The Voluntary Provident Fund (VPF) – A Comprehensive Guide

How to use the Fintoo Chatbot for managing your money?

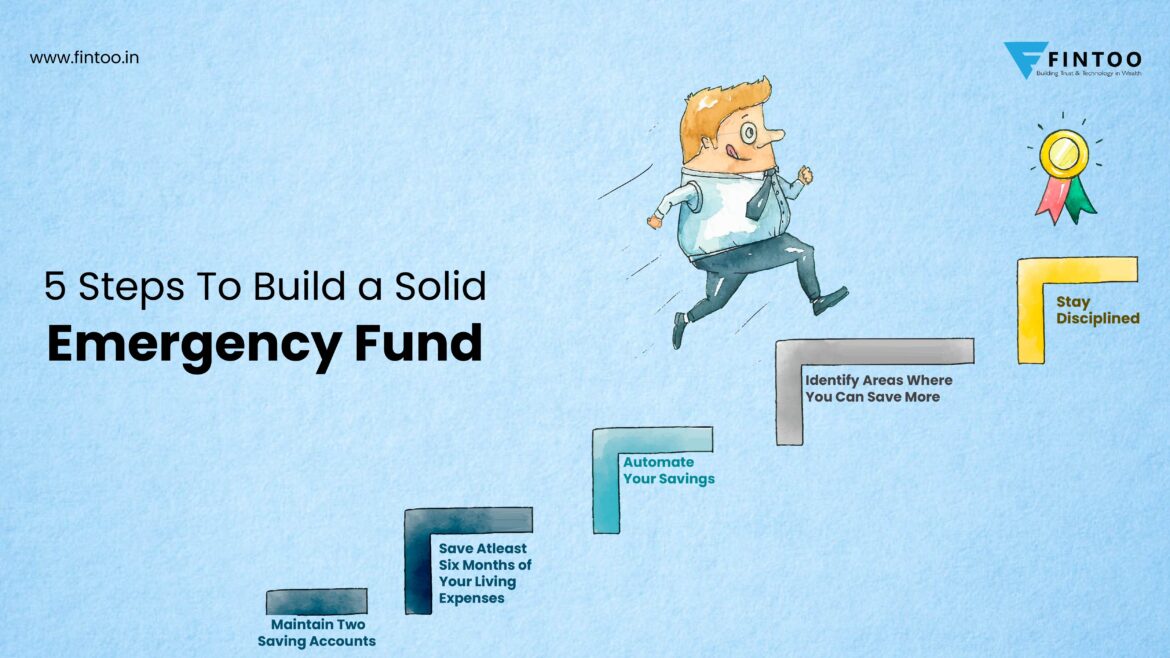

5 Steps To Build A Solid Emergency Fund

Know How To Save Taxes By Claiming Expenses

Tax Saving Strategies for Senior Citizen

7 Signs That Signifies Financial Health Checkup Need

Saving Or Investing? Are These Two Different?

How much you are worth today?

Saving Lessons You Can Learn From Your Parents