The global economy remains in the grip of policy uncertainties. Rising asset values, political uncertainty, and shipping disruptions continue to offer major downside risks to growth and upside risks to inflation while India’s economic growth continues to be the shining exception and will remain so in the years ahead.

As mentioned in the interim budget, the government is focusing on 4 major castes, namely ‘Garib’ (Poor), ‘Mahilayen’ (Women), ‘Yuva’ (Youth) and ‘Annadata’ (Farmer) providing support to each class of castes.

In this budget the government is particularly focused on employment, skilling, MSME’s and middle class with PM’s package of 5 scheme to facilitate employment, skilling and other opportunities for 41 mn youth over a 5-year period with a central outlay of Rs. 2 trillion and for this Rs. 1.48 trillion provisions have made this year.

In pursuant to government’s Vikasit Bharat strategy the budget has 7 priorities i.e. (i) Productivity and resilience in Agriculture (ii) employment and skilling (iii) Inclusive human resource development and social justice. (iv) Manufacturing and Services (v) Urban development (vi) Energy Security (vii) Infrastructure.

In the FY25 budget the government has maintained capex target of FY25BE at Rs. 11.1 trillion, reflecting a growth of 17 pct compared to FY24. The capex to GDP ratio pegged 3.4 pct in FY25BE against 3.2 pct in FY24BE. Fiscal deficit target has been revised downwards for both FY25RE and FY26BE at 4.9 pct (down from 5.1 pct in interim budget) and 4.5 pct respectively. In interim budget, the FY24RE disinvestment objective has been reduced to Rs. 30 bn from Rs. 51 bn. The estimated budget for FY25E is pegged at Rs. 50 bn. For FY25 revenue receipt seen at Rs. 32.07 trillion and expenditure seen at Rs. 48.21 trillion. The net tax receipts are estimated at Rs. 25.83 trillion. The gross and net market borrowings through dated securities during 2024-25 are estimated at Rs. 14.01 trillion and Rs. 11.63 trillion respectively.

Budget and Impact

Agriculture

Budget Highlight

- For agriculture and allied sectors, Rs. 1.52 trillion of Provision has made.

- New 109 high-yielding and climate-resilient varieties of 32 field and horticulture crops will be released for cultivation by farmers.

- Government proposes to reduce BCD on certain broodstock, polychaete worms, shrimp and fish feed to 5 pct Also, propose to exempt customs duty on various inputs for manufacture of shrimp and fish feed.

- Financing for shrimp farming, processing and export will be facilitated through NABARD.

Budget Impact

It will help to boost disposable income of farmers.

Key Beneficiaries

Avanti Feeds, Godrej Agrovet, Fertilizers stocks

BFSI

Budget Highlight

- Capex outlay of Rs. 11.11 trillion in FY25BE, up by 17 pct.

- Aims to build 30 mn more houses under Pradhan Mantri Avas Yojana.

- financial support for loans up to Rs. 1 mn for higher education.

- Provision of Rs. 2.66 trillion for rural development including rural infrastructure.

- Limit of Mudra loan has increased to Rs. 2 mn from 1 mn.

Budget Impact

- CAPEX-led spending will fuel credit expansion in the BFSI for FY25E.

- Positive for lenders in housing space in urban segment.

- PMMY (Pradhan Mantri MUDRA Yojana) supports income-generating micro-enterprises in manufacturing, trading, and services, including agriculture. It will be favorable to banks and NBFCs.

Key Beneficiaries

HDFC Bank, ICICI Bank, Axis Bank, Bank of Baroda, HUDCO, PNB Housing, LIC housing Finance, Aptus, REC, PFC, IREDA

Housing

Budget Highlight

- Aims to build 30 mn more houses under Pradhan Mantri Avas Yojana.

- Under the PM Awas Yojana Urban 2.0, housing needs of 10 mn urban poor and middle-class families will be addressed with an investment of Rs. 10 trillion.

