PMS Products & their strategies in the Indian Market

Portfolio Management Services (PMS), is investment management services offered by the Portfolio Manager. The investment portfolio can be diversified into stocks, fixed income, and other structured products. These services can potentially be structured and tailored to meet specific investment objectives based on the risks, rewards, and investor goals as reflected in the Investment Policy Statement. PMS offers customized equity options, but you should have a large sum of money to invest to avail service of a Portfolio manager. A portfolio manager has a thorough understanding of the businesses and uses it to improve investor’s gains. The PMS provides you with experts who are well-versed with the market happenings and they can better guide you on important investment decisions. They track the market and invest your money keeping your requirements in their mind. They advise you on whatever you are going to do in the share market.

Features of PMS

- You get higher returns with the help of a well-knowledgeable portfolio manager.

- You can transfer the headache of monitoring your shares and taking decisions on those shares to the experts.

- The primary job of the portfolio manager is reducing the risk of the investor’s investment by selecting the right stocks according to the analysis and thereby increasing the returns or the earning on the investment.

- CA has to certify the minimum specified net worth of portfolio managers of Rs 5 crores.

- A maximum exit load of 3 percent can be charged in the first year, 2 percent in the second year, and 1 percent in the third year. No exit load applicable after three years.

- PMS investment suits only those who have a large affording power or who is a wealthy person as the minimum ticket size is 50 Lakhs as per SEBI norms. The PMS charges a large percentage of money from its users which are not within the capacity of a normal or average class investor.

- The service providers have different models portfolios for the investors which the investors can choose as per their financial goals and requirements. They can even customize them if they want some additional or want little adjustment.

- You get a piece of expert advice across instruments from debt to equity to gold and mutual funds.

PMS Charges in India

There are different types of fees charged by these service providers out of your total invested part.

- Entry Load– Whenever you take an entry into the PMS, you are charged an entry fee which is generally termed as the Entry Load. It is 3% or it may vary.

- Management Charges– This is a service charge for managing your portfolio. It may vary from 1-3%, depending upon the service provider. It is charged on a quarterly basis.

- Profit Sharing Fees– If a PMS has profit-sharing agreements between the client and provider, in addition to other fixed fees, then this charge is based on such terms of an agreement. It is charged above as hurdle rate is the minimum amount of profit that a PMS needs to earn before it can charge a profit-sharing fee.

- Apart from the charges mentioned above, the PMS also charges some other fees like Custodian Fee, Demat Account opening charges, Audit charges, Transaction brokerage etc.

The experts do not follow or cram the usual investing activities like what people usually do as they invest when the market is rising or vice versa. This is not so with the PMS experts. They take wise decisions and they deeply understand or analyze the market phenomenon. They keep your requirements in their minds and accordingly invest in the segment preferred.

There are three types of Portfolios in PMS:

Discretionary PMS– Discretionary Portfolio provides the service provider a right to make decisions on behalf of the client, whether he wants to sell or buy the shares.

Non-Discretionary PMS- This is the just reverse of the above. Here, the service provider consults with his clients on investment decisions or buying and selling of shares before transacting any event. The decision making power lies in the hands of the client only.

Advisory: Only advice is given to the client. No execution on behalf of the client is done by the portfolio manager.

As per the current market scenario, There are a variety of PMS in the market which focus on different sectors & further are customised according to investor’s needs.There are many PMS available according to individuals needs. We have listed two PMS for analysis purpose:

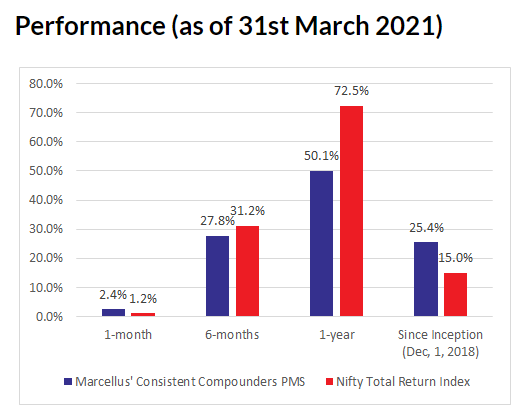

Marcellus PMS

The Marcellus PMS company is one of the highly renowned broking companies available in India. The portfolio is actively managed by Mr Saurabh Mukherjee. He is also the Founder & Chief Investment Officer of Marcellus Investments. The company is registered under the Securities Exchange Board of India and its headquarters are in Mumbai, Maharashtra.

