Markets End In The Red In A Volatile Week; Fed Rate Action To Dictate Trend

Market Overview

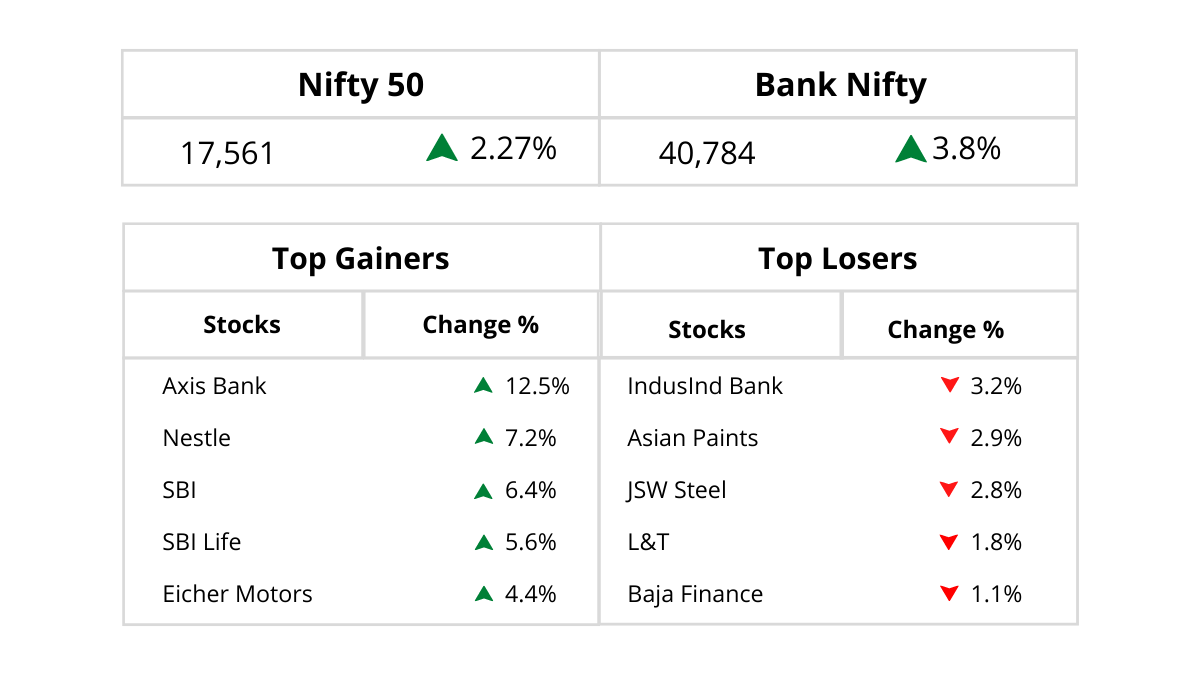

Equity markets remained bullish during the week as positive global markets and in-line corporate earnings supported the sentiments. The Nifty settled above the 17,500 mark, while the Nifty Bank index gained about 1500 points to close above the 40,700 mark. The rally got supported by Axis Bank, the surged more than 12% over the week and hit its 52-week high after the Bank reported a good set of numbers for the quarter that ended September.

The broader markets, however, underperformed. For the week, FIIs were net buyers to the tune of Rs 13.69 bn, and DIIs were net buyers to the tune of Rs 35.69 bn.

Brent Crude oil prices gained 2% to USD 93.5 per barrel. OPEC+ agreed to cut production by 2 million barrels per day in November, the most significant curb since the start of the pandemic, while speculation grows that the oil cartel will further intervene in markets to shore up prices.

The rupee hit a record low of 83 against the U.S. Dollar. The unexpected decline in U.S. initial jobless claims and further hawkish comments from Federal Reserve officials had lifted Treasury yields to new multi-year highs. This reinforced bets that the Federal Reserve would keep opting for large rate increases.

Stocks in Spotlight

ITC:

ITC results were better than expected. Cigarette volumes were up 20.5%- Volumes have continued to surprise on the upside & remain comfortably above pre-pandemic levels backed by innovation & premiumization across segments, FMCG business reported 21.0% sales growth, EBITDA margins were down 50bps YoY. Paper margins were up 518 bps, and Hotels demand outlook remains strong.

