Markets extend gains, FIIs flows and earnings are in focus this week

Investors focused on the Federal Reserve’s Jackson Hole conference for clues about the central bank’s policy outlook in the week gone by. The Federal Reserve raised rates by three-quarters-of-a-percentage point in June and July.

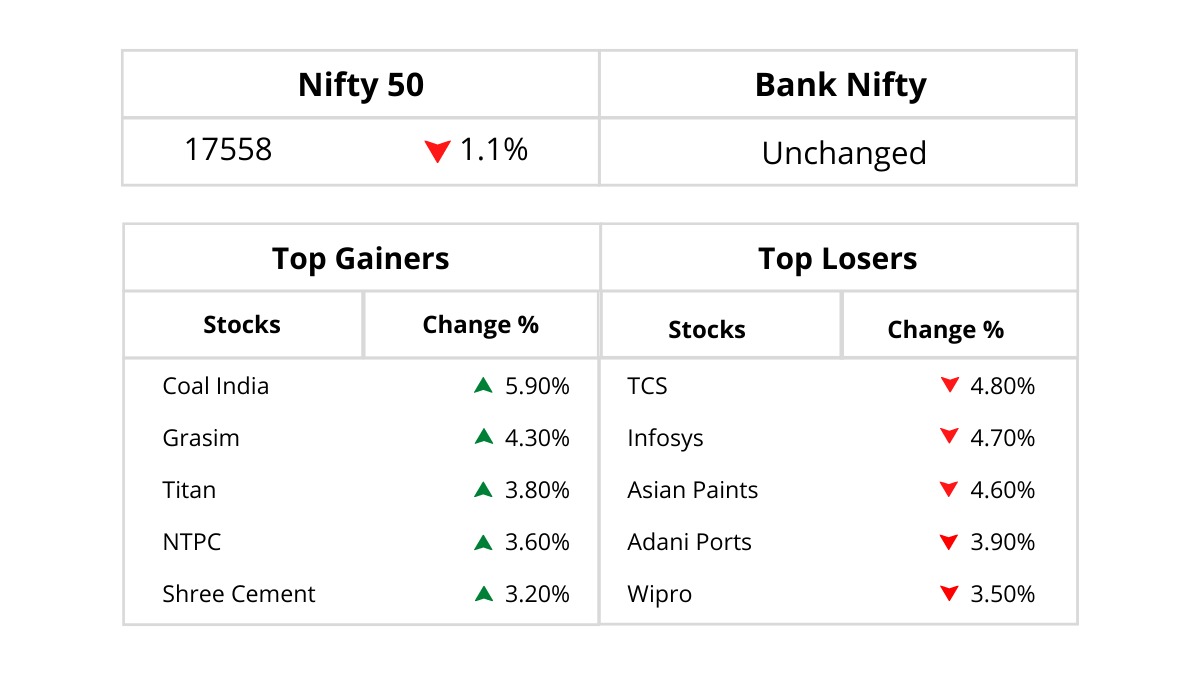

Its next policy meeting is in September, and it is expected that the Fed will maintain its hawkish stance and raise rates by 75 bps. For the week, the Nifty ended down by 1.1% to 17,559 and the Nifty Midcap100 and Nifty Smallcap 100 index fell by 0.3% and 1.5% respectively.

On the global front, Euro-area economic activity declined for a second month, as record inflation saps demand and weakness seeps into more and more sectors. On the flip side, GDP data from the continent’s largest economy, Germany, had brought relief. News that the country had narrowly avoided a contraction in the second quarter also lifted the sentiments of the investors to some extent.

Chinese stock market moved higher after its government announced billions in infrastructure spending. Meanwhile, the Japanese economy rebounded at a slower-than-expected pace in the second quarter from a COVID-induced slump, while growing fears of a global slowdown are clouding the outlook for the trade-reliant nation.

FIIs remained active buyers in Indian equities and were buyers to the tune of Rs 4.51 bn and DIIs were net sellers to the tune of Rs 5 bn. For the month of August, FII bought equities worth Rs 184.2 bn after being net sellers for 10 months. DIIs were exactly the opposite for the August month, they turned net sellers for Rs 65.55 bn after months of back-to-back buying.

