The Securities and Exchange Board of India (SEBI) in its recent circular made some changes in the application of NAV rules.

Before jumping directly to what does this actually means. Let us understand why rules on NAV applicability exists in the first place. So that our understanding on this subject is clear.

We take an instance where you buy shares and then we will compare it to buying mutual funds.

When you buy a share, the share price applicable is on real time basis. While buying the stock, you know what the price of that stock is and so you invest a particular amount and you get some number of shares depending upon your investment amount.

Example, I want to buy shares of XYZ Company whose current share price is Rs. 500. Prices of the stock keeps on changing during the market hours and when you put an order of purchase you get the real time stock price. Here, in this case the price is 500. Now because this price can slightly change by the time you actually put in the transaction so you can also put the price while buying i.e. “Limit Price”. Suppose now I had put an order of buying 10 shares at a price of Rs. 500. If the real time price is same, your order will get executed or it will take some time to execute until you get your price.

The point here I am trying to make is you can decide at which price point you want to buy a stock.

Now, when it comes to mutual funds, the concept is different. If I want to invest in a fund, I will have to decide the amount that I want to invest. The price of each unit of mutual fund is called NAV which does not change on real time basis. Every day has one closing NAV which is updated latest by 11pm online. Suppose I invest 5000 on Monday, I do not know the NAV of Monday yet. I will get some units based on “applicable NAV”. But which NAV will be applicable? NAV of Monday when I made an investment or NAV of next day i.e.Tuesday or NAV of the day when AMC actually receives money?

Therefore, SEBI has defined some provisions which are uniformly applicable for all the mutual funds to decide which NAV will be applicable.

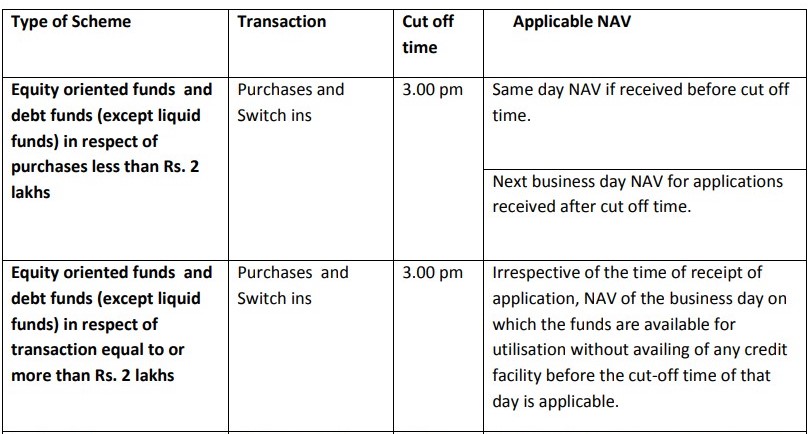

In order to understand the change, let us first get an idea what the rule was before. Below table describes the current rules to know which NAV will be applicable.

For Equity oriented funds and Debt Funds (Except Liquid Funds)

Note: Taking into account the impact of the revised trading hours for various markets as per the RBI Press Release dated April 3, 2020, SEBI has decided to reduce the cut-off timing from 3pm to 1pm. However, this change is temporary until further notice.

As you can see in the above table, there are two different rules for NAV applicability, one where the investment is less than 2 lacs and other where investment is equal to or more than Rs. 2 lakhs. Cut off time was 3pm for deciding which NAV will be applicable.

Current Scenario 1

If AMC receives purchase application before 3 pm, Same day NAV will be applicable. If after 3pm, then next business day NAV will be applicable.

Current Scenario 2

In case the transaction amount is equal to or more than 2 lacs, then NAV of the business day on which the funds are available for utilization will be applicable.

With this change, From January 1 2021, irrespective of the time and size of purchase application, NAV of the business day on which the funds are available for utilization by AMC will be applicable. It means the NAV of the day when investor’s money reaches AMC. This means scenario 2 rule will be applicable in case of first scenario as well.

