Your Guide To Investing In Passive Mutual Funds

Star Rating Methodology Of Mutual Funds

Where should you invest in Bank FDs or Debt Mutual Funds?

Understanding Indexation In Debt Mutual Funds

Everything You Need To Know About Equity Mutual Funds

Should You Stop SIP When Equity Market Reaches Peak?

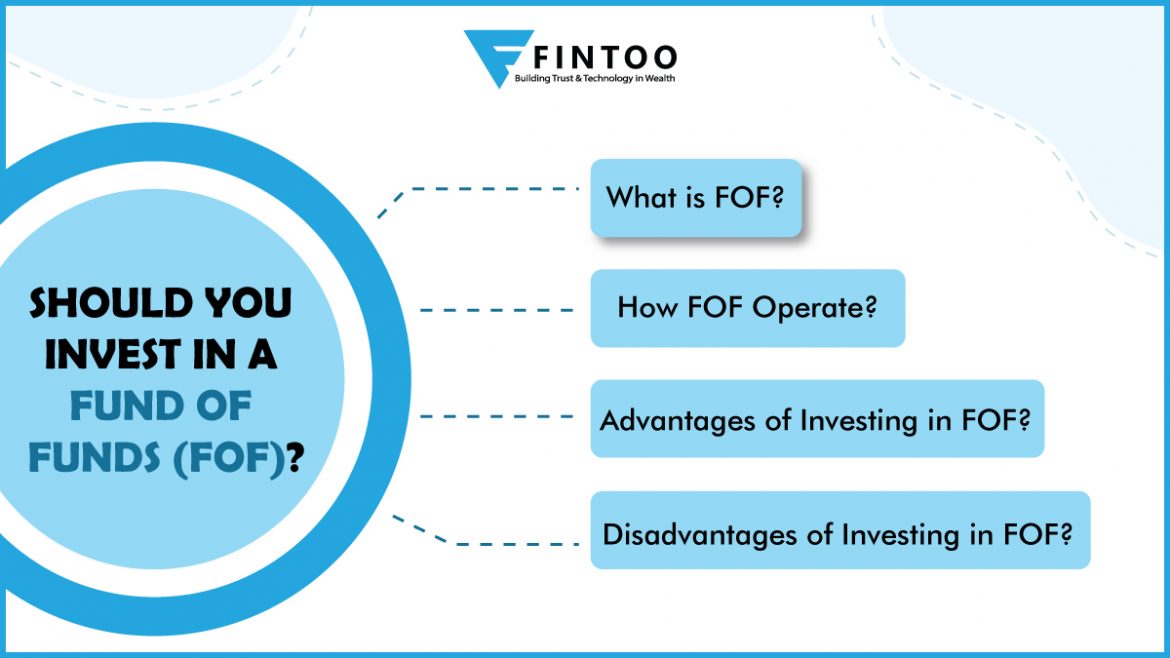

Should You Invest in a Fund of Funds?

Hybrid Funds And Its Types

How safe is it to invest in Mutual Funds through an Online Platform?