Markets extend flat in a volatile week; FII flows and global cues dictate trend

Equity markets gained during the week on the back of supportive global market cues with investors largely pricing in more interest rate hikes aimed at taming runaway inflation. European markets were trading higher, as investors digest the European Central Bank’s jumbo rate hike ahead of a key EU meeting to discuss plans to tackle the region’s energy crisis.

Back home, sentiments remained upbeat after FM Nirmala Sitharaman said India has ramped up the import of crude oil from Russia at discounted prices amid sanctions on Moscow. She said India ramped up its import from Russia from about 2% of the total shipment of petroleum products to 12-13% in a couple of months as part of inflation management

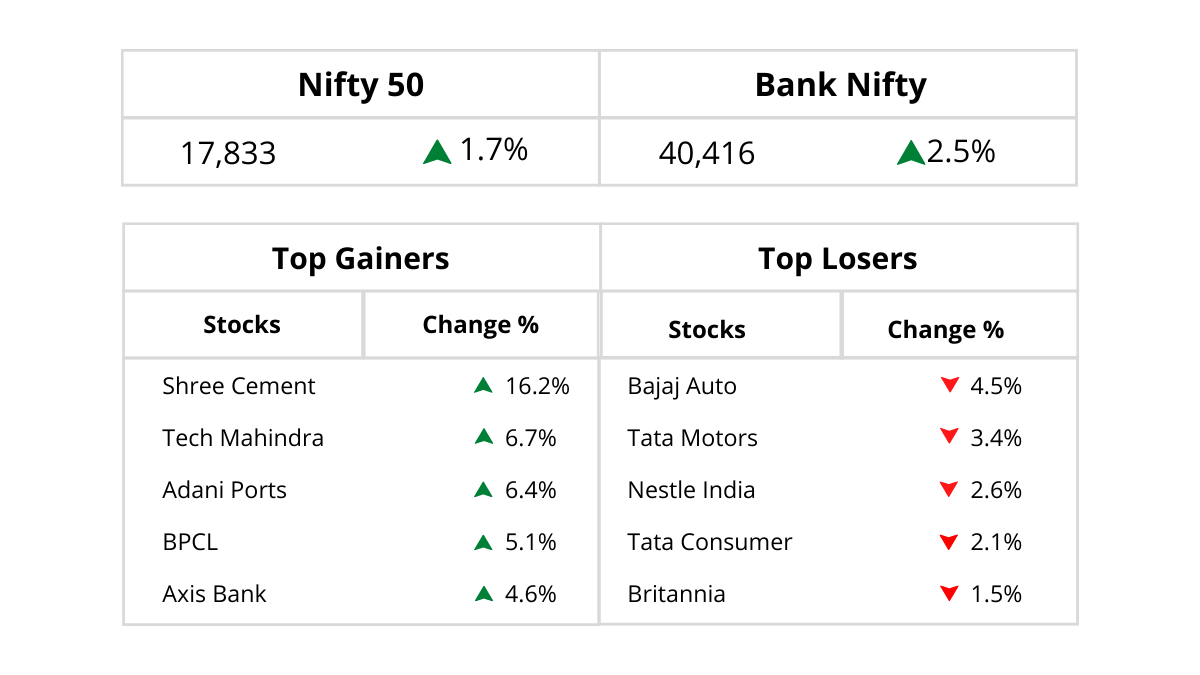

The Nifty ended higher by 1.7%. Nifty Midcap and Nifty Smallcap indices gained 2% and 3.3% respectively. Nifty IT index gained 3.5%, Nifty Bank gained 2.5% and Nifty Metal gained 2.3% during the week. FIIs were net buyers to the tune of Rs 61.36 bn while DIIs were net sellers to the tune of Rs 3.52 bn.

Crude Oil prices fell below USD 90 a barrel due to fears of weakening demand amid policy tightening and Covid curbs in China caused a rally in equity markets. Brent crude futures settled the week at USD 92.42 a barrel as supply threats supported prices. The fall in crude oil prices and buying by FIIs has helped the Indian rupee appreciated against the dollar from its recent low. However, we remain bullish on USDINR with an upside target of 81-82.