The portfolio management service model is the leading model of the broking company.The filters followed by the company to choose a stock are very stringent which makes the process tough for a stock to be in their portfolio.

They follow coffee-can investing which states the company buys and forgets the stock as they take high bet on fundamentals of a stock. The promotion and marketing is also on the aggressive side.

The portfolio is agnostic to parameters like market cap, sectors etc. Their core investment strategy is to invest in a concentrated portfolio of heavily moated companies that can drive healthy earnings compounding over long periods with very little volatility. Companies which are chosen for investment are taken into account on grounds of corporate governance and capital allocation track record.

The three tenets for selecting stocks Consistent Compounders strategy:

1. Clean accounting and good corporate governance

2. Historical evidence of prudent capital allocation

3. A major filter for stock to be in a portfolio is those chosen industries which have high barriers to entry. Which helps companies generate returns which is higher than the cost of capital.

The upper hand of investment goes to companies with strong sustainable competitive advantage, on account of brand built, business verticals and strategic assets.Marcellus’ Consistent Compounders portfolio has five stocks enjoying a cumulative 48.80% weightage – Asian Paints, HDFC Bank, Bajaj Finance, Page Industries and Pidilite. Their highly flexible commission models, as well as investment plans, provide good convenience and satisfaction to all of its clients. –

Stallion Asset

This Portfolio Management Services follows growth investing as its core philosophy. They started with beginnings as a Research Analyst company and have become a portfolio management company due to consistent performance on their research analyst services which helps their clients successfully & consistently beat the Market. They are specialists in buying high quality midcap companies that are often ignored by the analyst community. Their unique investment philosophy of catching the trend and managing the risk has been back tested and they are aiming to create 25% plus CAGR returns for their clients.

Also read: What is ELSS? Is ELSS Different from Mutual Funds? – Fintoo Blog

Investment Objective:

The objective of this service is to provide the client with a structure that can achieve preservation and growth of its capital, the portfolio manager shall endeavour to apply its professional expertise in order to help clients to achieve goals as per the PMS scheme opted.

Risk Management: If given a choice between High risk, High return ans Low risk decent returns stallion prefers to choose low risk decent returns. The Core Stocks in their Portfolio gives them a lot of time to exit if there is a change in the expected growth rate of stocks. They focus on Incremental Return of Capital Employed,Competitive Advantage Period and Cost of Capital.

Part A: Core Stocks – In core stocks focus is on Market Leadership, Management, Market Opportunity, Margin of Safety.

Part B: Trends – They believe There is no bull market without earnings growth and they always buy sectors with high expected sustainable growth of more than 20% for next 3-5 years.

Part C: Special Situation Growth Rate, Business Quality & Management Quality play the role here.

This above photo shows Stallion Assets core fund performance over the years.

While a core only portfolio will work well in a Bear market but typically underperforms in a Bull Market. A special situation only Portfolio might have opportunities in sometime & be on cash in others. Their Portfolio of Core, Trend and Special Situation will not only lower the Portfolio Volatility but will deliver decent returns. Focused Sectors: Stallion Asset focuses on 4 major sectors i.e. Consumer, Financials, Consumer Tech and Pharma. Their Financials & Consumer Tech Part of the Portfolio should Ideally create alpha in a Bull Market whereas our Consumer & Pharma basket will protect us during the bear Market.

Recommendation

Market regulator SEBI has made it mandatory for portfolio managers to provide investors with regular performance reports. The reports are not verified or authenticated by SEBI. When you compare PMS expenses with different avenues, then PMS expenses are really heavy. For an investor with limited time and knowledge and high capital base, PMS is a suitable option given the investment management institution is reputed and offers transparency of operations. PMS also helps in better realization of diversification benefits than aimlessly investing in any number of securities. The performance of the portfolio is solely dependent on the manager’s ability to outperform the market. The portfolio manager’s returns and performance are highly dependant on the accuracy of the security analysis done by the portfolio manager and hence are highly dependant on the competency of the fund manager and the investment management company.

To Invest and keep regular track of your portfolio download Fintoo App Android http://bit.ly/2TPeIgX / Fintoo App iOS – http://apple.co/2Nt75LP

Related Posts

Stay up-to-date with the latest information.