- Enabling policies and regulations for efficient and transparent rental housing markets with enhanced availability will also be put in place.

Budget Impact

Boost the housing demand in the country and other real estate ancillary products such as ceramics, plywood etc.

Key Beneficiaries

Godrej Properties, Man infra, Capacite Infra, Ultratech Cement, JK Cement, Polycab, kajaria Ceramics, Century plyboard, Astral pipes, Finolex pipes

Water supply and Sanitation

Budget Highlight

- will promote water supply, sewage treatment and solid waste management projects and services for 100 large cities.

- Also envisage use of treated water for irrigation and filling up of tanks in nearby areas.

Budget impact

- Access to clean water and sanitisation facilities.

- Can reduce healthcare cost, associated with waterborne diseases.

Key Beneficiaries

Va Tech Wabag, EMS, Thermax, Kirloskar Brothers, Antony Waste Handling Cell

Renewable Energy and Power Sector

Budget Highlight

- PM Surya Ghar Muft Bijli Yojana has been launched to install rooftop solar plants to enable 10 mn households.

- Strong response with more than 12.8 mn registrations and 1.4 mn applications received.

- Propose to expand the list of exempted capital goods in GST for use in the manufacture of solar cells and panels in the country.

- Government to support Advance Ultra Super Critical Thermal Plants.

Budget Impact

- households can obtain free electricity up to 300 units every month.

- Higher demand for solar panels.

Key Beneficiaries

Tata Power, IREDA, NTPC, BHEL, Adani Power, Thermax

Travel and Tourism

Budget Highlight

- Development of Vishnupad temple corridor, Mahabodhi Temple corridor will be supported, modelled on the successful Kashi Vishwanath Temple Corridor, to transform them into world class pilgrim and tourist destinations.

- Comprehensive development initiative for Rajgir will be undertaken which holds religious significance for Hindus, Buddhists and Jains.

- Government will support the development of Nalanda as a tourist centre.

- Assistance to development of Odisha’s scenic beauty, temples, monuments, craftsmanship, wildlife sanctuaries, natural landscapes and pristine beaches making it an ultimate tourism destination.

Budget Impact

- Employment will generate and tourist site will be developed.

- Air and Road Connectivity will improve.

Key Beneficiaries

IRCTC, INDIGO, TBO Tek, DreamFolks Indian Hotels, Lemon tree hotel, Devyani International, Jubilant food works.

Road Infrastructure

- PMGSY will be launched to provide all-weather connectivity to 25,000 rural habitations.

- Government will support development of road connectivity projects, namely (1) Patna-Purnea Expressway, (2) Buxar-Bhagalpur Expressway, (3) Bodhgaya, Rajgir, Vaishali and Darbhanga spurs, and (4) additional 2-lane bridge over river Ganga at Buxar at a total cost of Rs. 260 bn.

Budget Impact

- This improves connectivity, reduces travel time,

- Improved and well-maintained roads can lead to less accidents, smoother movements of goods and people.

Key Beneficiaries

L&T, IRB Infra, Action Construction Equipment.

Taxation

Direct Tax

(expected to save Rs. 17,500 by salaried Individual under new tax regime)

| Old Slabs | Rates | New Slabs | Rates | |

| 0 – Rs. 3,00,000 | NIL | 0 – Rs. 3,00,000 | NIL | |

| Rs. 3,00,000 to Rs. 6,00,000 | 5% | Rs. 3,00,000 to Rs. 7,00,000 | 5% | |

| Rs. 6,00,000 to Rs. 9,00,000 | 10% | Rs. 7,00,000 to Rs.10,00,000 | 10% | |

| Rs. 9,00,000 to Rs. 12,00,000 | 15% | Rs. 10,00,000 to Rs. 12,00,000 | 15% | |

| Rs. 12,00,000 to Rs. 15,00,000 | 20% | Rs. 12,00,000 to Rs. 15,00,000 | 20% | |

