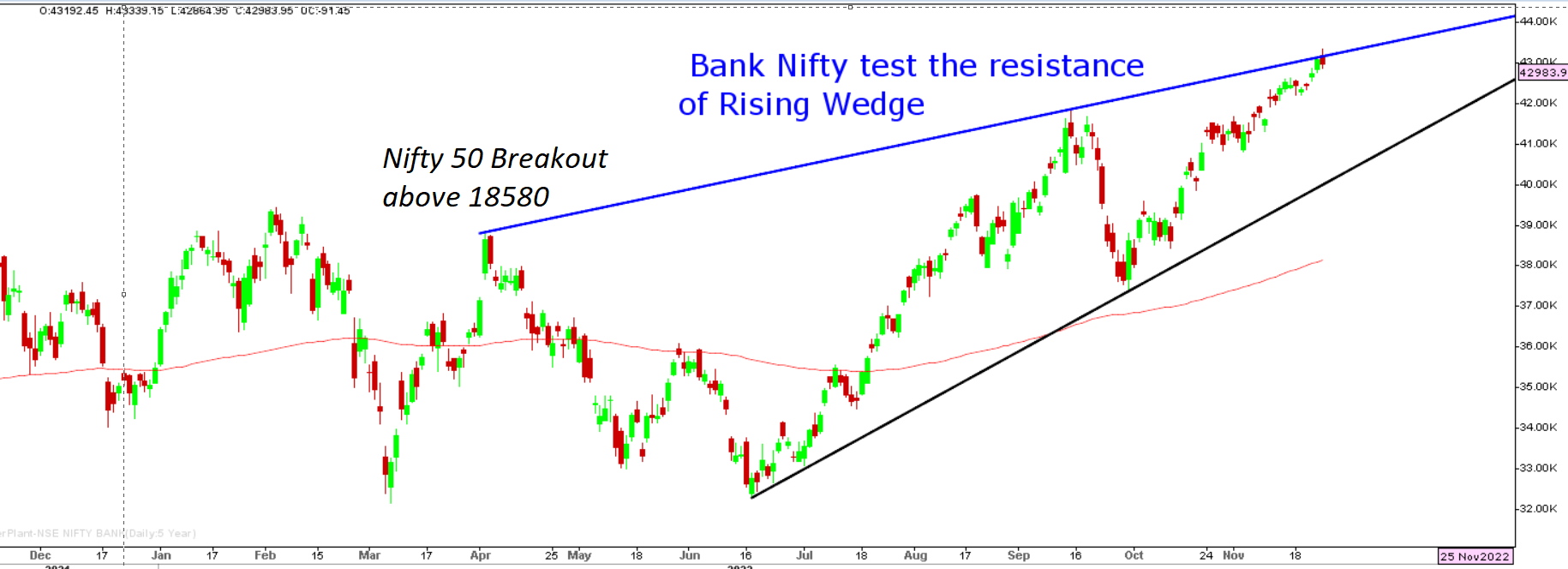

Markets rallied on the back of gains from Reliance Industries and lower crude prices but failed to close above 18580 on the back of selling in Bank Nifty at higher levels. At the current juncture, markets are gearing for a major breakout, which is coming at a time when brent crude prices have entered the long-term support zone and Bank Nifty testing the resistance of a rising wedge.

The broader indices namely the Nifty 500 index also have been attempting a breakout, but triangle support placed 2% lower than current levels and should be seen as a long-term trend reversal for the current upmove.

US markets closed lower, Dow fell nearly 500 points as supply chain concerns mount amid protests in China Selloff was driven by demonstrations that broke out in mainland China over the weekend as people vented their frustrations with Beijing’s zero-Covid policy. Fed officials Mester and Williams reiterate hawkish intentions.

Nifty Bank

Stocks to watch

Positive Read Through

- Jubilant Foodworks in focus- Dominos will launch their gourmet pizzas on a pan-India basis.

- Tyre cos in focus- rubber prices at 2-yr low on supply chain issues, recession concerns.

- Lupin – Brazilian arm to acquire all rights to 9 medicines from BL Industries Otica

- BSE- SEBI approves Sundararaman Ramamurthy as MD and CEO of BSE

- NDTV- Promoter RRPR agrees to issue 99.5 pct of its Equity to Adani’s arm VCPL

- AMI Organics- Govt pension Fund, Valuequest buy nearly 13 lakh shares

- Fusion Microfin- AUM up 9%, NII rises 31% and Profit up 27% QoQ

- Yes Bank- acquires 9.9% in JC Flowers ARC at Rs 11.43 a sh, to acquire 10% more

- NBCC bags two work orders for Rs 272 cr

Negative Read Through

- Five Star Biz- Loan book up 8%, NII up 10% QoQ

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the investor’s sole decision, and the company or any of its communication cannot be held responsible for it.