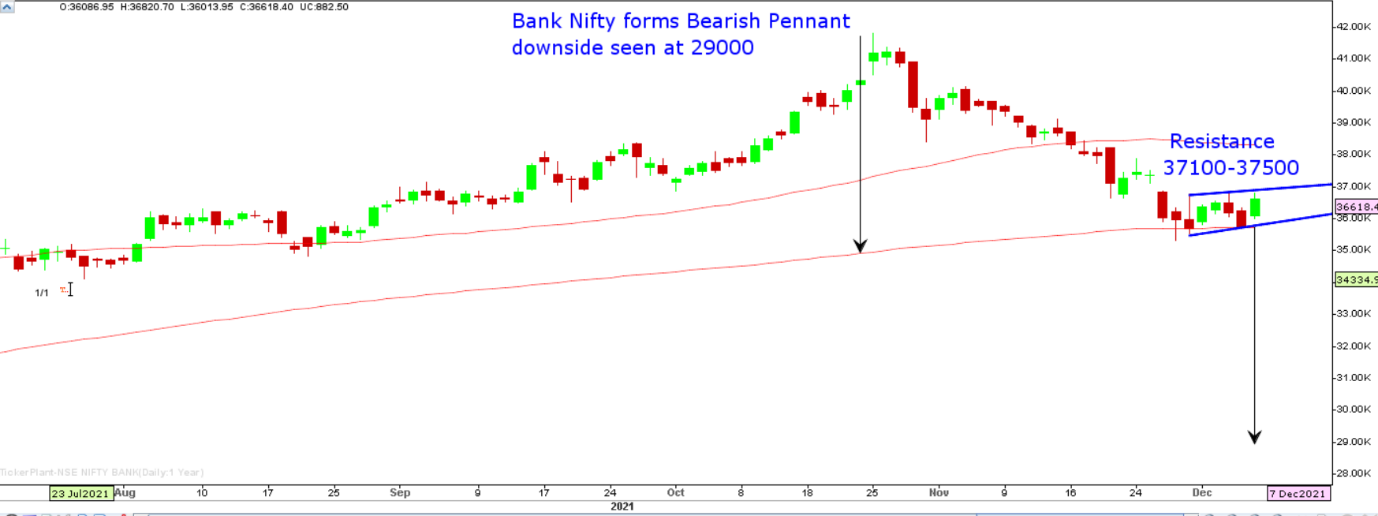

Markets rebounded sharply on Tuesday reversing its Monday losses after Bank Nifty rallied by 2.5% from the crucial support of 200 DMA on back of global cues and ended above 36500. However despite the upmove, both Nifty and Bank Nifty continue to remain below 50 DMA and 100 DMA thus turning any upmove unsustainable in near term. Infact Bank Nifty has thrown up bearish pennant formation which projects downside of 29000 in the near term. Selling is expected from the resistance zone of 37100-37500.

Wall Street’s main indices finished Tuesday’s session with strong gains as investors shook off some anxiety about the latest coronavirus variant and boosted Nasdaq by piling into technology stocks. The Dow Jones Industrial Average rose 492.4 points, or 1.4 percent, to 35,719.43, the S&P 500 gained 95.08 points, or 2.07 percent, to 4,686.75 and the Nasdaq Composite added 461.76 points, or 3.03 percent, to 15,686.92.

Stocks in news

NHPC: The company has approved a proposal for monetisation by securitisation through a bidding process of RoE of Chamera-I power station (Positive)

Hindustan Zinc: The company approved an interim dividend of Rs 18 per equity share on a face value of Rs 2 per share for FY22 (Positive)

Reliance Ind: The new JV will construct and operate a Chlor-Alkali, Ethylene Dichloride (EDC) and Polyvinyl Chloride (PVC) production facility, with an investment of more than $2 billion. (Positive)

Housing Companies: India, ADB Sign $150 Million Loan to Provide Affordable Housing (Positive)

Coal India: India’s coal output at 67.84 MT in Nov: PTI (Positive)

Nestle: Company gets approval under Production Linked Scheme (Positive)

Sugar Companies: India unseats Brazil as No.1 food supplier to Arab nations after 15 years (Positive)

Praj Ind: Announced innovative solution to process sugarcane juice in to a new sustainable feedstock BIOSYRUP for round the year ethanol production. (Positive)

Larsen and Toubro: L&T has signed an agreement with the Saudi Arabian Oil Company Aramco to develop manufacturing capabilities in Saudi Arabia, as per a report (Positive)

Texmaco Rail: The company has informed about the successful completion of its rights issue aggregating to Rs 164 crore (Neutral)

Orchid Pharma: The company had availed a Rupee term loan from Union Bank of India which was at an outstanding level of Rs 164.67 crore on December 06 (Neutral)

SpiceJet: Madras High Court has ordered the winding up of private carrier SpiceJet and directed the official liquidator attached to the High Court to take over its assets. (Negative)

Polyplex Corporation: PT Polyplex Films Indonesia has commenced operations of a 10.6-metre BOPP film line with a capacity of 60,000 tonnes per annum (Positive)

Must Read: Tips and Suggestions for the Financial Portfolio

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning without any cost on: http://bit.ly/Robo-Fintoo

Disclaimer: The views shared in blogs are based on personal opinion and does not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the sole decision of the investor and the company or any of its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.