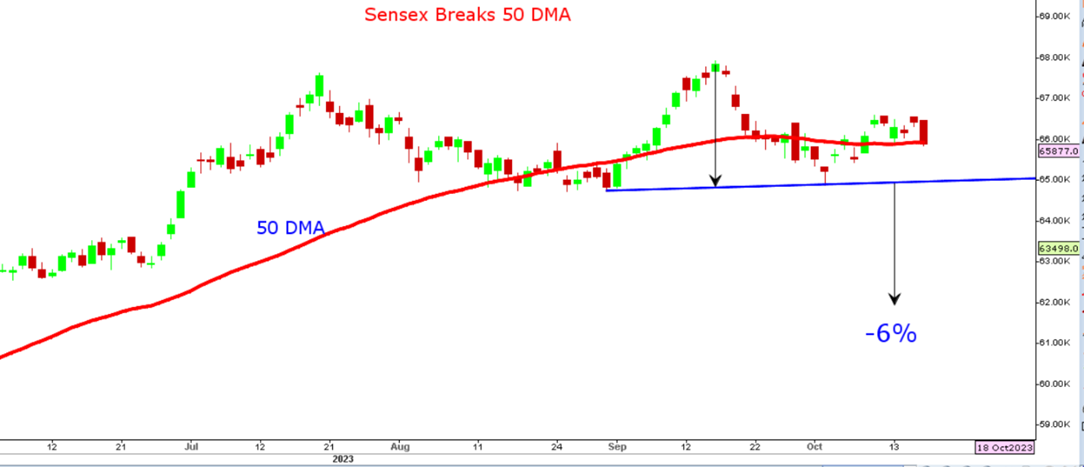

Markets reacted lower on Wednesday on back of rising tensions in Middle East. Nifty settled below 19700 while BSE Sensex managed to violate short-term support of 50 DMA. The selling was mainly intensified from financial sector where Nifty Bank dropped more than 1 pct and almost closed at monthly low. From derivative positioning, maximum long buildup in Nifty futures is seen around 19,600 and a move below the same should trigger the necessary unwinding to trigger 7-10 pct fall in immediate terms. From a trading perspective, it is better to initiate fresh short in Nifty futures below 19500 so that support is taken out convincingly for a target of 18,466.

Result Today – Hindustan Unilever, ITC, Nestle India, Ultratech Cement

Sensex 30 chart

Stocks to watch

Positive Read through

- Bajaj Auto – Margin up by 2.6 pct, EBITDA Rises by 20 pct YoY.

- Indusind Bank – Operating profit rises for 11th straight Quarter, GNPA came at 11 quarter low.

- Coforge – Maintain FY24 CC sales growth guidance, USD sales above estimates.

- LTIMindtree – Q2 results in-line, EBIT margin stood at 16 pct Vs 16.7 pct QoQ.

- Persistent – CC sales growth above estimates, deal wins at record high of USD 479.3 mn.

- ICICI Lombard – Gross direct premium income rises by 17.4 pct, profit rises by 2.2 pct YoY.

- Alkyl Amines – Starts commercial Production at newly set up plant In Kurkumbh.

- RPG Life – EBITDA up by 25.3 pct, margin stood at 24.3 pct Vs 22.1 pct YoY.

- Bharti Airtel – Company sees Rs. 80 bn market opportunity with CCaaS cloud platform launch.

- Power Mech – Board approves fund raise via QIP, floor price st at Rs. 4,085.4 per share.

- Titagarh Rail – Profit rises by 46.5 pct, sales increased by 54.1 pct YoY.

- Astral – Q2 in line with estimates, Pipes and fitting sales volume rises by 28 pct YoY.

- IIFL Fin – Profit rises by 25 pct , Sales up by 22.2 pct.

- Welspun Corp – Bags order to supply 61,000 MT bare pipes and bends to west Asia.

- Bajaj Health – Commissions Alkaloid extraction plant at Vadodara.

- Hudco – Government to exercise green shoe option in OFS.

- Coromandel – Commissions Sulphuric acid and Desalination plant at Visakhapatnam.

Negative Read through

- Wipro – Third consecutive Quarter of sales decline, IT Svcs CC sales guidance at 1.5-3.5 pct.

- Dabur – Litigations against 3 subsidiaries of Dabur in US & Canada.

- Bandhan Bank – Q2 below estimates, asset quality deteriorates.

- Oracle Fin – sales Decline by 1.2 pct, margin stood at 38.6 pct Vs 38.6 pct QoQ.

- VA Tech – Pankaj Malhan resigns as Dy MD & Group CEO of The Co.

- Shoppers Stop – EBITDA Decreased by 2.6 pct, margin stood at 15.5 pct vs 16.3 pct YoY.

- Allcargo – Sep LCL volume decreased by 1 pct, container utilisation continues to remain soft.

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the investor’s sole decision, and the company or its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.