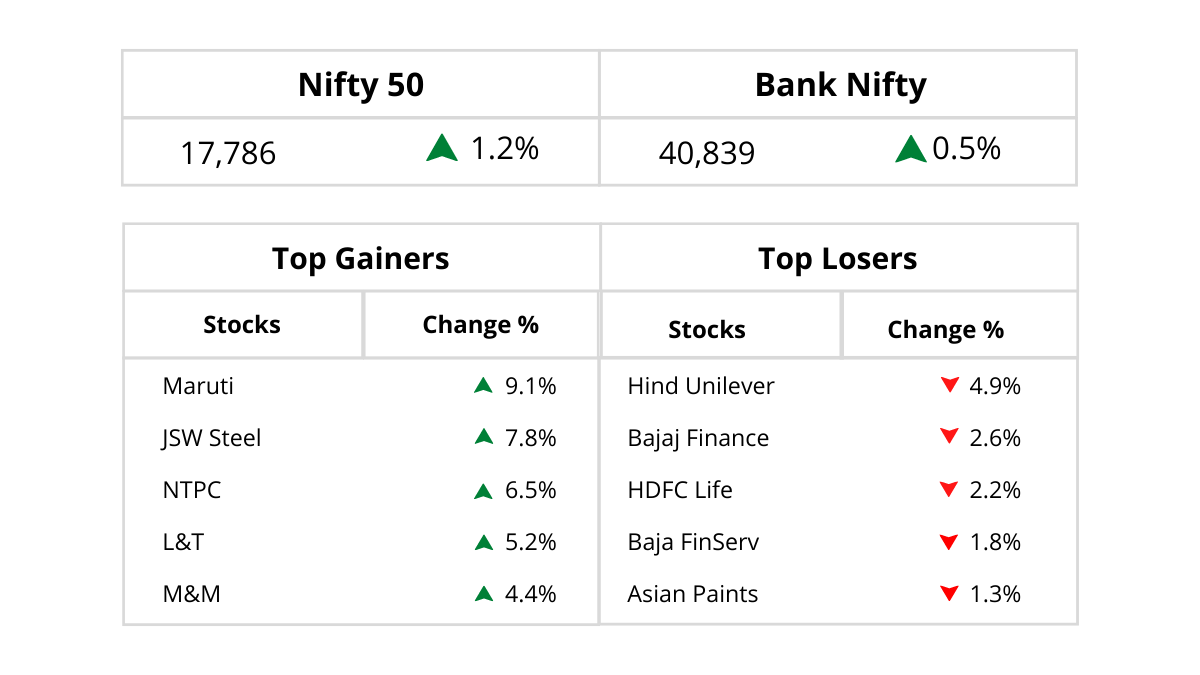

On the weekly basis, the Nifty gained 1.2% to end at 17,787 levels while the Nifty Midcap 100 and Nifty Smallcap 100 gained 1% and 0.2% respectively. The nifty PSU Bank index was the top sectoral gainer and was up 5.1% followed by the Nifty Auto index, up 3.9%, and the Nifty Energy index, up 2.3%. The nifty FMCG index fell 0.7 % and Nifty IT ended flattish.

Brent crude prices gained 2.7% to USD 93.77 a bbl, boosted by optimism generated by record U.S. crude exports as well as doubts about the effectiveness of the proposed price cap on Russian oil.

November month is a busy month for the primary markets with 4 mainboards IPOs and 6 SME IPOs aligned in the first week of November. DCX Systems, Fusion Micro Finance, Global Health Limited, and Bikaji Foods are the mainboard IPOs opening the first week of November.

Stocks in Spotlight

ICICI Bank reported strong Q2FY23 performance on the back of robust credit growth, multi-quarter high margins, and lower credit costs. NII grew by 26.5% YoY (11.9% QoQ) to Rs 147.8 bn. Core operating profit grew by 23% YoY to Rs 117.6 bn. ICICI Bank reported improved asset quality, with GNPA/NNPA declining to 3.38% / 0.65% vs 3.6% / 0.74% in 1QFY23.

HUL’s Q2FY23 earnings were a mixed bag with 16 % topline growth (4 % volume growth and 11.5 % price-led). It reported 16 %, 7.8 %, and 8.8 % growth in sales, and EBITDA, and adjusted net profit to Rs 145 bn, Rs 33.8 bn, and Rs 23.8 bn.

Airtel Africa reported strong growth in 2QFY23 with revenue/EBITDA growth of 4.1 %/3.9 % QoQ on a reported basis; while on a CC basis, revenue/EBITDA grew 6.7 %/7.1 % QoQ to USD1.4b/USD663m, respectively. The reported ARPU grew 6.9 % QoQ to USD 3.1, while the subscriber base rose 3 mn to 135 mn.

