Markets snap 3-week losing streak; Quarterly earnings in focus in the coming week

Indian stock market position

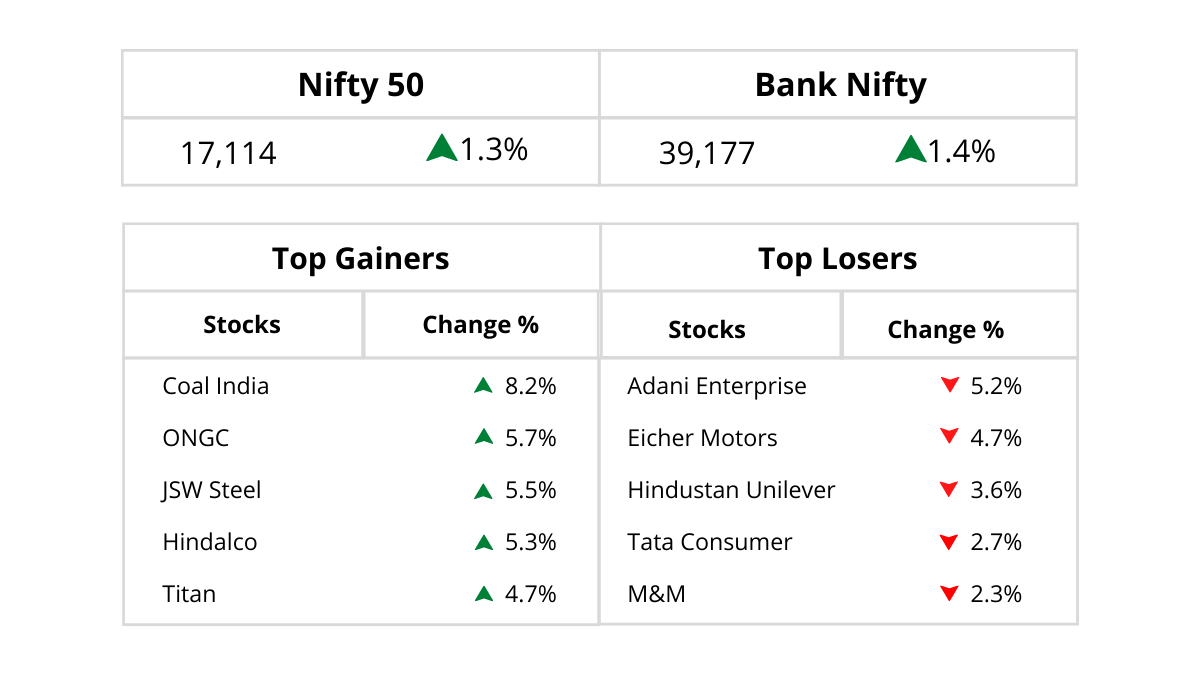

Equity markets snapped a three-week losing streak and logged modest gains even as volatility remained high. Markets rebounded after witnessing a sharp sell-off in the past couple of weeks as Nifty got supported by a rally in metal, realty, and IT stocks.

Global markets rose after weak manufacturing reports boosted hope for smaller rate hikes. Cautiousness prevailed as the rupee weakened past the 82 per dollar mark for the first time against the US dollar amid a surge in crude and US bond yields.

The Nifty gained 1.3 pct while the Nifty Midcap and Nifty Smallcap index gained 2.4 pct and 2.6 pct respectively. On the sectoral front, the Nifty IT index gained 2.8 pct and the Nifty Metal index gained 2.8 pct. Nifty Realty was up 3.4 pct while Nifty Pharma was up 1.3 pct. Nifty Bank gained 1.2 pct. The Nifty FMCG index was the sole loser, down 1.3 pct.

Foreign investors and the fall of the rupee

FII were net sellers to the tune of Rs 370 mn while DIIs were net buyers to the tune of Rs 10.24 bn. FIIs turned net sellers for the month of September to the tune of Rs 167.42 bn after buying Rs 220.25 bn in the month of August 2022.

DIIs on the other hand supported the markets and bought equities worth Rs 108.74 bn after having net sold equities worth Rs 70.68 bn in August 2022.

The rupee weakened past the 82 mark for the first time to hit a fresh record low against the US dollar amid a surge in crude and US bond yields.

Rising oil prices were the most significant weight on the rupee this week, given India’s status as the third-largest crude importer in the world. The Rupee traded near 84.2 against the dollar.

On the commodity front, crude oil advanced past USD 98 a barrel, up 11 pct this week – its biggest weekly gain since the early days of the Russia-Ukraine conflict this year- spurred by OPEC’s production cut.

Oil prices rose on the back of a ‘deep’ supply cut by OPEC and its allies and are set for more volatility as the U.S. readies response to the move.

Updates on Indian business indices

There was a slew of business updates released during the week. Titan’s Q2FY23 business update indicates 18 pct YoY growth in jewelry sales (recurring, excluding bullion sales) on a high base led by low double-digit growth in walk-ins, and steady conversions, and the rest contributed by a likely growth in average ticket size.

HDFC Bank reported strong business performance in Q2FY2023 in terms of loan growth as well as deposit growth on a YoY basis. Total advances grew at a healthy pace of 23.5 pct YoY vs. 21.6 pct YoY in Q1FY2023. Marico’s domestic business (~77 pct of revenue) saw low single-digit volume growth with the 3-year CAGR in high single digits, essentially pulled down by Parachute Coconut Oil and Value-Added Hair Oils.

Microtech Developers (Lodha) reported strong pre-sales of Rs 31.48 bn (up 57 pct YoY, up 12 pct QoQ) for Q2FY23. The H1FY23 pre-sales stood at Rs 59.62 bn (up 101 pct YoY) which is 52 pct of its pre-sales target of Rs 115 bn for FY23.

Market highlights

Zee Entertainment remained in the limelight after CCI granted conditional approval to the proposed merger of the company with Sony Pictures Networks India. The Telecom industry remained in limelight, as the government has approved a sum of Rs 260 bn to set up 25,000 telecommunication towers in the country over the next 500 days, as connectivity is vital for Digital India.

TCS gained on reports it has created two new business units dedicated to telecom and 5G solutions led by industry veterans.

Outlook for this week

This week will see the start of the Q2FY23 earnings season with IT companies reporting their September quarter numbers. It is expected to be a reasonably strong growth quarter given the challenging macroeconomic scenario in US/EU.

TCS will be reporting on 10 Oct, Wipro & HCL Tech on 12 Oct, Infosys, and Mindtree on 13 Oct, and Tata Elxsi on 14 Oct. Other key companies that will be reporting the numbers are Bajaj Auto, Shree Cement, Tata Elxsi on 14 Oct and HDFC Bank, and Avenue Supermart on 15 Oct.

Economic data that will be out this week are- IIP data for the month of August will be released on 12 October. Inflation data for September will also be released on the same day. WPI data for September is due on 14 October.

What to expect?

With the recent correction, the valuations have come back to decent levels. The recession fear and global market melt-down have led to risk aversion amongst investors and markets seem to be oversold for now. With a sharp rally on the last day of the month, markets have given some hope to the bulls. We maintain our bullish stance on the markets with a near-term target of 18,200 in the Nifty.

Disclaimer: The views expressed in the blog are purely based on our research and personal opinion. Although we do not condone misinformation, we do not intend to be regarded as a source of advice or guarantee. Kindly consult an expert before making any decision based on the insights we have provided.