Ultratech Cement:

Ultratech Cement reported a lower-than-expected EBITDA of Rs 17.1 bn, down 41% QoQ. This is a result of lower volume amid a demand slowdown due to excessive rainfall across India and higher CoP on account of escalated coal prices. Post-monsoon, cement demand is expected to recover and stay firm even in FY24 due to 2024 pre-election government spending. Ultratech, with its ongoing expansion projects, will add ~16.7mtpa capacity in FY23 and will be the major beneficiary of demand improvement in FY24. The management is optimistic about pre-general election demand to improve volumes for the next 12-18 months and guided 10%+ volume growth in FY23 and FY24.

Axis Bank:

Axis bank reported a strong quarter with Q2FY23 PAT at Rs 53.3 bn, driven by strong NIMs (up 36 bps QoQ) along with healthy growth (~4% QoQ), controlled opex, and comfortable asset quality. Annualized RoAs and RoEs at 1.8%/18.5% were multi-years high. The bank has already received CCI approval for the Citi acquisition, and the same should be consummated by Q2FY24. The stock was up sharply by around 12.5% and was one of the top gainers in the Nifty Bank index.

In our report dated 13 October, we stated that a rally in Nifty and Nifty Bank will be supported by Axis Bank. We had said that – There is a breakout in Axis Bank in USD terms for a 30% upside, which may trigger major buying in Bank Nifty and help it to cross the 43000 mark. We have a positive view of the stock and expect it to outperform the Nifty Bank index in the near term.

Asian Paints:

Asian Paints reported below-expected Q2FY23 numbers as an extended monsoon season impacted growth for the quarter, resulting in lower-than-expected revenue despite festival dates being earlier this time round. Asian Paints reported 19.2%, 35.7%, and 31.3% growth in revenue, EBITDA, and adjusted net profit to Rs. 84.6bn, Rs 12.3bn, and Rs. 7.8bn, respectively. The company has lined up a Rs. 65 bn+ Capex program over the coming three years to augment decorative paints capacity by 30%, backward integration (emulsions manufacturing), and also strengthen adjacencies.

Bajaj Finance:

Bajaj Finance PAT was up 7% QoQ / 88% YoY to Rs 28 bn, ahead of estimates on account of sequentially higher yields & lower credit costs. NII growth came in at 31% YoY and 5.4% QoQ. PPP was up 36% YoY / 5.4% QoQ. AUM grew 7% QoQ / 31% YoY. The company reported another quarter of 5%+ RoA (the third consecutive quarter).

For Q2FY23, Bajaj Auto reported a net operating income of Rs 102 bn, a growth of 16.4% YoY and 27.5% QoQ. The total volumes for Q2FY23 increased by 0.6% YoY and 23.3% QoQ. Volumes improved due to improvements in semiconductor supplies. EBITDA for Q2FY23 was at Rs 17.49 bn, grew by 25.0% YoY/ 36.0% QoQ. EBITDA margin improved by 117 bps YoY and 108 bps QoQ to 17.1% for the quarter.

Margin expansion was aided by judicious price increases, cost management, and better F.X. realization. Net Profit for the quarter was at Rs 17.19 bn, down 15.7% YoY/ up by 47.8% QoQ. Net Profit is not comparable on a YoY and QoQ basis due to exceptional items in Q2FY22 and half-yearly accounting of share of profit of associates. Excluding exceptional items, the Adj. Net Profit grew by 11.8% YoY/ 47.8% QoQ.

Tata Elxsi:

Tata Elxsi fell sharply by 14.2% during the week after it reported weak revenue growth during Q2FY23, with a sharp drop in margin due to strong headcount addition, back-to-office costs, the opening of new facilities, and increased discretionary spending related to travel and training. It registered constant currency (CC) revenue growth of 4.7% QoQ during the quarter, below estimates, and notably missed the six consecutive quarters of 6% CC growth. Management admitted to facing a crunch in mid-level staff, such as delivery managers, due to supply-side challenges. The utilization rate had dropped to 78.9%, and management’s immediate focus would be to get it back to 80%.

DMART:

Shares of DMART turned weak after it reported mixed Q2FY23 performance. Revenues grew by 36.6% YoY and 6% QoQ to Rs106.4bn. EBITDA grew by 32% YoY to Rs 8.8 bn while margins contracted by 29 bps YoY to 8.3%. PAT grew by 61.7% YoY to Rs 6.8 bn which included a one-time tax write-off of Rs1.4bn. Excluding one-time tax adjustment, PAT grew by 28% to Rs 5.35 bn. DMart added 18 stores in H1FY23, taking the total store count to 302 with a retail Business Area of 12.4mn sq. ft.

