LTCG Tax on Equity Investments from 1st April, 2018.

The New GST Amendments as per the 23rd Council Meet

How Health Insurance Becomes Tax Saving Tool?

Top 3 Noteworthy Tips to Help You Stay Away From Income Tax Notice

All You Need To Know About DTAA (Double Tax Avoidance Agreement)

Know All About Deduction Under Section 80C

8 Incomes That Are Considered as Tax Free

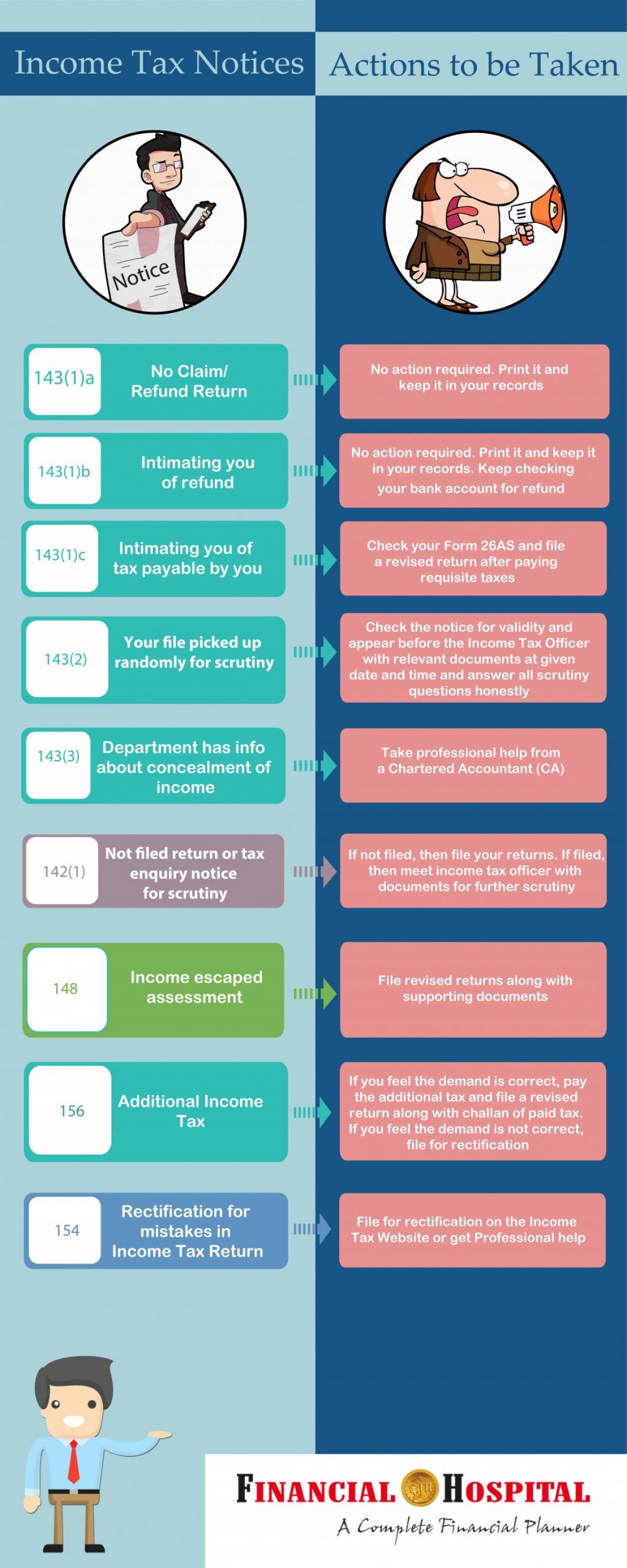

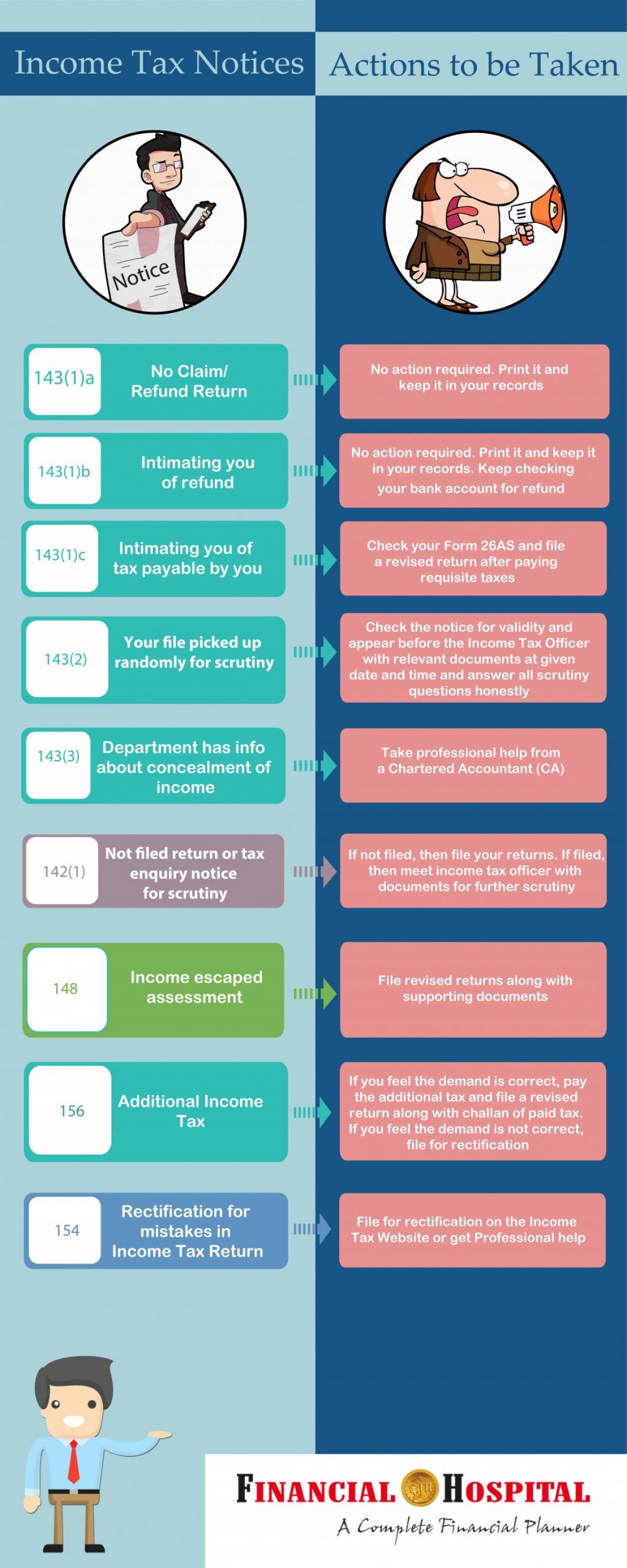

Income Tax Notices – Actions to be Taken