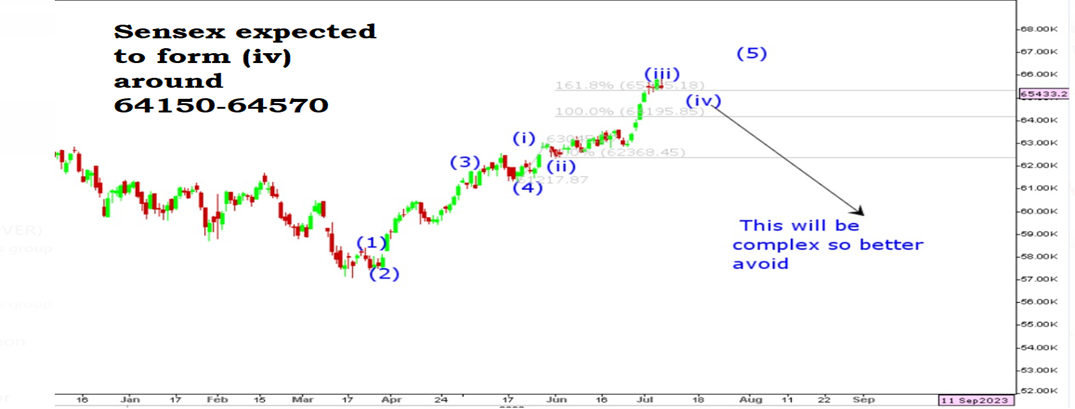

Markets last week reacted from highs of 19,523 to form a shooting star on the weekly chart mainly on the back of weakness from rupee and selling in global markets. Applying ‘The Elliot Wave principle’ in Sensex suggests that the market still has upside room left before peaking but in the short term Sensex may correct further in the range of 1.2-1.7% from current levels. The lower reading in India’s VIX below 11.75 indicates a decline may be a temporary phase and India’s VIX may shrink to levels around 9.2.

Sensex Chart

Stocks to watch

Positive Read Through

- Aurobindo Pharma- gets exclusive rights for BioFacturas monoclonal antibody ustekinumab biosimilar.

- Zydus Life- US FDA concludes pre-approval inspection with Zero observations for Ahmadabad-based formulation mfg facility

- Gland Pharma- gets USFDA nod for Fomepizole’s Abbreviated New Drug Application.

- HAL- Ministry of Defence and HAL sign Rs 458 cr deal for two upgraded Dornier aircraft for Indian Coast Guard

- Samvardhana Motherson To acquire Rollon Hydraulics for an equity value of Rs 103 cr.

- Sula Vineyards- Co has recorded its highest ever Q1 net revenues overall as well as for Own Brands.

- RVNL: Company emerges as the lowest bidder for an NHAI project worth Rs 808.48 cr

- TVS Motor: Company launched the ‘Modern-Retro’ motorcycle in Indonesia

- Reliance Industries sets July 20 as the record date for Reliance Strategic Investments’ demerger

- IRB Infra: June toll revenue is up 16.5% at Rs 383.3 cr vs Rs 329.1 cr (YoY)

- Oil upstream stocks: Oil prices climb to the highest in two months outweighing the Fed rate hike

- Usha Martin: Societe Generale bought 16,59,466 shares at Rs 279.99/ share

- Hindustan Zinc: Company declares an interim dividend of Rs 7 per share

- Tata Motors: Group global wholesales at 3,22,159 in Q1 FY24

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the investor’s sole decision, and the company or its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.