Must read: SEBI’s recent announcement on new Stamp duty charges

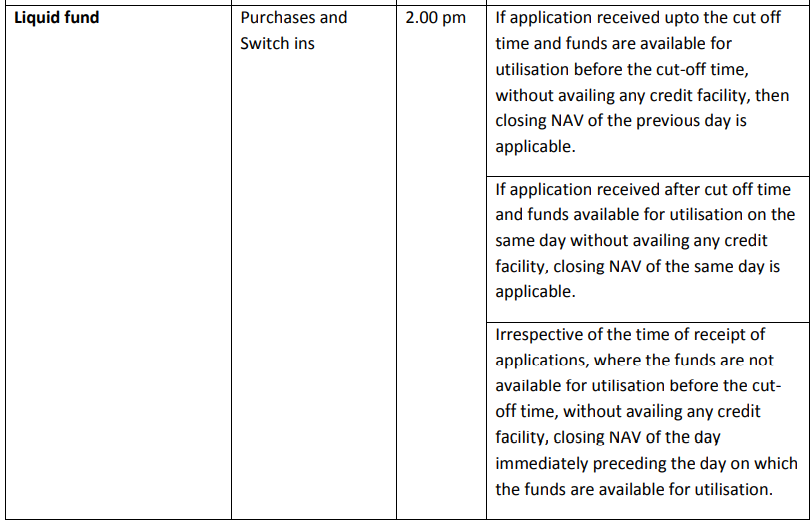

For Liquid and Overnight Funds

Below table shows the current rules for liquid and overnight funds and there is no change in these rules. The same rules apply even now.

Note: Taking into account the impact of the revised trading hours for various markets as per the RBI Press Release dated April 3, 2020, SEBI has decided to reduce the cut-off timing from 2pm to 12:30pm. However, this change is temporary until further notice.

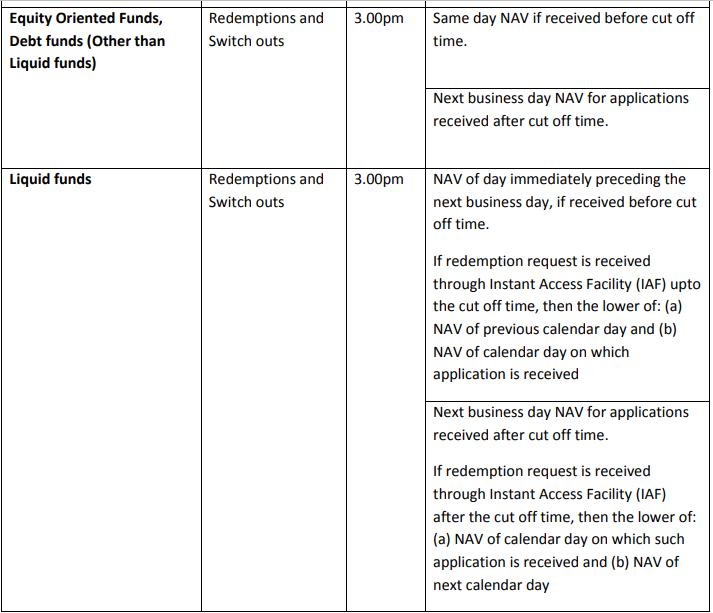

For redemption of funds

At the time of redemption, whether from an Equity fund or debt fund or liquid funds, the rules remain unchanged. Below table describes the same.

Note: Taking into account the impact of the revised trading hours for various markets as per the RBI Press Release dated April 3, 2020, SEBI has decided to reduce the cut-off timing from 3pm to 1pm. However, this change is temporary until further notice.

SEBI said such a policy will ensure that all the schemes and its investors are treated in a fair and equitable manner. These new set of rules is made to ensure more efficiency and effectiveness. It makes the internal control mechanism stronger which protects and safeguards the interest of investors.

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning without any cost on: http://bit.ly/Robo-Fintoo

To Invest and keep regular track of your portfolio download: Fintoo App Android http://bit.ly/2TPeIgX / Fintoo App iOS http://apple.co/2Nt75LP‘

Disclaimer: The views shared in blogs are based on personal opinion and does not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the sole decision of the investor and the company or any of its communication cannot be held responsible for it.