Oil prices are back with a vengeance after a brief drop below USD 100 a barrel and are now currently above USD 120 a barrel.

In fact, oil prices have jumped to a 13-week high as demand from the U.S. is rising while expectations that China’s oil demand will increase amidst growing supply concerns in several countries, including Iran.

However, there is a growing expectation amongst the market participant that China’s Covid suppression policy could keep China’s demand for oil lower.

We estimate oil prices to rise beyond their previous high of USD 138 a barrel to at least USD 150 a barrel this year. This is obviously a short-term negative for India. However, on the positive side, India is able to buy more oil from Russia at a cheaper price. However, fundamentally, there are big structural factors, which are pushing oil higher.

If a major portion of Russian energy exports were to be removed from global energy markets if there are further economic sanctions and a voluntary embargo by the EU on Russian crude oil and gas.

Russia is a meaningful exporter of crude oil and refined products in the context of global demand and supply as it exports 4.5 mn b/d of crude; it also exports another 3 mn b/d of refined products. Already, the global oil supply-demand situation is tight. Efforts by OPEC+ oil producers to boost output are “not encouraging” to satisfy the rising demand. OPEC + is currently 2.6 million BPD short of its target.

OPEC does not have meaningful spare capacity to rebalance oil markets if the entire Russian oil and refined products were to go out of global oil markets. Also, Incremental drilling activity in shale oil regions has been fairly muted despite the spike in crude oil prices.

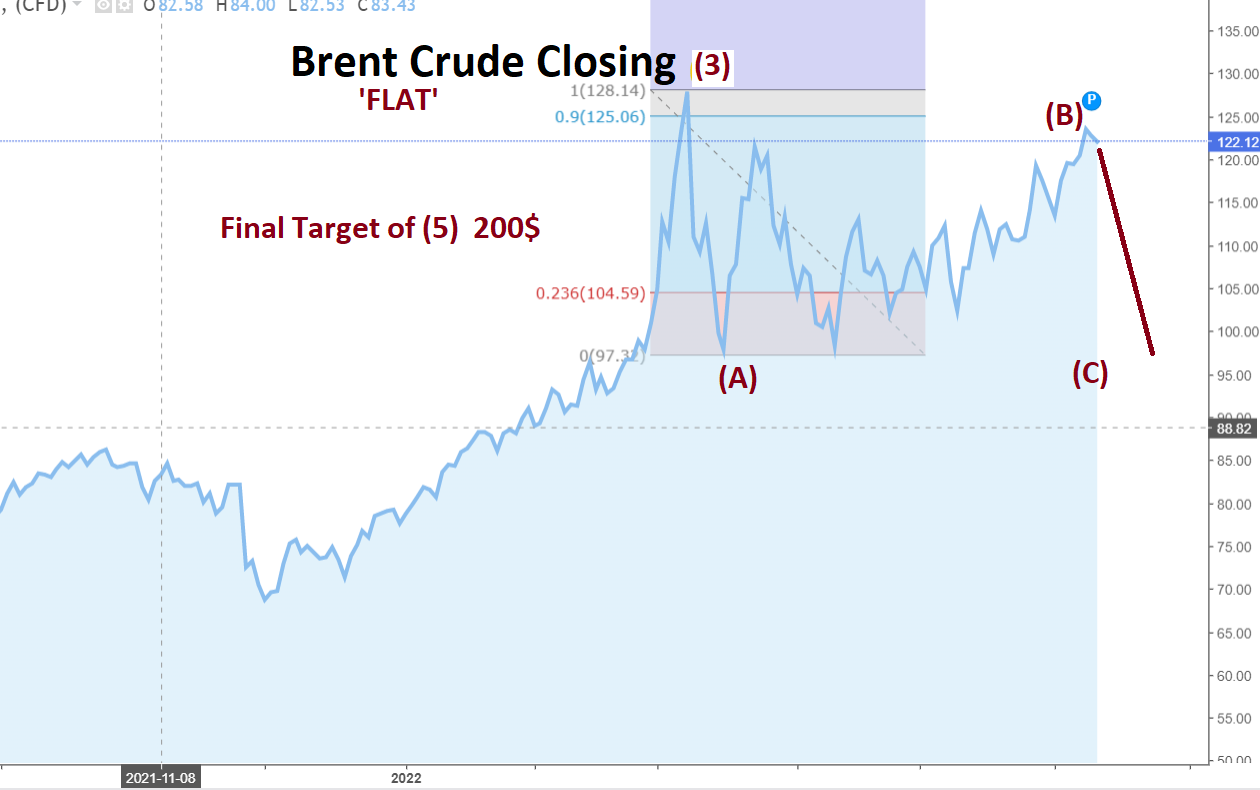

Technically, Brent crude prices after peaking at USD 138 in the month of March 2022 have been going through a correction pattern since then with a lower price range recently seen at USD 97 in the month of April 2022. The price setup in Brent crude typically resembles Wave 4 Flat A-B-C.

This would mean prices still would have the potential to form a marginally lower low below USD 97 before the bullish momentum begins. Generally, prices in Wave B of flat formation retraces 90-110% of Wave A and followed by Wave C of the down leg. This flat formation can be clearly seen when depicted on the closing chart of Brent crude price.

The long-term setup of Brent crude indicates the target of USD 200 but in the short-term crude may be about to peak out and re-test the lower end of the trading range.

If Brent oil prices surge to USD 140 a barrel, there is a consensus that an economic recession is imminent. According to an analysis by Datatrek since 1970 whenever oil prices have doubled in a year a recession has followed in the next 12-18 months.

From an Indian standpoint, given the global crude prices at USD 120 per barrel, rising commodity prices, and a depreciating rupee against the US dollar, the upside risk to current inflation (7.79 pct in April) is very high.

Higher interest rates are not good for the economy as they will impact the current economic recovery which is underway. RBI Governor Shaktikanta Das says that it is an extremely uncertain situation and the future rate of action will depend on the evolving dynamics.

He, however, listed out upside risk to inflation from higher global commodity prices, supply-side issues, pass-through of higher prices from companies to consumers, and elevated international crude oil prices.

Thus, we feel the level of USD 140 a barrel is a crucial level to watch out for to determine the economic recovery trajectory.

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 99/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the sole decision of the investor and the company or any of its communication cannot be held responsible for it.