The market remains extremely volatile; the Nifty rangebound between 15,900-16,200

Equity markets continue to remain volatile, and range-bound. The range however seems to have shifted higher from 15600 – 15800 and 16000 – 16200. The uncertainty regarding the direction of index movement remains due to high inflation in the economy and uncertainty over the FII inflow in the market.

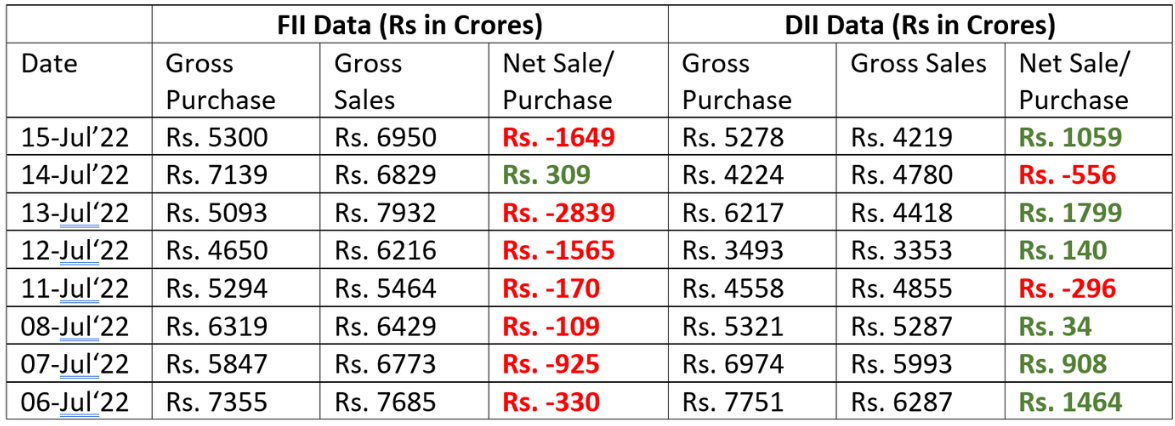

While inflation seems to be coming under control around the 7% mark, the dollar-rupee dynamics and the resulting FII behavior seem to be one of the driving forces behind market movements.

In June, the Federal Reserve raised its interest rates by 75 bps, which was its highest rate hike since 1994. It is widely expected that the FOMC aims to end the current year (2022) with an interest rate of 3.4%.

This has had a cascading effect on the global currency market with the dollar gaining strength against all major global economies. For the first time in 20 years, Euro reached parity with the dollar. The rupee too did not remain safe. It reached a new low of 79.63. This has caused an exodus of FII from the Indian Stock Market.

The FII outflow on a month-on-month basis seems to have slowed down, and this has now essentially made all market participants and the market go into a wait-and-watch mode.

The next triggers for the markets are macro-economic data from India and the US and important government and central bank interventions regarding rupee and dollar dynamics.

Macro Data – Indian and Global

The data point around the world that is under the scanner of the global markets is the inflation data.

India, the US, Canada, and a host of other global economies reported inflation related this week. India reported a CPI of 7.01%, though this is marginally lower compared to 7.04% reported in June 2022, inflation remains at all-time high levels. Similarly, WPI in June

2022 too came in at 15.18%, down marginally from 15.88% in May 2022. A bigger jump was noticed in the IIP data, which came in at 19.6% for the month of May compared to 6.7% in April.

The US market is experiencing a different trend in its inflation data. Inflation in the US has come at 9.1% in the month of June. This is the highest inflation in the country since 1981. The Labour Department data showed Wednesday, rising from its 8.6% level recorded in the month of May. Inflation worries have become a global concern.

In Europe, too June inflation CPI came in at 8.6% up from 8.1% MoM. Governments and Central Banks across the world have taken up arms against inflation worries. Especially, the central bankers are using the most important weapon at their disposal – interest rates – to try and control inflation.

Federal Reserve, RBI, Bank of Canada, and all other major central banks have all increased interest rates or are expected to increase to the tune of 0.5% to 1% in the coming economic review. This in turn will have an impact on global currencies.

Steps taken by the RBI

RBI in its next monetary policy is expected to raise interest rates by 40 basis points to 0.4%. Along with this, RBI has taken another important step to target two problems at the same time. RBI has enabled exports and imports to be denominated in rupees. This will internationalize the rupee and allow traders to import and export without having to worry about currency fluctuations. This will also bring a dent in the demand for dollars.

One of the biggest beneficiaries of this system will be India’s Oil imports. Russia now contributes 30% of all crude oil imports by India. Being able to execute this trade in a rupee-rubble exchange, will allow India to stay free from dollar fluctuations and may even allow the government to get a stable and cheaper price.

This coupled with the falling commodity prices is expected to help bring down the country’s deficit in a big way.

