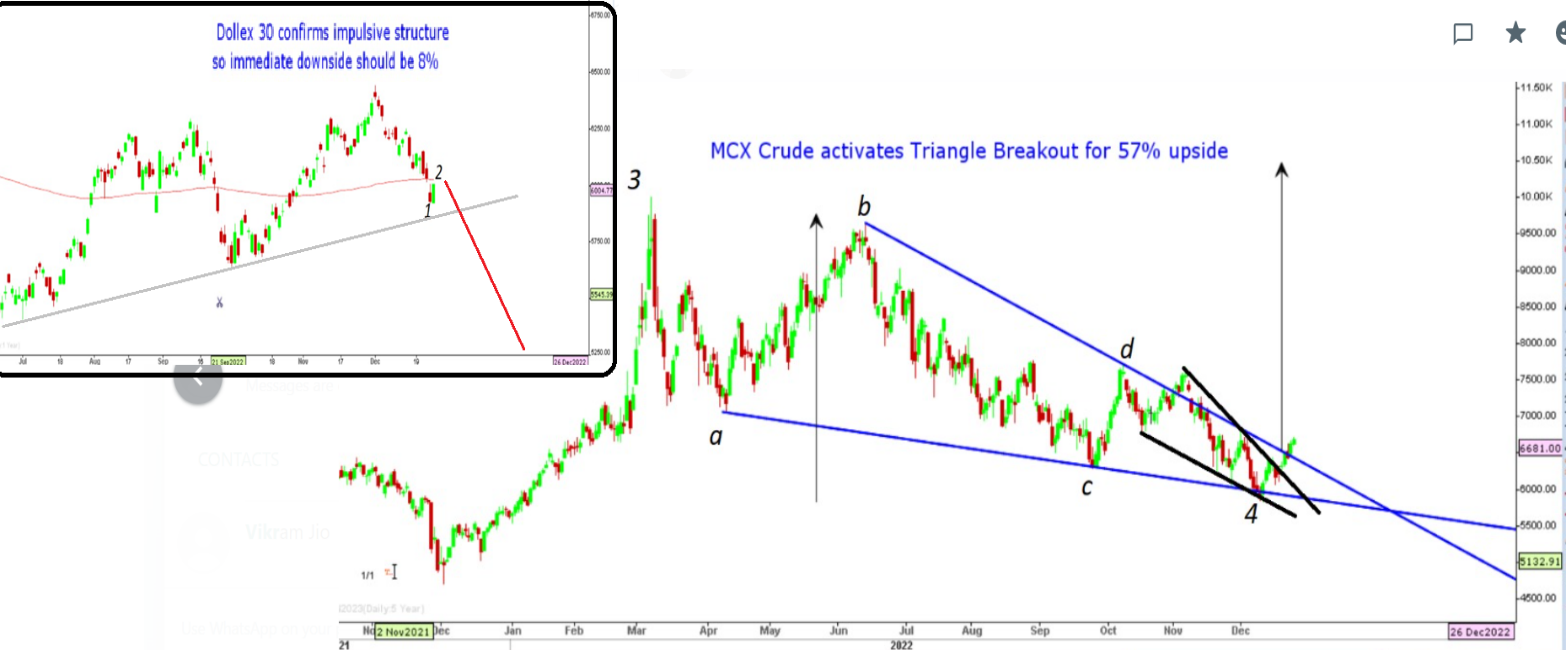

Markets rebounded on Monday on the back of gains from Nifty Bank with Nifty regaining its control above psychological levels of 18000 but remaining vulnerable to a major slide. The volumes were relatively lower in yesterday’s up move and the setup in Dollex 30 i.e.

Sensex in USD terms has thrown up an impulsive structure during the current down move which would mean that it would be followed by downward Wave 3 after the recent rebound. The MCX crude too confirmed a major breakout on weekly basis for an immediate upside of 57%, the rise in crude prices may potentially force aggressive selling in Indian equities, especially financials which saw massive outperformance in 2022.

Dollex 30 Index & MCX Crude Breakout

Stocks to watch

Positive Read through

- HEG incorporates wholly owned subsidiary TACC, announces Rs 2000 cr capex

- LIC Housing Finance hikes rates by 35bps.

- Sugar Stocks- Govt plans a course of action to achieve 12 pct ethanol blending target in ESY 2022-2023.

- Time Techno- bags order worth Rs 75 cr from Adani Total Gas

- NTPC- in MoU with Tecnimont for green methanol production

- ONGC, OIL- crude higher, brent nears USD 85 a bbl mark

- Aurobindo Pharma- gets USFDA nod for Dimethyl Fumarate

Negative Read through

- Asian Paints in focus- crude prices higher, Brent near USD 85 a bbl.

- IRB InvIT- temporarily suspends toll collection at IRB Pathankot Amritsar toll road

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the investor’s sole decision, and the company or any of its communication cannot be held responsible for it.