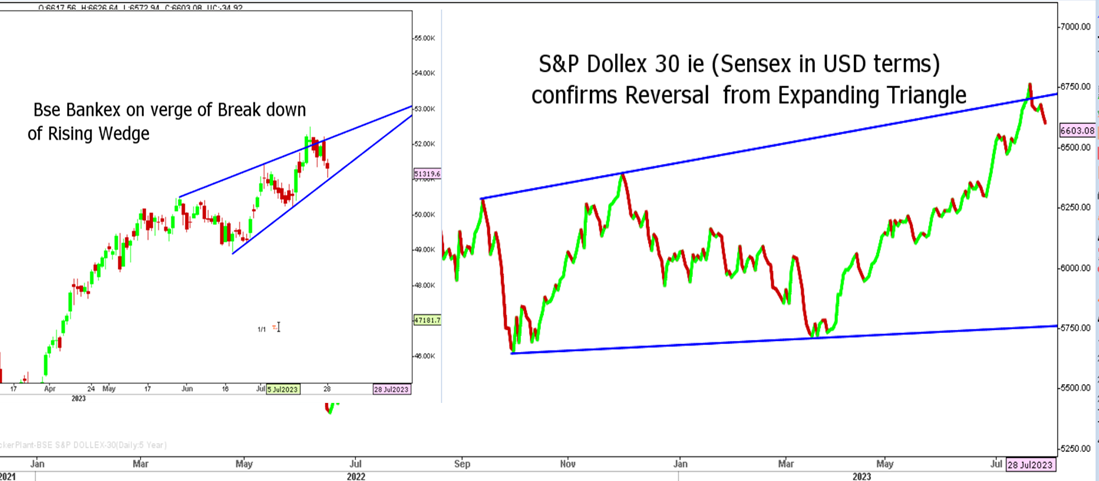

Nifty for the week ended in the negative terrain despite lower reading in Indian VIX after posting gains for four straight weeks. The crucial support for Nifty is seen at 19,600 on a closing basis below which, we may see selling intensifying towards 19100 and below in a quick span of time. The rising crude prices and base metals prices pose a major threat to Indian markets with Brent Crude already confirming major breakouts on a weekly basis. The BSE Bankex has seen sharp reactions from higher levels and is currently very closer to breaching the support of the rising wedge. The immediate downside in BSE Bankex is expected in the range of 5-7% and would be a key catalyst for the significant breakdown in the Indian markets.

USDINR for the week rebounded sharply to pierce back into a triangle setup after prices closed above 82 levels on Friday. The 40-week consolidation may be ending with an extended triangle, and we expect a major breakout to emerge above 82.50 with an immediate target of 87.

BSE Bankex & Dollex 30

Stocks to Watch

Positive Read through

- Marico Q1 results largely in-line with estimates, volume growth above estimates at 3 pct YoY

- Gland Pharma US FDA clears co’s Visakhapatnam facility

- RVNL shareholders agreement signed between co & foreign partners

- RBL BANK had a one-on-one meet with M&M on July 28

- SIEMENS shareholders vote against proposal to sell lv & geared motors business to SIEMENS AG

- IDFC FIRST Bank reported NIM at 6.33 pct vs 5.89 pct YoY, results in-line with estimates

- INDUS Towers revenue up by 4.8 pct YoY, total tower additions at multi-qtr high

- POWER GRID is the successful bidder for two inter-state transmission system projects

- EQUITAS Small Finance Bank posted Q1 results above estimates , deposits up by 35.9 pct YoY

- Chalet Hotels reported net profit at 887 mn vs 290 mn, revenue up 22.8 pct (YoY)

- KFIN Tech EBITDA rises by 12.5 pct, margin stood at 38.7 pct vs 37.1 pct (YoY)

- Bank Of India’s NII rises 45.2 pct, provisions decline 40.5 pct YoY.

Negative Read through

- NTPC’s revenue down by 2.3 pct, average tariff down 1 pct YoY

- United Breweries’ results below estimates, volumes down 12 pct YoY

- Piramal ENT AUM down 1 pct, NII slips 31.1 pct, operating profit down by 58 pct YoY

- SBI Cards reported lowest NIM in 24 Qtrs, asset quality worsens QoQ

- NAZARA Tech posts second consecutive Qtr of QoQ rev decline, margin flat YoY

- Sonata Software’s EBIT down by 25.5 pct, margins stood at 7.3 pct vs 10.3 pct ( QoQ)

- IFB IND net loss at 0.6 cr vs *19 mn profit, margin flat (YoY)

- Laxmi Organic EBTIDA down by 23 pct, margin stood at 10.5 pct vs 13.3 pct (YoY)

- CIGNITI Tech EBIT down by 10.6 pct, net profit slips 9.4 pct ( QoQ)

- Jaiprakash Power EBITDA down by 17 pct, margin at 30.5 pct vs 34.5 pct (YoY)

- DCB Bank’s NIM contacts 35 bps, slippages rise 27 pct QoQ

- NLC INDIA EBITDA down 24.4 pct, margin at 36 pct vs 40.9 pct (YoY)

- Rossari Bio revenue down 5.5 pct, EBITDA flat YoY

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the investor’s sole decision, and the company or its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.