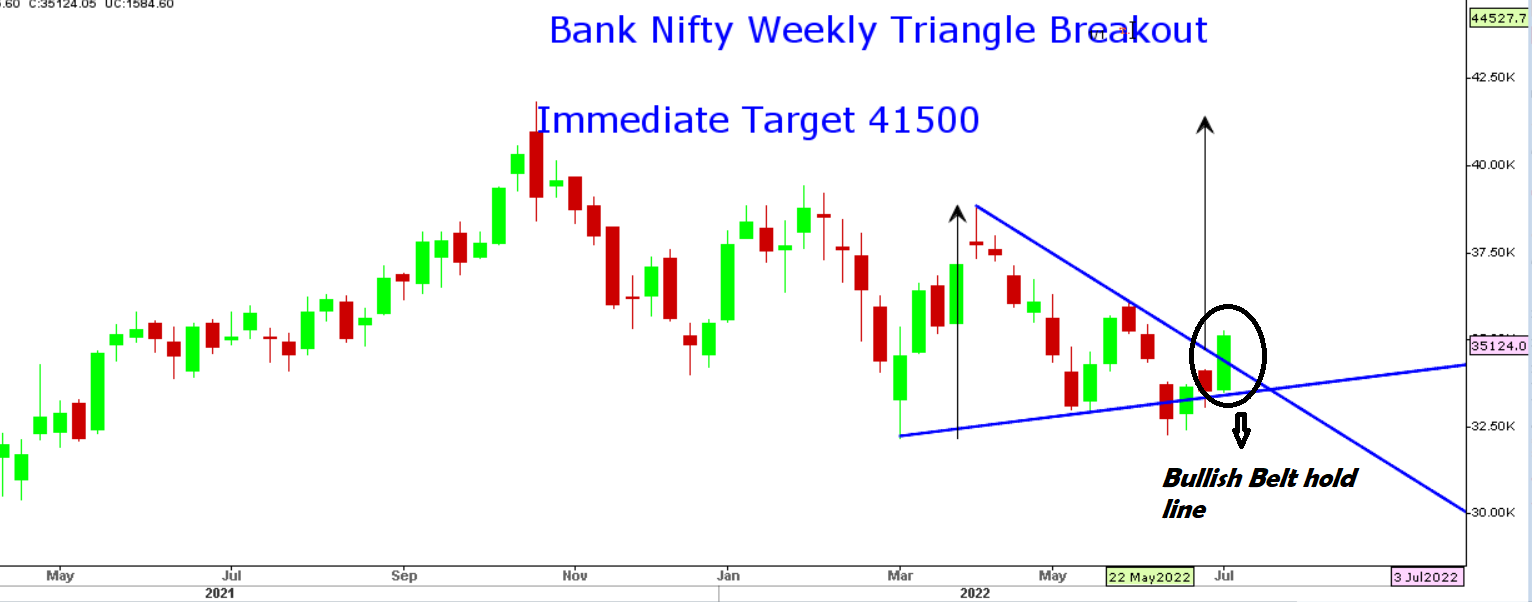

Markets for the week ended with gains of around 3% with the Nifty forming a ‘Bullish Belt-hold line’ pattern on the weekly candlestick chart and India VIX triggering a sharp decline towards 18% on the back of aggressive put writing. Bank Nifty outperformed Nifty with a wide margin with the index ending higher than 5% for the week.

For the first time after after 8 months FII data in cumulative cash & future segment for the first half of the month has shown positive inflow while DII has toned down its aggressive buying.

With Nifty sustaining above 16123, the immediate target for Nifty is seen at 17500 with rallies likely to be concentrated from Financials, Auto, and FMCG. Any rebound in sectors like technology and commodities should be seen as a dead cat bounce as they have confirmed the start of a significant bear market.

Meanwhile, as per reports, the RBI governor is to hold closed-door meetings this week in Singapore with FIIs & Senior Fund officials & discuss the economy, rate trajectory, and soft landing.

Stocks to watch

Positive Read Through

- Power Grid- Bags Transmission supply agreement for the evacuation of power in MP

- NTPC- plans to raise Rs 5,000 Cr via stake sale in green energy arm

- Avenue Super Marts- Highest ever quarterly numbers; led by growth in gross margins

- Himadri Chemicals- Promoters enter into a family settlement agreement

- Adani Enterprises- Company to bid for 5G spectrum for private spectrum

- Dr. Reddy’s- Launched generic version of Fesoterodine tablets used for overactive bladder in the US

- Bandhan Bank- Advances grew 20% YoY

Negative Read Through

- IRB Infra – June toll collection down 4% MoM

- TCS Profit Misses Estimates as Recession Fears Hit IT Spending

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the sole decision of the investor and the company or any of its communication cannot be held responsible for it.