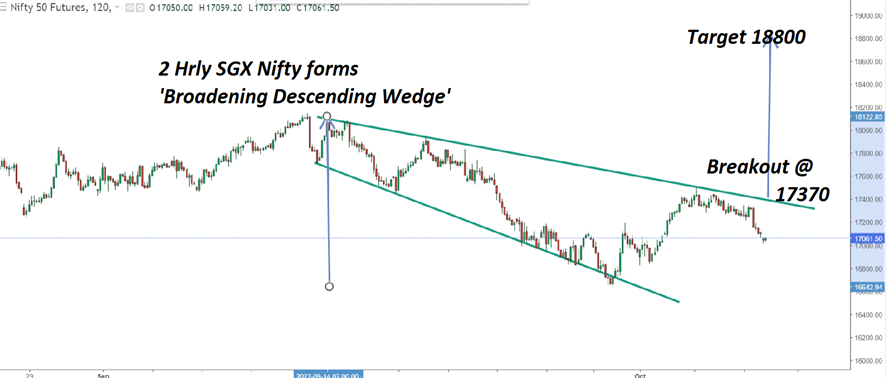

Markets last week ended with gains of over 1% after Sensex was able to close above the key resistance of 57634 despite pressure in the rupee where USDINR closed above 82.50 on the international exchanges. The current setup in SGX Nifty clearly indicates the formation of a ‘Broadening Descending Wedge’, which is highly bullish, and post-breakout above 17370, prices are likely to see a sharp up-move towards 18800.

For the week, key support for Sensex is seen at 57522 and as long the market sustains above the same the bias remains positive for a potential upside breakout and hit an all-time high.

SGX Nifty Futures

Stocks to watch

Positive Read through

- LIC, Centre to sell 60.7% stake in IDBI Bank; DIPAM invites EoIs.

- Dilip Shanghvi will participate in Suzlon Energy’s Rs 1,200-cr rights issue.

- Tata Power to develop 10000 Mw RE plant in next five years in Rajasthan.

- Kalyan Jewellers sees 20% revenue growth in Sept qtr despite challenges.

- Bandhan Bank reported a 22% jump in loans and advances at Rs 99,374 cr at the end of Sep’22.

- HDFC will raise up to Rs 12000 cr by issuing bonds on a private placement basis.

- Hero MotoCorp forays into the electric segment; drives in VIDA V1 e-scooter.

- Indiabulls Housing Finance public issue of bonds to raise debt capital of up to Rs 800 cr.

- Equitas Small Finance Bank’s gross advances grew by 20% to Rs 22,802 cr at end of Sep 22.

- Mahindra Lifespace forms JV with Actis; to invest Rs 2,200 cr in industrial units.

- NMDC has kept iron ore prices unchanged for October 2022 deliveries.

- PNC Infratech Achieves financial closure for 2 road projects with Axis Bank; the total debt size of the two projects at Rs 15.6b.

- Bajaj Finserv- Bajaj Allianz General Sept. Gross Direct Premium INR12.14B.

Negative Read through

- Hindustan Unilever cuts prices of soaps, and detergents by 2-19% after 2 years of hikes.

- Lupin Says Kamal Sharma is to step down as board director from Oct. 14.

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the sole decision of the investor and the company or any of its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.