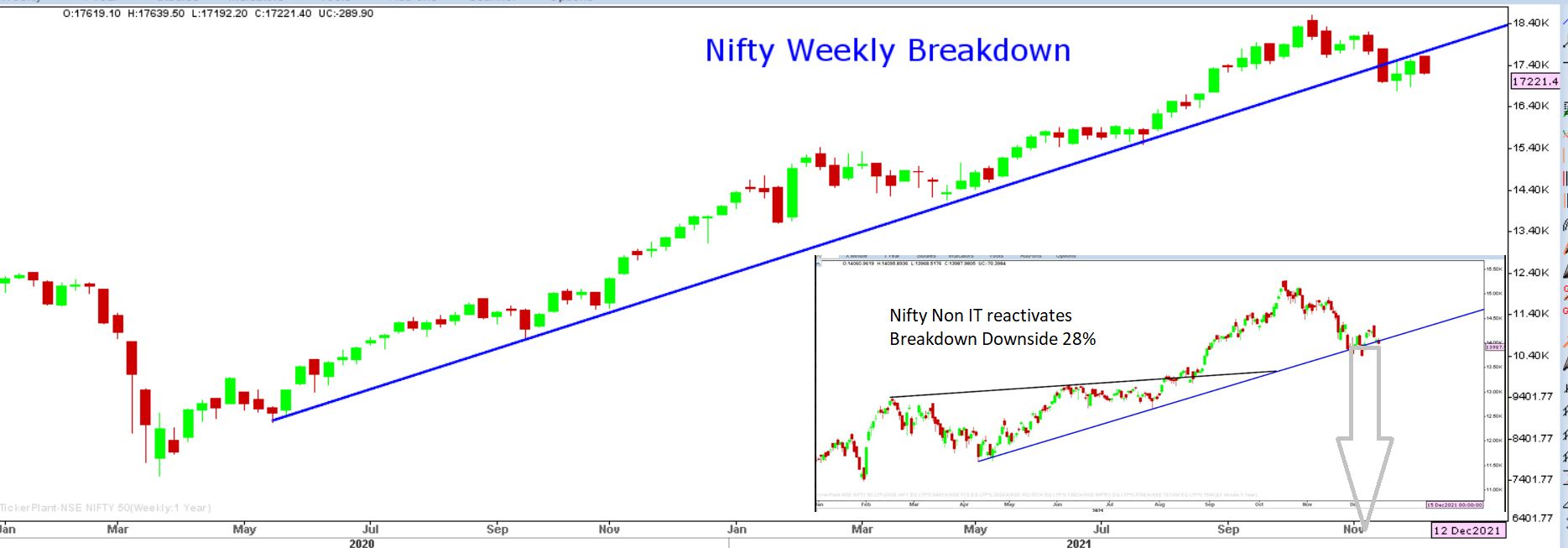

Markets violated the key support on Wednesday after Nifty closed below 17312 while USDINR cleared its psychological barrier of 76. The close below 17312 has also reactivated breakdown in Nifty Non IT Index which holds 82% weight within Nifty and projects downside potential of 28% in near term. With JPYINR clearly sustaining above 66.70, we expect any rebound in equity markets to remain unsustainable and expect aggressive FII selling to force Nifty 16% lower in the next few days. Resistance from hereon will be seen at 17312 and potential target 14600.

Policymakers at the United States Federal Reserve voted unanimously to leave interest rates unchanged at the end of their two-day meeting on Wednesday. The Fed will also continue to support the nation’s economic recovery by buying bonds at a clip of $120bn per month.

Nifty Weekly & Nifty Non IT Index

Stocks in news

PGCIL board approves interim dividend of Rs 7 per Rs 10 share for 2021-22

Drug major Cipla to acquire 33% stake in Clean Max Auriga Power

Reebok deal price, growth potential positive for Aditya Birla Fashion

Infosys subsidiary to acquire Singtel’s Malaysia delivery centre

TVS Motor, BMW Motorrad join hands for EVs; first product in 24 months

ICICI Prudential signs United Nations Principles of Responsible Investing

Ola delivers S1 scooters to its first 100 customers in Chennai, Bengaluru

Reliance eyes first oil cargo from UAE trade arm in Dec

Jio, WhatsApp signal a deeper embrace in online retail and digital payments

JSPL to bid ‘aggressively’ for debt-laden steel maker NINL next week

SpiceJet settles disputes with Canadian plane maker De Havilland

NTPC awards India’s first green hydrogen-based microgrid project

Tata puts key focus on beauty business as startups blaze the trail

Tata Group in talks with Taiwan companies to make chips in India

Medplus’ Rs 1,398 crore IPO subscribed 52.6x on strong QIB interest

SBI MF’s Rs 7,000-cr IPO likely in Q1FY23; eyes valuations of Rs 70,000 cr

Burger King India plans to raise Rs 1,500 crore via securities

Industries & Sectors

Distributors write to FMCG companies for the second time on price parity

Govt approves Rs 76,000-cr plan for semiconductor, display manufacturing

Govt expects Rs 1.7 trn investments in 4 years under semiconductor scheme

India’s sugar exports in a sweet spot despite WTO subsidy ruling

Govt exploring public financing for road infra projects. Total length of national highways up at 140,937 km till Nov-end – Gadkari

Domestic steel prices to soften 10-15% in 2022 – S&P Global Platts

ICRA cuts growth forecast for passenger vehicle industry to 8-11% for FY22

Scheduled payment banks, SFBs to do government agency business – RBI

Micro-loan disbursement up 154.5% QoQ to to Rs 64,899 cr in Sept – MFIN

Economy & Policy

India’s exports rose 44% to $16.46 billion during Dec 1-14

Indian economy recovering well, but Omicron poses a risk – RBI

Govt approves implementation of PMKSY for 2021-26 to benefit 2.2 mn farmers, with an outlay of Rs.93,068 cr

Meeting FY22 fiscal deficit target hinges on disinvestment proceeds

India’s GDP to grow 8.2% in FY23, RBI to hike rates by 100 bps – BofA

WPI inflation hits record high of 14.23%, raises retail inflation fears, the highest WPI rate in 2011-12 series with WPI inflation remaining in double digits for 8th month in a row

Must Read: Wealth Creation Myths Every Young Investor should Know!

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning without any cost on: http://bit.ly/Robo-Fintoo

Disclaimer: The views shared in blogs are based on personal opinion and does not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the sole decision of the investor and the company or any of its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.