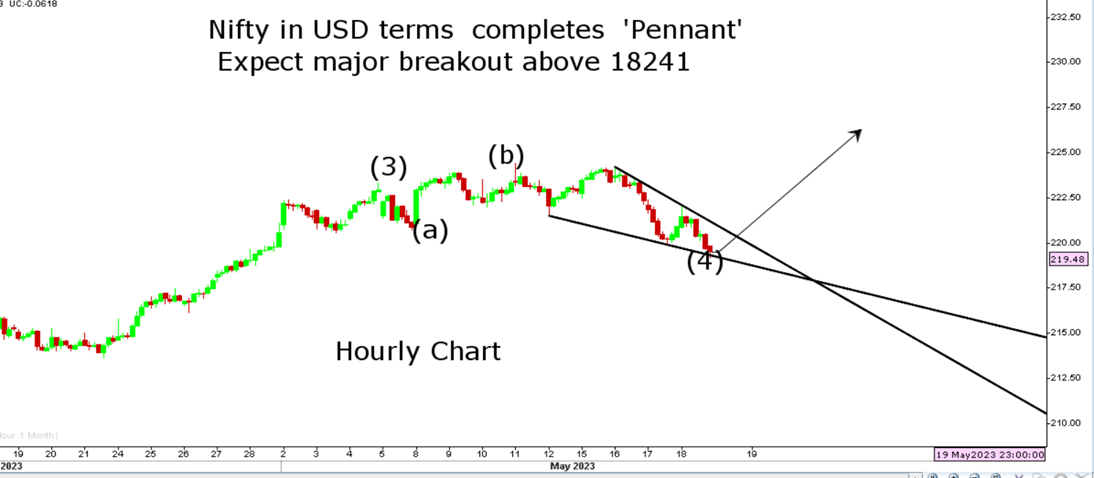

Markets gave away their opening gains on Thursday to end below 18150 on the back of a sharp surge in USDINR to 82.60. For Indian markets, selling from domestic participants has been putting pressure while FIIs continue to remain net buyers. The Sensex has completed seven trading sessions of expanding triangle and should be followed with Wave 5 which has a minimum potential target of 8%. The sharp fall in India VIX below 13 also suggests a high probability of follow-up buying in the coming days. The Nifty in USD terms also has completed pennant formation which may also be a signal that correction may be coming to an end with a breakout placed at 18241.

Nifty in USD terms

Stocks to watch

Positive Read through

- CMS Info System forays into the production of banking automation products

- United Spirits- EBIDTA up 8.1 pct, domestic business EBIT at Rs 74.9 cr vs Rs 24.5 cr YoY

- Bata- Q4 above estimates, EBIDTA rises 10.6 pct YoY

- Granules- gets USFDA nod for Venlafaxine ER capsules

- Indigo- Net profit at Rs 919.2 cr vs loss, margin at 20.9 pct vs 2.1 pct YoY

- KIMS- EBIDTA rises 43.8 pct, revenue up 54.7 pct YoY

- UNO Minda- EBIDTA up 16 pct, revenue rises 20 pct YoY

- Jet Airways- Net loss at Rs 54.9 cr vs loss of Rs 233.6 cr YoY

- AMCs- SEBI releases paper on total expense ratio (TER) charged my MFs

- Man Industries- EBIDTA rises 0.6 pct, margin at 6.8 pct vs 6.6 pct YoY

- GR Infra- EBIDTA up 31.8 pct, margin at 27.2 pct cs 21.2 pct YoY

- PTC India- Net profit up 45.7 pct, revenue slips 15 pct YoY

- Thomas Cook- Net loss contracts, EBIDTA at Rs 36.1 cr vs loss (YoY)

Negative Read through

- PI Industries- Q4 below street estimates, margin flat at 22 pct YoY

- Gland Pharma- EBITDA down 51.7 pct, margin at 21.5 pct vs 31.6 pct YoY

- PNB Housing- NIM at 3.74 pct vs 4.68 pct QoQ, AUM down 1.2 pct YoY

- RITES- EBITDA down 6.3 pct, revenue slips 10.3 pct YoY

- Transport Corp- EBITDA down 10 pct, margin at 11 pct vs 13.4 pct YoY

- Pfizer- initiates a voluntary recall of 3 products manufactured by Astral SteriTech

- Nelcast- Revenue down 17 pct, profit contracts 33.6 pct YoY

- Tata Elxsi- CC Revenue growth at 1.6 pct, Rupee revenue rises 2.5 pct QoQ

- RBA- Jubilant Food denies report of it planning to buy a stake in RBA

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the investor’s sole decision, and the company or its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.