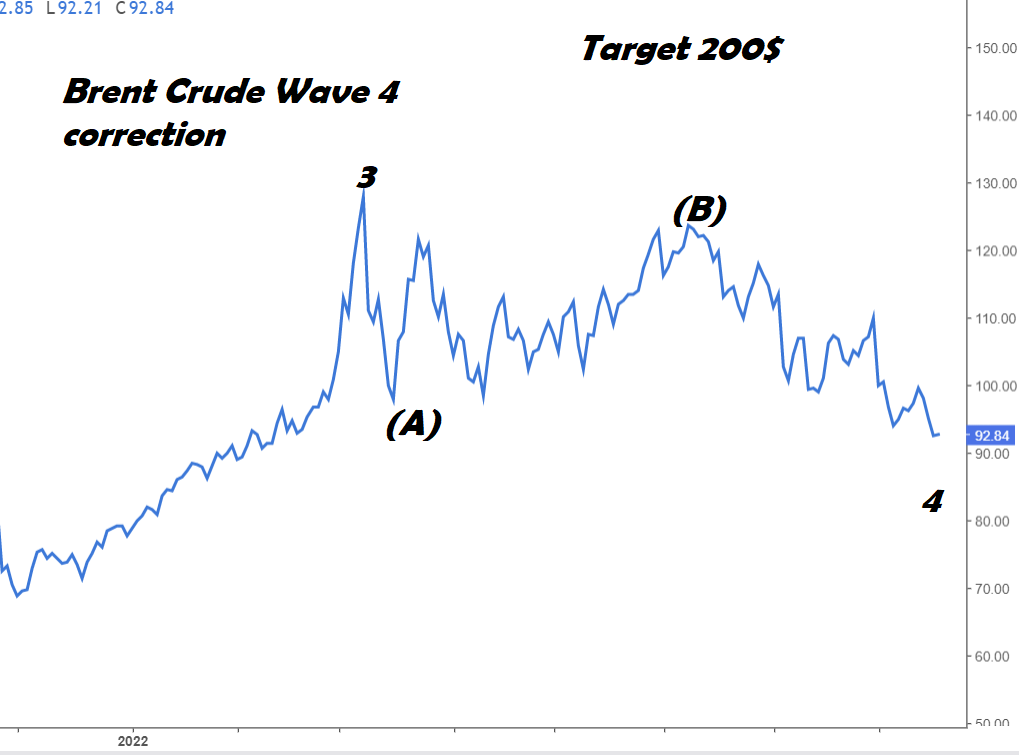

Brent Crude prices have seen a sharp correction in the past few days with the correction taking shape of Flat formation which is typically seen in the Wave 4 setup. In the next few days, we expect Brent crude to slip further towards USD 86, below which prices are unlikely to see a major decline as they enter the major Fibonacci support zone.

The long-term correction in Brent crude may be coming to an end in the next few weeks before we see a resumption of the upmove which can take prices to USD 200. The ideal strategy to be applied in the next few days would be accumulating Crude ETF when brent crude moves closer to USD 86.

Stock And Sector Specific Update

On the stock-specific front, cement stocks gained with Shree Cement being the top Nifty index gainer as the Adani group’s acquisition of Holcim’s stake in ACC, Ambuja brought the sector into the limelight as the sector may be poised for a re-rating. Also, the recent hike in prices up to Rs 20 per bag in the west/east regions for September 2022 boosted sentiments.

Defense Shipyard stocks like Mazagon Dock, Garden Reach Shipbuilders, and Cochin Shipyard gained on optimism of naval spending. in FY23, the navy aims to spend Rs 470 bn, with Rs 294 bn on naval fleets. As against the budgeted Rs 332 bn in capital outlay for FY22, the Indian Navy ended up spending Rs 460 bn. We continue to remain bullish on the Defence sector with a focus on Bharat Dynamics, Hindustan Aeronautics, Bharat Electronics, and defense shipyard stocks as mentioned above.

With a fall in crude oil prices near USD 90 a barrel, paint industry stocks were buzzing. NDTV started trading in lower circuits during the week after the back-to-back upper circuits in the week earlier. Reports emerged that Gautam Adani-led Adani Group’s open offer for 26% of shares in NDTV is set to open on October 17.

Airport service aggregator platform DreamFolks Services listed with a strong 56% gain on September 6. The Rs 562-crore IPO had received a strong response from investors, getting subscribed 56.68 times during August 24-26. DreamFolks Services is a dominant player and India’s largest airport service aggregator platform. The company facilitates access to airport-related services such as lounge, food & beverages, spa, and pick up and drop service.