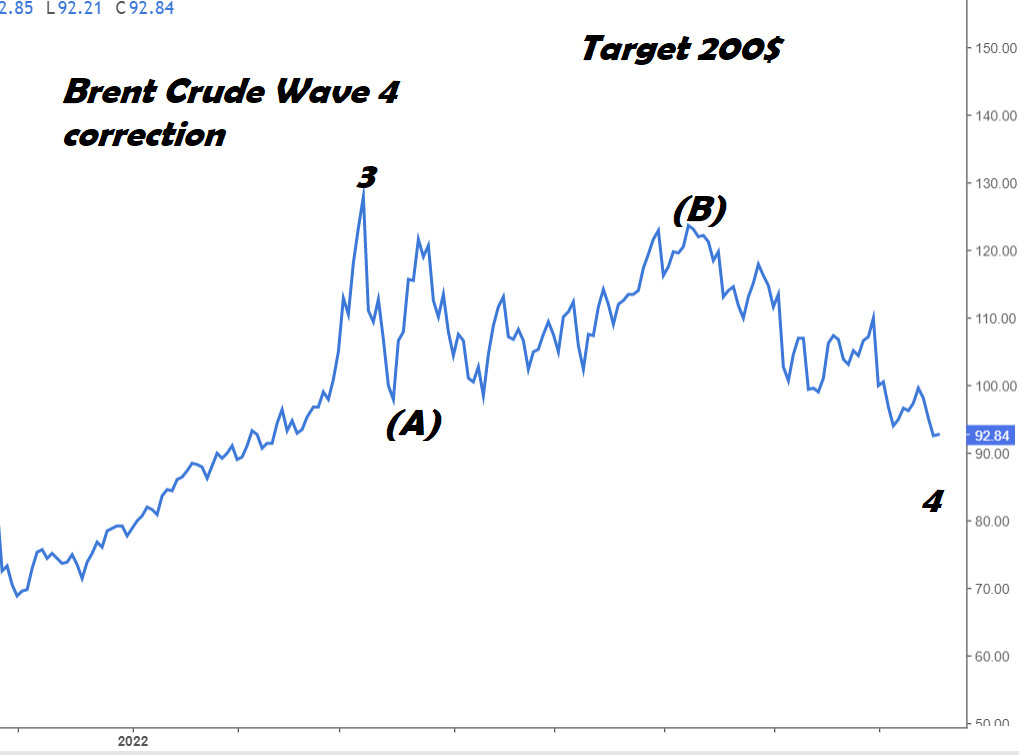

Brent crude prices have bounced about 10% from its recent lows of USD 92 after Saudi Arabia floated the idea of OPEC+ output cuts to support prices in the case of returning Iranian crude and with the prospect of a drop in U.S. inventories. We continue to remain bullish on crude and expect it to rise back to its highs.

The long-term correction in Brent crude may be coming to an end and we may see a resumption of up move which can take prices to USD 200 a bbl. An ideal strategy to be applied in the next few days would be accumulating Crude ETF and may add long positions in USDINR simultaneously.

USDINR is seeing no major signs of reversal despite decline in brent crude prices and next upmove could be lined up towards 86.5 if prices clear hurdle of 80.5. Currently, RBI putting all efforts to force USDINR below psychological mark of 80 but global strength in USD could eventually trigger major depreciation in rupee.

Stock And Sector-Specific Updates

- NDTV gained sharply as reports said that Adani Group would acquire 29.2 pct in the Company via indirect route, along with an offer to buy another 26 pct from the open market. Adani Group has made an open offer for NDTV at Rs 294 a share.

- Most of the Adani Group stocks tumbled after CreditSights, a Fitch Group unit, said in a report that the conglomerate is ‘deeply overleveraged’ with the group predominantly using debt to invest aggressively across existing as well as new businesses.

- Indian Oil Corporation rose after it announced plans to invest Rs 2 lakh crore to achieve net-zero operational carbon emissions by 2046.

- Fertilizer industry stocks in focus as India and Saudi Arabia signed a pact for an annual supply of 2.5 million tonnes of ammonia and DAP, NPK fertilizers for the next three years.

- Sugar industry stocks were in focus with a report that India’s sugar exports are likely to decline by 28.57 at around 8 million tonnes in the 2022-23 season on expected lower opening balance stock and higher diversion for ethanol.

Meanwhile, in an important development on the primary market front, API Holdings, the parent entity of PharmEasy, announced the withdrawal of the DRHP submitted for an IPO due to “market conditions and strategic considerations”. The company is committed to its growth and expansion plans, and is considering raising funds via a rights issue, the Company said in a statement. PharmEasy will now raise money through a rights issue.

Market Outlook For Coming Week

For the coming week, the markets open gap down after Federal Reserve Chairman Jerome Powell commented that the central bank’s job of lowering inflation is not done, suggesting that the Fed will continue to aggressively raise interest rates to cool the economy.

The market will continue to take cues from the various global as well as domestic factors. FII flow will be watched as they have been net buyers recently while the DIIs are staying on the sidelines. On the macro-economic data front, India’s economic expansion for the quarter ending June would be announced on August 31.

Fiscal deficit and core sector data for July will also be out on the same date. Automobile stocks will be in focus as the companies will start declaring their monthly sales data for August. Markets after the recent sharp run may witness some consolidation before we see the next leg of upmove. The strategy will remain ‘buy on dips’ and accumulate quality stocks on every decline.

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the sole decision of the investor and the company or any of its communication cannot be held responsible for it.