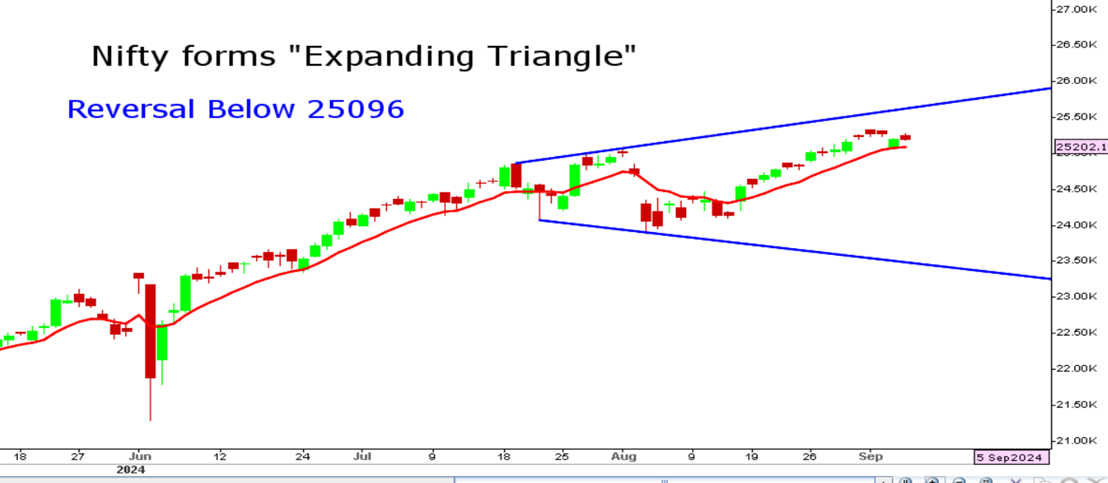

Markets opened lower on Wednesday but managed to recoup losses and closed above 25,100 while banking stocks ended with deeper cuts. Nifty at present has formed expanding triangle with reversal expected on close below 10-day exponential moving average which placed at 25,096. The downside below 25,096 should be seen lower towards 23,450 thereafter. With JPYINR gaining strengthening, we expect selling pressure to accelerate further in markets.

Nifty 50 Chart

Stocks to watch

Positive Read through

- Ril – Secures 10 gwh battery storage capacity under pli, budgetary outlay at Rs.36 bn.

- Suzlon – Sells corporate office building to 360 one aam for Rs. 4.11 bn.

- Century text – Arm to buy Hindalco’s land parcel in thane for corporate guarantee of Rs.4 bn.

- Gic re – Govt to exercise oversubscription option in the offer for sale.

- Apollo Hospitals – Apollo Healthco incorporates arm for corporate agency biz in insurance.

- Kalpataru projects – to pre-pay ncds worth Rs. 1..50 bn on oct 4 to recalibrate debt portfolio.

- Allied blenders – to invest Rs. 700 mn in 80:20 jv w/Ranveer Singh entity for premium spirits biz.

- Zaggle – Enters into an agreement with blue star for expense management platform.

- Lind – to acquire tata steel’s Indian gas supply assets at Kalinga Nagar phase 2 expansion projects.

- Rategain- Africa- based taag angola partners with co for real-time competitive insights.

Negative Read through

- Glenmark pharma – to pay $25 mn over 5 yrs to us doj as settlement, with 4.25 pct interest per annum.

- Sona blw – Launches QIP to raise up to Rs. 24 bn, indicative price Rs. 675-700 per share.

- Mastek- Euro pacific growth fund sold 5.57 pct stake via blocks, ICICI PRU mf among buyer.

- Thangamayil – promoters sell 4.7 pct stake block deals, custody bank of Japan buyer.

- Exide Industries – Arun Mittal resigns as md & ceo of arm w.e.f october 31, 2024.

Financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 2499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the investor’s sole decision, and the company or its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.