HDFC Life Q2FY23 Gross written premium for Q2FY23 stood at Rs 1,32,826 mn, with healthy growth of 32.2 % QoQ/ 14.2 % YoY led by strong growth in the renewal premium. The New Business Premium (NBP) for the quarter grew by 28.8 % YoY, while the renewal premium grew by 35.4 % QoQ (37.2 % YoY). New business margin (NBM) expanded by 171 bps YoY (149 bps QoQ) at 28.3 % in Q2FY23 on a profitable product mix and merger impact.

Tata Power reported an 85 % rise in its consolidated net profit at Rs 9351.8 mn compared to Rs 5056.6 mn YoY. The consolidated revenue rose 49 % to Rs 140.31 bn from the revenues of Rs 98.10 bn YoY. EBITDA was up by 18 % at Rs 20.43 bn. This was on account of higher availability in Mundra and capacity addition in renewables and higher efficiencies achieved in the distribution business, especially in Odisha Discoms.

Reliance Retail is expanding its business into the fast-growing toy sector through its brand Rowan to operate in the affordable segment with a smaller shop size. The company was running its toy distribution business through Rowan. It has now brought this homegrown brand to the front end by opening its first EBO (exclusive brand outlet) at Gurugram in NCR in the last quarter with a store size of 1,400 sq feet.

Dabur India is set to enter the branded spices and seasoning category. It has signed an agreement to acquire 51 percent of Badshah Masala for a cash consideration of Rs 5.87 bn. The acquisition, the company says, is in line with its strategic intent to expand its food biz to Rs 5 bn in three years.

International Update

- US GDP shot up by 2.6 % in Q3 following a 0.6 % drop in Q2 and a 1.6 % slump in Q1. Economists had expected GDP to jump by 2.4 %. Services PMI slumped to 46.6 from 49.3 and the Composite PMI fell to 47.3 from 49.5.

- U.S. existing home sales fell for an eighth straight month in September, the longest streak of declines in 15 years. The U.S. trade deficit in goods widened sharply in September, likely as a strong dollar and softening global demand weighed on exports.

- US new home sales tumbled by 10.9 % to an annual rate of 603,000 in September after soaring by 24.7 % to a revised rate of 677,000 in August. Economists had expected new home sales to plunge by 14.6 % to a rate of 585,000 from the 685,000 originally reported for the previous month.

- The European Central Bank announced a 75-bps interest rate hike- its third consecutive increase this year. ECB hinted at more such hikes in order to bring down inflationary pressures.

- The Bank of Japan kept its massive monetary policy stimulus unchanged defying the global tightening stance and maintaining its guidance on the interest rate despite the weakening yen.

- According to the International Energy Agency (IEA) in its World Energy Outlook, India is likely to see the world’s biggest rise in energy demand this decade, with demand climbing 3 percent annually due to urbanization and industrialization.

Outlook Week Ahead

For the coming week, markets are expected to open with a gap of 200 points on Monday (as indicated by SGX Nifty) with Nifty expected to cross past the 18,000 mark. Once the Nifty crosses this psychological barrier of 18,000, markets are expected to touch the 18,400 mark in a quick span of time. We advise investors to stay fully invested as markets are in a breakout mode.

Q3FY23 results of India Inc. will remain in focus with some of the key results being IOC, NTPC, Bharti Airtel, L&T, Tata Steel, Adani Ports, Sun Pharma, Tech Mahindra, UPL, Adani Enterprise, Hero Motocorp, HPCL, HDFC, Cipla and Titan.

Automobile sale numbers for the month of October will be out from November 1. Thus, automobile stocks will be in focus.

In a surprise move, the RBI will hold an additional meeting on November 3 in unscheduled meeting. According to the original schedule, the MPC’s next policy decision was scheduled between December 5-7. Meeting has been called under section 45ZN of the RBI Act, which is ‘failure to meet inflation target’. The September retail inflation print released on October 12 confirmed the Indian central bank had failed to meet its mandate for the very first time. RBI must now submit a report to the central government explaining why it failed to contain inflation, the remedial actions it proposes to take, and the period within which inflation will return to target.

Globally, the most important event will be the U.S Federal Reserve meeting on November 2 where the Fed will announce its interest rate decision. Global markets are expected to take cues from the outcome of the meet and the post-meet commentary by the Federal Reserve.

Disclaimer: The views expressed in the blog are purely based on our research and personal opinion. Although we do not condone misinformation, we do not intend to be regarded as a source of advice or guarantee. Kindly consult an expert before making any decision based on the insights we have provided.