Markets managed to end at the highest point of the day after an initial gap-up opening on Tuesday but failed to cross the crucial hurdle of 17156 in Nifty Index. The high of the bullish hammer appearing on Monday’s trading session was taken out on a closing basis, thus putting more firepower for bulls to trade higher for the next few days and more leg of buying is likely to emerge once Nifty corroborates closing above 17156.

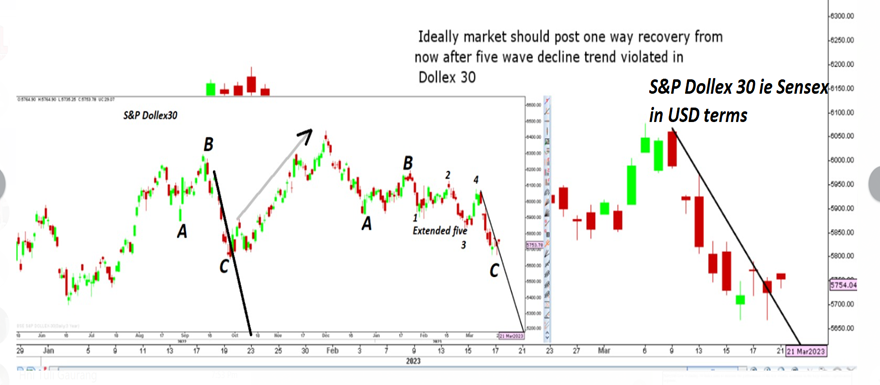

The Dollex 30 i.e., Sensex in USD has shown strong signs of reversal after the breakout from the ‘Five wave decline’ setup, this can be construed as an end to a complex corrective wave and open gates for a 10-12% upside in the near term. We can expect further confirmation of bullish momentum in the market after India VIX closes below 14.30. For the short term, 16,800 in Nifty 50 is seen as a strong base and is unlikely to be re-tested after the recent breakout in Dollex 30 Index.

S&P Dollex 30 ie Sensex in USD

Stocks to watch

Positive Read through

- Sonata Software bags project worth USD 160 m from a US-based consumer retail co.

- BL Kashyap Secured new order from Railways Land Development Authority worth Rs 313 Cr.

- IOC- receives ‘in principle’ nod to carry out pre-project activities for Rs 61,077 cr project.

- Greenlam- Asiana Fund bought 33 lakh shares or 2.6 pct stake worth Rs 101cr.

- SBI Cards declared an interim dividend of Rs 2.5.

- Power Grid – board meeting on Mar 24 to consider the issue of taxable bonds under Pvt placement.

- Tata Motors announces price increase for CV ahead of phase II emission norms.

- Pidilite- Co unit agreed to make investments of Rs 130 mn in Finemake Technologies.

- Hind Zinc- approved a fourth interim dividend of Rs 26 a sh.

- Zydus Life receives approval from USFDA for Tofacitinib tablets.

- Patel Engineering JV bags Rs 555.1 cr order, cos share at Rs 281.1 cr.

- Bandhan Bank- approves sale of written-off portfolio and NPAs worth Rs 4930 cr to ARC.

- Tata Power- receives LoA for 200 MW Solar PV Project from MSEDCL.

- Aurobindo- USFDA nod for Prednisolone and Teriflunomide.

Negative Read through

- Devyani International- Temasek sells a 2.8 pct stake worth Rs 500cr.

- Greenlam- Smiti Holding & Trading sells 2.6 pct stake at Rs 306 a sh, Asiana Fund buyers.

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the investor’s sole decision, and the company or any of its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.