Aarti Industries:

Aarti Industries hit a 52-week low ahead of the pharma business record date. The company announced the demerger last year in August to focus on the opportunities within each sector separately. The swap ratio is 1 fully paid-up equity share of Rs 5 each of Aarti Pharmalabs for every 4 fully paid-up equity shares of Rs 5 each held in Aarti Industries. The demerger would be carved out in Aarti Pharmalabs, which would be independently listed on the stock exchanges.

BEL:

BEL has signed an MoU with Triton Electric Vehicle (TEV) – an electric vehicle company headquartered in the USA – for manufacturing Hydrogen Fuel cells with technology transfer from TEV. BEL bagged an order worth Rs 80.6 bn from Triton Electric Vehicle India Pvt Ltd. for supplying Li-Ion Battery Packs. Thus, with the recent MoU in the E.V. space, BEL is moving towards its strategy of diversifying into non-defense space, which forms 10% of total revenue. The management targets non-defense revenue to be 25% in the long run.

Triton Electric Vehicle (TEV):

TEV is an electric vehicle company headquartered in the USA. The company has recently forayed into Hydrogen run vehicles and has started the journey of manufacturing Hydrogen-run Two-Wheelers, Three-Wheelers, and Buses. The company has recently set up its R&D center and manufacturing facility in India with best-in-class infrastructure. Triton Electric Vehicle India Pvt Ltd. is a part of Triton electric Vehicle LLC, USA.

International Update

- U.S. initial jobless claims slipped to 214,000, a decrease of 12,000 from the previous week’s revised level of 226,000. The dip surprised economists, who had expected jobless claims to inch up to 230,000 from the 228,000 originally reported for the previous week.

- U.S. leading economic index fell by 0.4% in September after revised data showed the index was unchanged in August.

- U.S. existing home sales slid 1.5% to an annual rate of 4.71 mn in September after falling by 0.8% to a revised rate of 4.78 mn in August. Economists had expected existing home sales to slump by 2.1% to a rate of 4.70 mn from the 4.80 mn originally reported for the previous month.

- Consumer prices in Japan were up 3% on year in September. That was in line with expectations and unchanged from the August reading.

Outlook Week Ahead

In the coming week, markets are expected to extend gains as the SGX Nifty reading is showing a gap-up opening of 245 points to 17,800+ levels on Monday. It is a holiday-shortened week and trading activity is expected to remain dull, however, the bias remains extremely bullish. Volatility is expected to remain high as the derivative contract is set to expire on Thursday.

Corporate earnings and global market cues, along with currency movement, will continue to dictate the trend. Some of the key earnings that will be out in the coming week are ICICI Bank, Kotak Mahindra Bank, SBI cards, Tata Chemicals, Dr. Reddys, Maruti Suzuki, Tata Power, and Vedanta.

Index heavyweight Reliance Industries (RIL) will be in action after its Q2FY23 profits fell by 20% on lower margins, however, the numbers were better than estimates. The export duty adversely impacted profit for the quarter by Rs 40.39 bn. If not for the windfall profit tax, the net profit would have been higher by 20 pct.

The net profit of Jio grew 4.4% QoQ to Rs 45.3 bn. The Board approved the demerger of financial services undertaking and to list Jio Financial Services. Pursuant to the scheme, the shareholders of RIL will receive one equity share of JFS of the face value of Rs 10 for one fully paid-up equity share of Rs 10 held in RIL.

Globally, key central banks will unveil their interest rate decisions. The Bank of Japan will announce the rate decision on 28 October and the European Central Bank (ECB) will announce it on 27 October.

The special 1-hour Muhurat trading session will take place on Monday. The trading hour is scheduled in the evening from 06:15 pm to 07:15 pm. Our special Diwali stock picks are Axis Bank (Initiation Price Rs 830, Target Rs 970), Tata Motors (Initiation Price Rs 399, Target Rs 520), VaTech Wabag (Initiation Price Rs 269, Target Rs 420), APL Apollo Tube (Initiation Price Rs 1116, Target Rs 1360) and Sona BLW Precision Forging Ltd. (Initiation Price Rs 486, Target Rs 640).

May this Diwali bring with it fresh hopes, brighter days, and new dreams! Wishing you and your family a very happy Diwali!