Market activity remained laggard on Wednesday ahead of the crucial Fed meet and merging of settlement which led to Nifty inching marginally higher but failing to cross 17156. The Fed raised key rates by another 25 bps, however, the commentary suggested some additional policy firming. However, it is the comment from Treasury Secy Yellen that spooked the markets- she says not considering a unilateral expansion of deposit insurance.

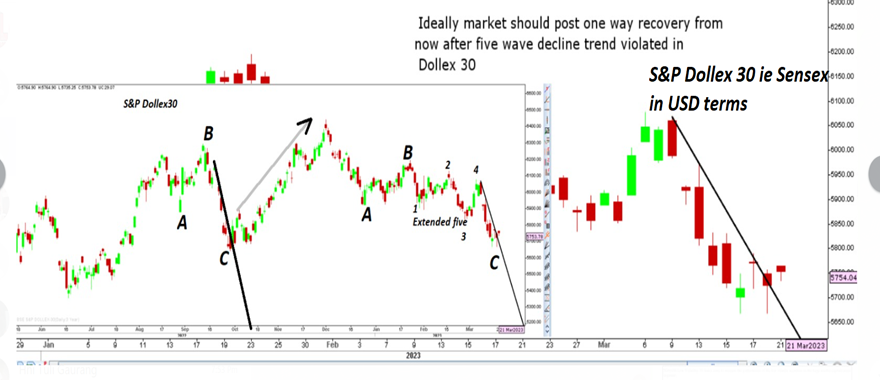

A crucial trigger to watch would be movement in India VIX, as a move below 14.30 should act as an impetus for Nifty heading towards 19500. The Dollex 30 has already confirmed major trend change from the recent complex corrective mode, so good possibility of a broad-based rally in the coming days.

S&P Dollex 30 ie Sensex in USD

Stocks to watch

Positive Read through

- Indian Hotels, ITC-Premium Hotels rates expected to be decadal high in fiscal 2023 says CRISIL.

- Paytm- Banks again fail to share subsidy with payment service companies – Rs 2,000cr at stake.

- Symphony- The record date for the buyback is set at March 29.

- L&T- signs Agreement with McPhy for Electrolyzer Manufacturing.

- Greaves Cotton- Promoter bought 1.19lk shares on March 22.

- HCL Tech- Promoter bought 97k shares on March 22.

- GR Infra Projects, Patel Engineering- JV gets L-1 bid for the project worth Rs 3537 cr.

- HG Infra- L-1 bidder for highway project worth Rs 925 cr.

- NBCC- receives building construction contract worth Rs 625 cr.

- PNC Infratech – Arm receives appointed date for NHAI HAM project.

- Coromandel International- announces entry into Specialty and Industrial Chemicals, to invest over Rs 1000 cr over next two years.

- IGL, BHEL- signed MoU for collaboration in the Hydrogen Value chain.

- Reliance Inds- Reliance Consumer launches Home & Personal care range.

- Hero Moto- to hike prices of select motorcycles and scooters by 2 pct.

Negative Read through

- Defence Stocks-Air Force slashes procurement budget on Russia supply delays.

- HAL- OFC opens today for non-retail shareholders for selling up to 3.5 pct stake.

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the investor’s sole decision, and the company or any of its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.