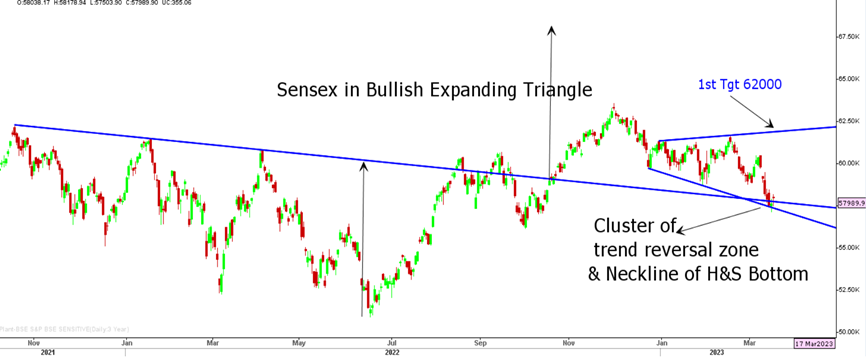

Markets last week remained under pressure but recovery on Friday trading session helped key indices to trim losses to less than 2%. The BSE Sensex has formed a typical bullish expanding triangle which has added significant confusion due to higher high and lower low and has recently tested the long-term breakout line or neckline of head & shoulder bottom.

With broader markets showing signs of recovery, there are good possibilities of significant trend reversal and an immediate upside projection of expanding triangle is seen at 62,000 in Sensex. The crucial levels to watch in Nifty 50 would be 17,205 and 14.30 in India VIX. Below 14.30 in India VIX, we expect bulls to regain control for a potential upside towards 19,500 in the coming months.

Sensex Index

Stocks to watch

Positive Read through

- Cochin Shipyard wins Rs 550 crore order for zero emission feeder container vessels from Samskip Group.

- RVNL emerges as the lowest bidder for the HORC project worth Rs 1,088.49 crore.

- Navin Fluorine to invest Rs 450 crore in setting up a hydrofluoric acid plant at Dahej, Gujarat.

- Havells commences commercial production of ACs at the Sri City plant.

- Godawari Power approves a buyback of 3.66% equity for Rs 250 crore.

- SJVN: Company’s arm secures LoA for a 200 MW solar project from MSEDCL.

- Adani Wilmar: Company’s flagship fortune Pulses rolls out 9 varieties of natural dal.

- Jindal Poly has commissioned the capacity expansion project at its Nashik Plant from 36000 MT to 58000 MT.

- JPPOWER: Vanguard bought 3.67 crore shares in the company.

- Power Stocks: India’s power consumption rises 10 pct.

- Sumitomo Chemicals: Gujarat Pollution Control Board Revokes Closure Order For Production At Bhavnagar Site.

- Equitas Small Bank: Vanguard and Norwegian Norges Bank have picked up stakes in Equitas Small Finance Bank via open market transactions.

- SKF India has agreed to make an investment in renewable energy company Cleanmax Taiyo.

Negative Read through

- Bliss GVS: US FDA issues form 483 with 3 minor observations for Bliss GVS Pharma’s Palghar manufacturing unit (Neutral).

- Tata Consumer: Company says it will not buy Bisleri International. (Neutral).

- Biocon: AHAN – I LTD sold 1.89 crore shares in the company (Negative).

- Future Consumer: VISTRA ITCL sold 1.5 crore shares in the company (Negative).

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the investor’s sole decision, and the company or any of its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.