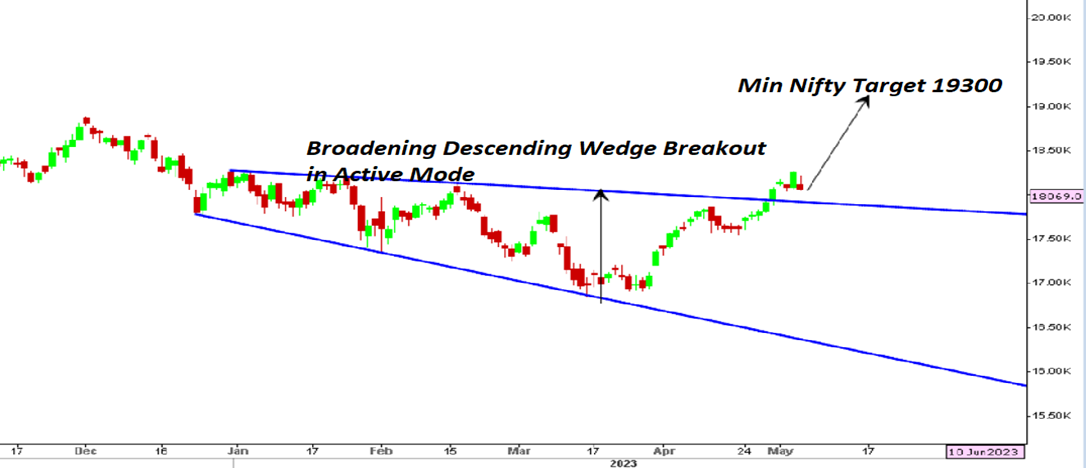

Markets for the week ended on a flat note after Friday’s losses forced Nifty to retreat from 18270 on the back of selling from HDFC twins. Friday’s decline can be considered as a temporary pause before we see main indices marching beyond 19000. The strengthening of the Nifty Alpha low Volatility Index even on Friday’s trading session clearly shows the divergence of fund flow towards low standard deviation stocks which would act as a key driver for the Nifty rally towards 19300. In the short term, 18050 should be seen as strong support with the coming week’s target placed at 18800.

Nifty 50 Index Daily

Stocks to watch

Positive Read through

- IndusInd Bank- R Meyyappan resigns as CRO, Sachin Patange appointed COO

- Lupin to acquire French pharma company Medisol for around Rs 160 crore

- TVS Motor partners with KidZania for motor racing for young riders in India

- TVS Motor partners with KidZania for motor racing for young riders in India

- Britannia- margin at 19.9 pct vs expected 17.4 pct, volumes up 1 pct vs expected 4-5 pct

- Marico- earnings in-line, domestic volume growth at 5 pct, international business up 16 pct YoY

- ICICI Lombard- April premium up 16.6 pct, market share down 16 bps YoY

- Paytm- April loam disbursals up 57.7 pct YoY, net loss declines to Rs 167.5 cr in Q4

- Thermax wins Rs 272 cr order for the mechanical balance of a refinery plant

Negative Read through

- Coal India’s Profit declines 18% YoY, revenue is up 16.6%, and the dividend declared at Rs 4/share

- Sun Pharma- USFDA says Mohali unit not operating in line with the consent decree

- ABFRL and TCNS Clothing- TCNS shareholders to get 11 shares of ABFRL for 6 shares held in Co

- Piramal Ent- NII down 19 pct YoY, operating profit slips 43 pct YoY

- Adani Gas, Adani Trans- MSCI to reduce free float in May review meet

- Alembic Pharma- US sales at USD 43 mn vs estimates of USD 47 mn, API sales up 41 pct YoY

- Union Bank- other income aids profit, NIM down 23 bps, slippages up 9 pct QoQ

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the investor’s sole decision, and the company or any of its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.