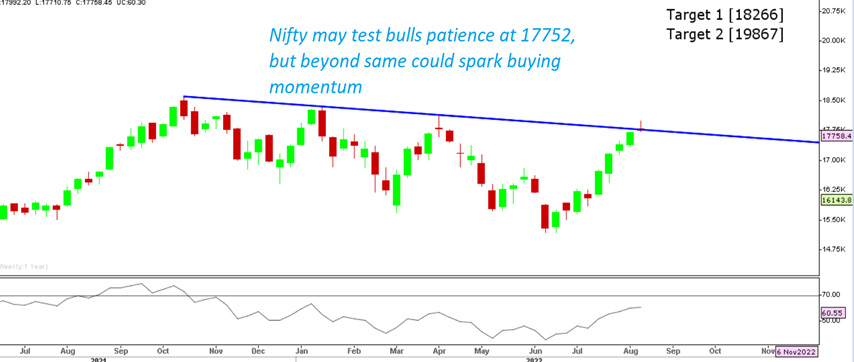

Markets ended with marginal gains despite severe pressure from call option writers during the expiry week. In fact, since 17th Aug hyperactivity was seen 17500 Call option where most market participants were seen heavily shorting it with an average price of 115, and open interest also swung from 10 lakh to all the way till 60 lakh.

This would mean we can expect major short covering after Nifty 50 surpasses 17615 and this may trigger a quick up move towards 17800 even on today’s expiry day. The widely traded Nifty 50 Etf has also regained the above breakout which would force a 13% up move in the coming days and hence overall view on the market remains highly bullish with an expectation of new highs in the Ganesh festival.

Nifty 50 Weekly chart

Stocks to watch

Positive Read through

- Bharti Airtel- Singtel to transfer 3.3 pct equity to Bharti Telecom for Rs. 12,900 Cr.

- RBL Bank- College retirement fund buys 45 lakh shares worth 50 Cr via block deal.

- ONGC, OIL- Oil prices higher overnight after a volatile session

- Torrent Pharma-Reports say the company is to acquire skin care-focused company Curatio.

- NHPC- MoU with Rajasthan Gov to develop a 10 MW renewable energy park.

- BEML- Gets September 9 as the record date for the BEML land asset share issue.

- Eris Lifescience- Reports indicate the company plans acquisitions to diversify and grow

- PSP Projects- Bags orders worth Rs. 247.3 Cr for Precast and Gov. segment

- Omaxe- Gets a 50-acre project from DDA to develop a sports complex

- PB Fintech- Approves Rs 6.5b investment in Policybazaar, to incorporate new tech company in Abu Dhabi

Negative Read through

- Lupin- US FDA nod for Perforomist, to acquire two brands from Boehringer

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the sole decision of the investor and the company or any of its communication cannot be held responsible for it.