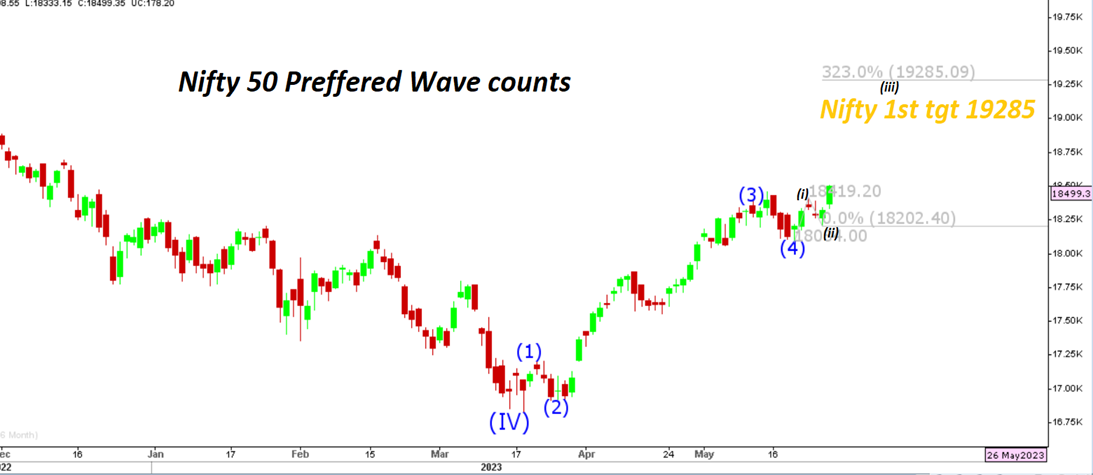

Markets for the week posted smart gains with Nifty 50 rising around 1.5% while broader indices like Nifty 50 Equal Weight Index and Nifty Midcap 100 index outperformed with wide margin by surging around 2.7%. The breakout above 140 in USDJPY may provide more stimulus for Indian markets to catch up momentum with Nikkei Index which so far for the year has been up +20%. Nifty 50 which already remains in Sub wave Wave (iii) of Wave (5) has an upper limit for the current up move to test around 19285 before we see some minor profit booking. Overall, upside target for Nifty is seen around 19800, which is expected to be completed before July end 2023.

Nifty 50

Stocks to Watch

Positive Read Through

- Lupin- Health Canada nod to market generic version of Spiriva in Canada

- Aurobindo Pharma- Q4 in-line with estimates, margin at 3-qtr high

- Dalmia Bharat- Northeast arm approves capex worth Rs 3642 cr

- Ethos- Subsidiary Silvercity Brands AG acquired 100 pct stake in Swiss-based Favre Leuba GmbH.

- JK Cement- Q4 better than expected on healthy realization

- ICICI Lombard- ICICI Bank to up its stake up to 4 pct in multiple tranches

- PFC- AUM up 13.23 pct, profit rises 33.8 pct YoY

- Ahluwalia- EBIDTA rises 72.7 pct, margin at 12.7 pct vs 8.7 pct YoY

- Geenlam Inds- EBIDTA up 49.5 pct, margin at 13.9 pct vs 10.7 pct YoY

- Purvankara- EBIDTA down 60 pct, margin at 4.2 pct vs 13.6 pct YoY

- Bharat Bijlee- Revenue rises 23 pct, margin at 9 pct vs 4.2 pct YoY

- Indigo Paints- EBIDTA rises 33.4 pct, margin at 22 pct vs 18.6 pct YoY

- Maharashtra Seamless- EBIDTA up 85 pct, margin at 19.7 pct vs 12.2 pct YoY

- Krsnaa Diagnostics- EBIDTA up 23 pct, margin flat YoY

Negative Read Through

- ONGC- reports a one-time loss od Rs 9235 cr, EBIDTA down 20 pct QoQ

- Sun Pharma- Board proposes non-binding indication of interest for Tara Pharma

- BHEL- Mgmt says, margin on Vande Bharat order likely challenging, EBIDTA slips 14.4 pct

- GMR Airports- EBIDTA down 52.5 pct, margin at 13.7 pct vs 41.6 pct YoY

- Chambal Fertiliser- EBIDTA declines 69.2 pct, margin at 3.1 pct vs 10.9 pct YoY

- Karnataka Bank- slippages up 55.8 pct, advances down 4.1 pct QoQ

- City Union Bank- FY23 NIM is at 7-year low of 3.89 pct, NII down 7.5 pct QoQ

- Sundaram Finance- Disbursements down 5.3 pct, NII slips 2 pct QoQ

- MOIL- EBIDTA down 38.1 pct, margin at 31 pct vs 45.7 pct YoY

- PNC Infra- EBIDTA down 14.5 pct, margin at 17.8 pct vs 21.6 pct YoY

- Balkrishna Inds- EBIDTA down 25.4 pct, margin at 20.7 pct vs 27.1 pct YoY

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the investor’s sole decision, and the company or its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.