India’s service sector growth bounced back strongly in August, led by strong rises in new orders, output, and employment. The services PMI index rose to 57.2 in August from 55.5 in July. A score above 50 indicates expansion in the sector. India’s merchandise exports declined 1.15% to USD 33 bn and the trade deficit more than doubled to USD 28.68 bn as imports rose by 37%. Meanwhile, India recently overtook the United Kingdom to become the fifth largest economy in the world.

Market Outlook For Coming Week

For the coming week, markets are expected to extend gains and will track global cues as well as crude oil price movement and FII flows closely. A few macro data points will like India CPI for August and IIP data for July will be announced on Monday. WPI inflation for August will be announced on Wednesday which is expected to be 13% as against 13.93% in July.

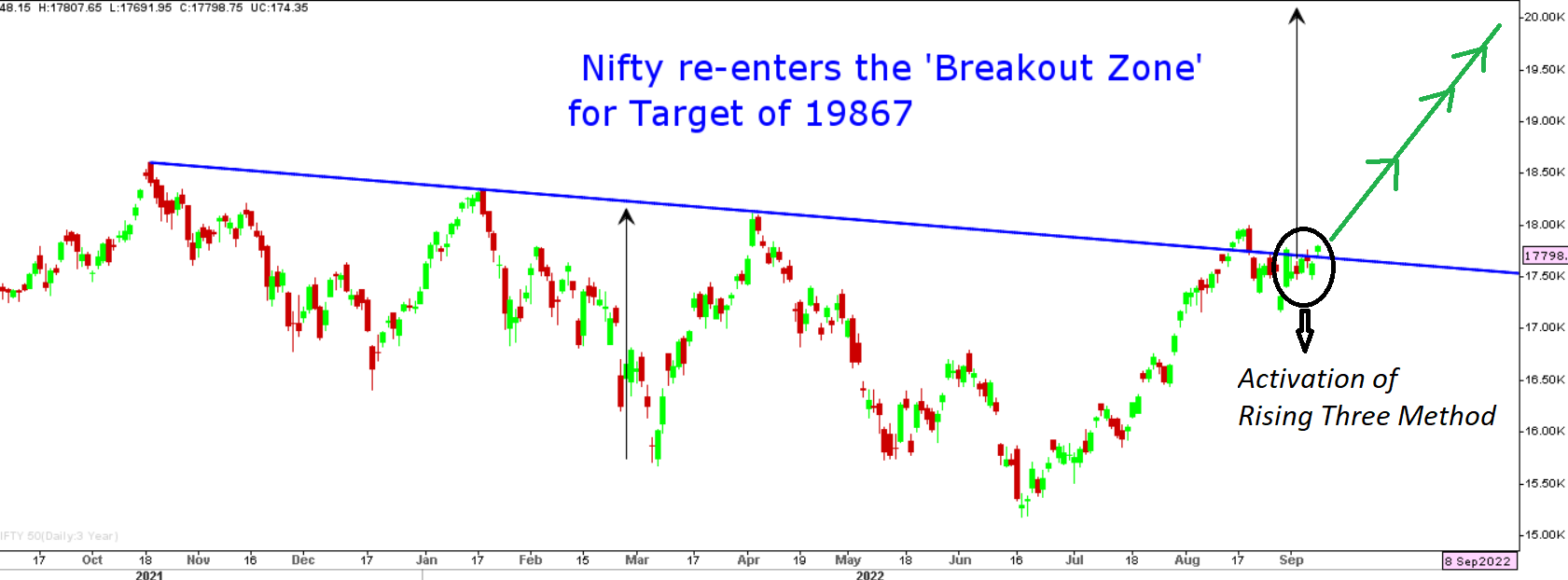

Globally, markets will keep a close eye on US inflation numbers on Tuesday as it will decide the trajectory for further rate hikes. Technically, the Nifty 50 Index has re-entered above the breakout line with upside potential seen at 19,867. We expect aggressive buying from FIIs in the next few days on the back of a sharp drop in brent crude prices and Bank Nifty would act as a catalyst for Nifty’s journey beyond the all-time high in the coming days.

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the sole decision of the investor and the company or any of its communication cannot be held responsible for it.