Sectoral Perspective

Pharma

The Nifty Pharma index rose 4.2% to 12,931 in the current week becoming one of the highest gaining sectors in the market. The top gainers in the segment are the large caps with Dr. Reddy rising 5.5% in the week. This sector is expected to have multiple positives right from the aging and rising population to access to quality healthcare worldwide is driving the pharma industry. This has given rise to fast-tracking of drug approvals by the regulatory bodies as we return to normalcy after the pandemic.

Apart from this, the Government of India, under its Atmanirbhar Bharat Programme, is expected to launch a slew of PLI schemes to promote the manufacturing of APIs and other research and development-related activities within India. Combining all these factors – namely, fast tracking of drug approvals, positive support from gov. and better awareness and spending for public healthcare and welfare, this sector is expected to be one of the sectors to look out for.

Paints

The Indian paint industry has been witnessing a gradual shift in the preferences of people from the traditional whitewash to high-quality paints like emulsions and enamel paints, which is providing the basic stability for the growth of the Indian paint industry.

Moreover, the rise in disposable income of the average middle class coupled with increasing investment in education; urbanization; development of the rural market; and various launches of many innovative products, like friendly, odor-free, and dust and water-resistant paints, are major drivers that are propelling the growth of the paint market in India.

Also, Crude oil’s derivative titanium dioxide (TIO2) which is a major raw material for making paint and pigment manufacturing has cooled off from its historic high prices. This has provided some relief to the manufacturers reducing their margin pressures and input cost.

Sugar Stocks

Sugar stocks have outperformed the market in the last two years. On a week-on-week basis, the sugar sector is 3.4% up. The sugar sector has seen a fundamental change with the implementation of the biofuel policy to bring ethanol blending level to 20%.

The government supported the industry with a floor price for sugar, a monthly quota mechanism, a buffer, and export subsidy in past. This led to a reduction in sugar inventories in the last four years. The sector is no longer seen as commodity-driven but as an energy story.

Stocks To Watch In The Coming Week

Gland Pharma Ltd.

Gland Pharma is a generic injectables business. The company is majorly in the B2B segment and does contract manufacturing and marketing of complex injectable products. Over the past 10-12 months, the stock price has corrected by over 50%, despite healthy earnings growth. However, now things seem to be working in its favor again and provide sufficient cushion on the valuation front.

The stock is trading at 30x FY23E EPS of Rs 89 and 23x FY24E EPS of Rs 113. The pharma outsourcing market in India expects to grow at 11% on an annual basis over the next four years to a $200-billion industry by 2026. Companies like Gland Pharma are perfectly positioned to take advantage of it.

Also, this business has a high barrier to entry into its respective niche, and given its superior business model, consistent compliance, strong return ratios, and surplus cash for inorganic opportunities, this company is poised to take advantage of market conditions and boost its growth exponentially.

Indigo Paints

Indigo paints, which is listed at an IPO price of around 3,200 Rs., has ever since been on a massive downside ride due to various factors. Going ahead, we believe Indigo is on a strong footing to outperform industry volume growth as:

- It has invested in outlet expansion at a CAGR of 18.7% over FY20-22. The company plans to focus on improving output/store with help of influencers (painters)

- Tinting machines have grown at a CAGR of 28.5% over FY20-22 and it will lead to higher sales of regular products and emulsions and

- Indigo continues to invest in differentiated products with the launch of Anti odor paint for kitchens and bathrooms in FY22 and plans to introduce ‘category creator’ products in FY23.

We believe growth in revenue per store will be a key matrix to track in FY23 and any maturity in stores will lead to outperformance vs industry. Indigo has done multiple initiatives over the past 1-1.5 years which will allow it to grow at rates higher than the industry. These initiatives include investments in distribution expansion, tinting machines, new depots, and launches of differentiated products.

Market Outlook For The Coming Week

Q2FY23 earnings season, oil, and USDINR movement to dictate trend.

The Market is expected to be range bound between 15900 to 16200, and a break above or below this range will decide the future trajectory of the market. Some of the major earnings that will be out in the coming week are Ambuja Cement, HDFC Life, HUL, ICICI Lombard, IndusInd Bank, Wipro, Hindustan Zinc, and Ultra Tech. The progress of the monsoon will also be closely watched. FII selling seems to have reduced for now, but more rate hikes do seem to be on cards in the U.S. market.

This may cause further weakness in the rupee on account of the FII exodus. How RBI will react to it is something that will be watched by everyone. On the bright side, crude and other commodities continue to show weakness, helping to keep inflation in check.

On the macro-economic front, The Bank of Japan and the European Central Bank will announce their interest rate decisions on 21 July 2022. U.S existing home sales data will be declared on 20 July 2022. Apart from this, inflation and key macro-economic data coming from Europe – majorly the UK, Germany, and France, will give the market cues about how other major economies are faring.

The results season is picking up now and it will be important to read into the management commentaries on their take on demand and cost pressures. Markets currently seem to be in a consolidation mode, and we may see sustained buying once the Nifty crosses the 16,200 mark.

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the sole decision of the investor and the company or any of its communication cannot be held responsible for it.