| Above Rs. 15,00,000 | 30% | Above Rs. 15,00,000 | 30% | |

| Standard Deduction | Rs. 50,000 | Standard Deduction | Rs. 75,000 | |

| Capital Gain Tax | Capital Gain Tax | |||

| Short term capital gain Tax | 15% | Short term capital gain Tax | 20% | |

| Long term capital gain Tax | 10% | Long term capital gain Tax | 12.5% | |

| Exemption on Capital Gains | Rs. 1,00,000 | Exemption on Capital Gains | Rs. 1,25,000 | |

| Security Transaction Tax | Security Transaction Tax | |||

| Futures | 0.0125% | Futures | 0.01% | |

| Options | 0.0625% | Options | 0.02% | |

- Apart from above corporate tax rate on foreign companies reduced from 40 pct to 35 pct.

- The budget has lowered capital gain tax rate on gold funds or gold ETFs, overseas funds and Funds of Funds (FoFs). LTCG from these funds would be taxed at 12.5 pct after holding for two years. Earlier international mutual funds, gold funds/ETFs and FoFs were taxed like domestic debt or fixed-income funds. Investments for less than 3 years were considered as a short term while those beyond that were termed as long term. STCG from these assets were taxed according to income tax bracket. Meanwhile, LTCG were taxed at 20 pct after indexation. However, indexation benefit available for the LTCG calculation has been removed.

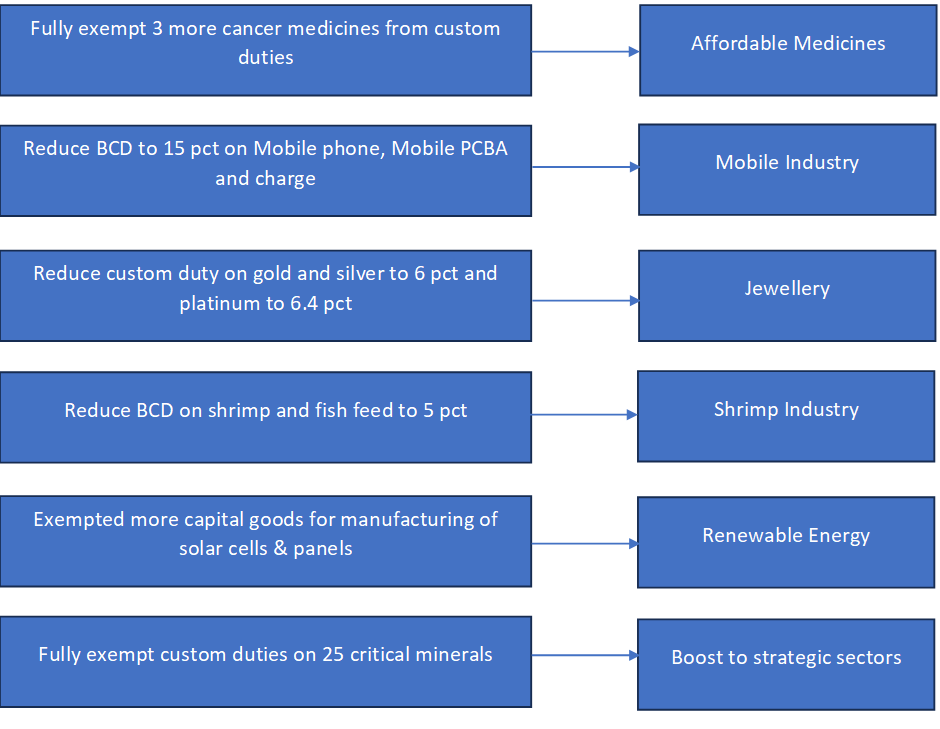

Indirect Tax

Changes in Custom Dusty and Its Beneficiaries

Also, read Blogs for Fintoo’s recommendations on several financial advices

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Investing using the app is the sole decision of the investor and the company or any of its communications cannot be held responsible for it.