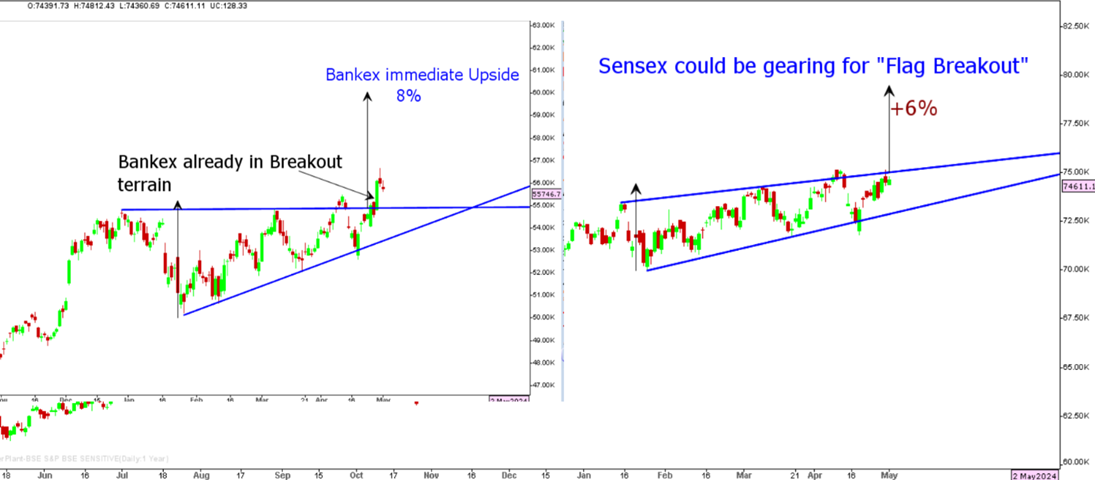

Markets witnessed listless trading activity on Thursday with Nifty ending with modest gains while Bank Nifty settled with marginal losses. At the current juncture, major push for markets is expected from Banking sector as BSE Bankex has already surpassed breakout resistance and could be poised for another 8% jump in the coming days while technology index has seen major selling. The key benchmark like Sensex is also likely to surge higher by 6% in the coming days, given formation of bullish flag on daily chart. An immediate upside in Sensex is expected of 6% with larger outperformance expected from Bankex. In Nifty terms, upside target is seen in range of 23500-23800.

Result Today – Titan, Britannia, MRF, Tata Tech

Nifty 50 Chart

Stocks to watch

Positive Read through

- Bajaj Fin – RBI lifts restrictions on Ecom & insta EMI card.

- Ajanta Pharma – Margin at 26 pct vs 17 pct, sales grew by 20 pct YoY.

- IEX – Blended April volumes jumped by 14 pct YoY, real-time business volumes rose 22 pct YoY.

- Ugro Capital – AUM surged by 48.8 pct, NII rises 25.5 pct YoY.

- KEI Ind – EBIDTA increased by 20 pct, sales rose 18.6 pct YoY.

- Cigniti – Coforge to acquire 54 pct stake of company at Rs. 1415/share.

- JBM Auto – margin at 11.6 pct vs 10.6 pct, EBIDTA rises 60.40 pct YoY.

- Moil – Manganese ore production up 22 pct, sales grew 17 pct YoY.

- Max Estates – Signs agreement for residential development project in Gurugram, GDV Rs. 90 bn.

- Affle – Gets patent in US for integration of intelligent conversational agents.

- GIPCL – Signs Rs. 28.32 bn loan agreement with National Bank for Financing Infrastructure and Development.

- Mazdock – Signed individual Shipbuilding Contracts with the European client.

- IndiGo – Company announces special bonus to staff across the board ahead of Q4 results.

- Century Tex – Birla Estates, real estate venture of Aditya Birla Group, books sales of Rs 54 bn from a project in central Mumbai.

Negative Read through

- Coal India – Q4 misses estimates, blended realisations down 9.6 pct YoY.

- Coforge – Margin lower than estimates, doesn’t give FY25 guidance.

- Yes Bank – Carlyle to sell 2 pct stake via block deal, as per report.

- Ceat – Profit down by 23 pct, margin flat at 13 pct YoY.

- CIE Auto – EBIDTA dropped by 5.2 pct, margin at 14.9 pct vs 15.6 pct YoY.

- Railtel – Margin at 14 pct vs 17.8 pct, sales grew 24.6 pct QoQ.

- Aptech Q4 – Net profit down 91.8 pct at Rs 28 mn, sales declines 41.7 pct at Rs. 1.04 bn.

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the investor’s sole decision, and the company or its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.