Markets reacted to sharp selling from FII in futures segment with FII selling Rs 8,000 crore and Rs 4,000 crore in cash segment forcing Nifty to re-test 19,600 with formation bearish engulfing line on daily candlestick chart. The selling was mainly led by financial stocks and extended towards technology counters. We expect selling pressure to intensify further below 19,600 with quick downside seen at 19,100. For Indian markets, key levels to watch would be USDJPY movement as fall in USDJPY would have enough potential to force Nifty below 17,000.

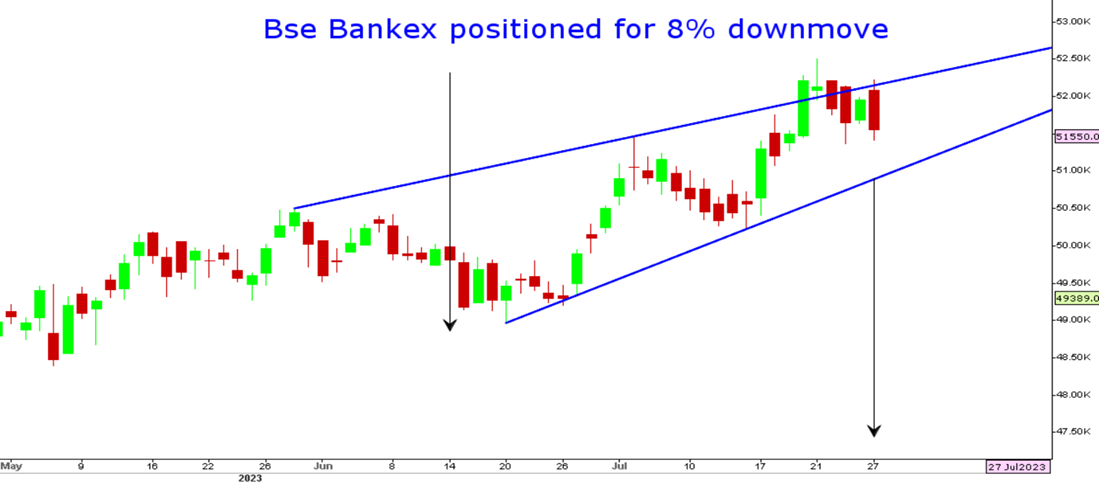

BSE Bankex

Positive Read through

- ITC Company says ROCE will rise by 18-20 pct & RoIC by 10 pct through hotel biz demerger

- Ajanta Pharma margin at 26.6 pct Vs 23.3 pct, EBITDA rises 22 pct (YoY)

- MACROTECH pre-sales up 30 pct YoY, targets pre- sales Of Rs. 145,000 mn in FY24

- BEL EBITDA rises 29.4 pct YoY, New Order wins at record high Of Rs 81,000 mn

- SONA BLW Margin at 27.7 pct Vs 23.5 pct revenue rises 25.2 pct (YoY)

- Shyam Metalics revenue Up 2.6 pct, board approves fund raise of Rs 36,000 mn

- Indus Towers revenue up 4.8 pct YoY, total tower additions at multi-qtr high

- Intellect Design EBITDA rises 8.1 pct, margin up 90 bps YoY

- Greenlam Industries EBITDA rises 27.8 pct, margin at 12.5 pct vs 10.7 pct (YoY)

- Motilal Oswal revenue from Operation up 9.2 pct , NII Rises 12.2 pct QoQ

- Railtel EBITDA rises 10.6 pct, net profit up 48.3 pct YoY

- Welspun Ent acquires 50.10 pct stake in Michigan Engineers For Rs 1,371 mn

- Home First Fin Q1 disbursements rise 35.4 pct, AUM rises 33 pct YoY

Negative Read through

- JK Lakshmi Q1 standalone results below estimates, net profit down 26 pct YoY

- Indian Hotels margin declines 180 bps YoY, occupancy Levels fall QoQ

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the investor’s sole decision, and the company or its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.