Markets for the week ended with marginal gains after Nifty failed to cross the key hurdle of 18800 after RBI opted for a cautious approach by refraining from a significant cut in inflation expectation. In the coming week, the global markets may have to battle out Fed meeting where a rate hike pause is already priced in but Fed commentary would be crucial for future policy stance.

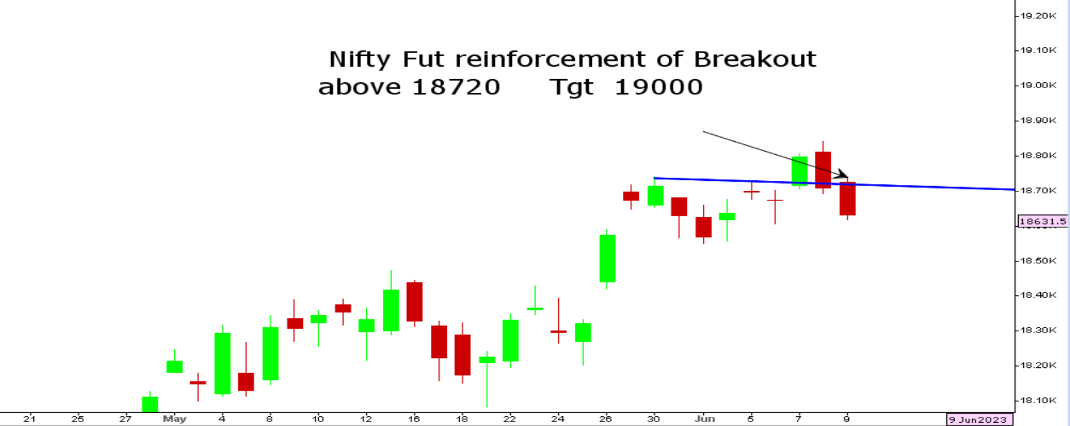

For Nifty, the weekly candlestick has turned out to be a shooting star which indicates caution but with India VIX settling around the 11 mark, it clearly suggests a positive stance for the market in the coming days. Most of the time before a meaningful rally, institutions resort to aggressive put writing which impacts lower reading in India VIX. A move above 18720 in Nifty Futures should be seen as a reinforcement of a breakout for a short-term upside of 19000.

Nifty 50 Futures

Stocks to watch

Positive Read through

- TVS Motor to acquire an additional 25 pct stake in SEMG at CHF 517.36 a share

- Metals- Steelmint report says Q1 contracts for HRC and CRC revised upwards

- Lupin- May export rise more than 63 pct to USD 67 mn MoM

- HDFC Life- May premium up 26 pct YoY, market share up 181 bps in FY24

- SBI Life- May premium up 58 pct YoY, market share up 243 bps in FY24

- Syngene- May exports are up 50 pct at USD 12 mn vs USD 8 mn MoM

- Titagarh Rail- to raise Rs 288 cr from Smallcap Fund at Rs 380 a share

- Cochin Shipyard- Lowest bidder to upgrade an Indian Naval Ship for Rs 300 cr

- Indigo- expands codeshare partnership with Turkish Airlines for the United States

- Maharashtra Seamless- prepays outstanding long-term loans of Rs 234 cr

- Lloyds Steels- Board meets on June 24 to consider fundraise

Negative Read through

- Conor divestment plan may be delayed indefinitely says Ministry of Rail

- Go Fashion- Sequoia to sell 10.2 pct via blocks, floor price Rs 1135 a sh accor to reports

- LIC- May premium down 11 pct YoY, market share down 746 bps in FY24

- ICICI Pru- May premium down 19 pct YoY, Retail APE up 4 pct YoY

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the investor’s sole decision, and the company or its communication cannot be held responsible for it

Related Posts

Stay up-to-date with the latest information.