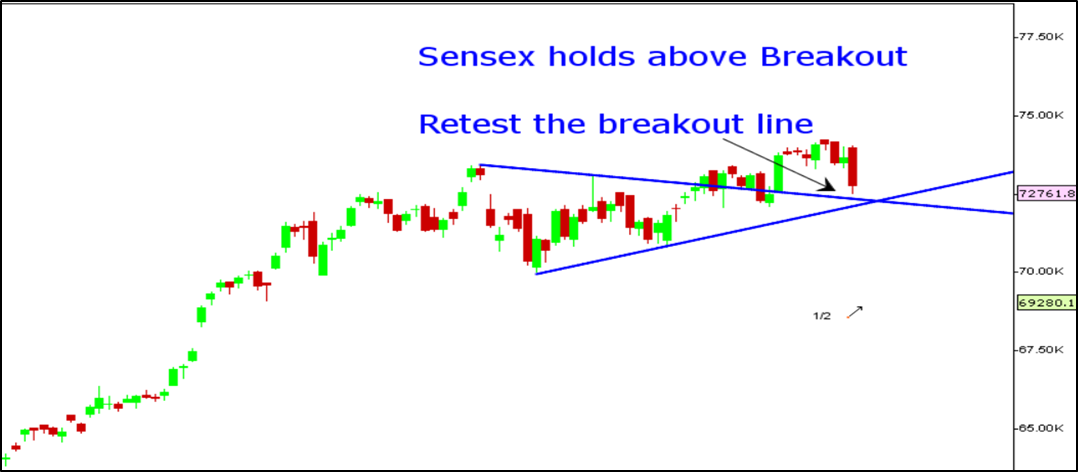

Markets witnessed sharp decline on Wednesday with midcap and small cap indices declining nearly 5% while Nifty ended lower with losses of 1.5%. The news of rising tensions between India-China border issue and the Supreme Court verdict on electoral bond mainly were responsible for carnage in the Indian Indices. From short term perspective, Sensex has rested the breakout line and markets have good potential to rebound and touch 23,500 in Nifty terms if this breakout in Sensex holds firmly in today’s trade.

Nifty Futures Chart

Stocks to watch

Positive Read through

- Antony Waste – Secures orders worth of Rs. 770 mn for Bio mining MSW with CIDCO

- Reliance – To acquire 13 pct of Paramount Entities in Viacom18 for Rs. 42.86 bn.

- Τata Motors – To set up EV manufacturing unit, to invest up to Rs. 190 bn.

- ITC – Capital Group, ICICI Pru MF, AB Sun Life MF, Max Life & GIC key buyers blocks.

- DLF – Sell 4.67 acres of land in Chennai for Rs. 7.35 bn to Chola Investment.

- Godrej Prop – Buys 3-acre land in Hyderabad, booking value potential at Rs. 13 bn.

- Cyient – Signs multi-year agreement with Airbus for cabin & cargo engineering.

- JSW Energy – Gets LoA for 700 MW from solar energy corporation.

- IIFL Finance – Board approves fund raise of up to Rs. 15 bn via rights issue.

- Yes Bank – According to report, company looking for new promoter, to sell up to 51 pct sale.

- KEC Intl – Gets orders worth Rs. 22.57 bn across its various businesses.

- IRB Infra – Cintra to acquire 24 pct stake from GIC in Infra Trust for Rs. 65.90 bn.

Negative Read through

- Federal Bank – RBI asks to halts issuance of new co-branded credit cards.

- South Indian Bank – RBI asks to halt issuance of new co-branded credit cards.

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the investor’s sole decision, and the company or its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.