Markets for the week ended with gains of over 1% to help Nifty close above 24,300 despite crude prices posted gains for the fourth week in a row. From the current juncture, the risk for Indian markets remains elevated and a 4% down move in USDJPY is likely to trigger major unwinding pressure in Indian markets. From a short-term perspective, 24,170 is seen as a key support below which the current momentum is likely to get faded while upper range for Nifty is seen in the zone of 24,700-24,800. Overall data suggests the need for aggressive hedging given irrational exuberance along with complacency seen among market players.

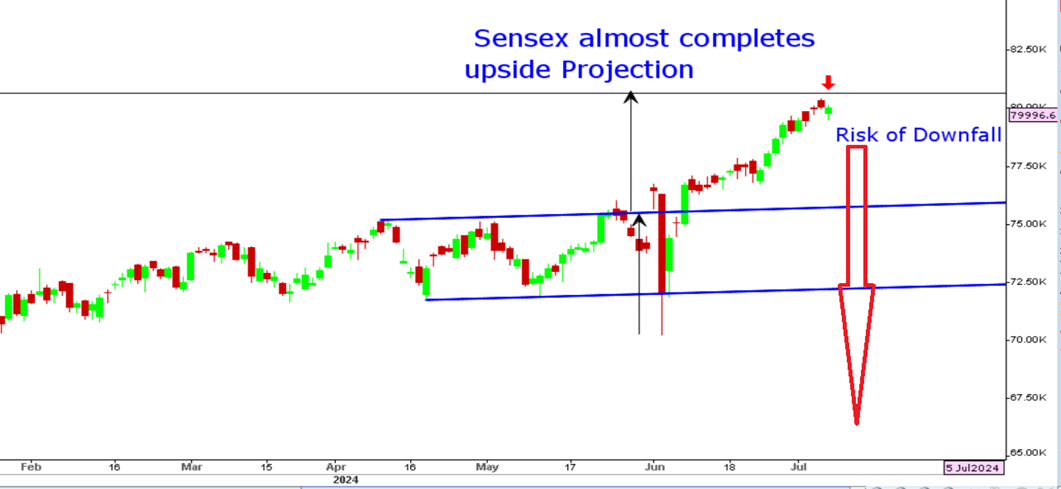

Sensex Chart

Stocks to watch

Positive Read through

- Τata Motors – JLR Q1 wholesales grew 5 pct, retail sales rose 9 pct YoY

- Apollo Hosp – To acquire shares of Rs.1.03 bn in Apollo Health & Lifestyle

- Marico – Consolidated sales grew in high single digit, operating profit ahead of sales growth

- Dabur – Consolidated sales growth expected in mid-to-high single digit

- Info Edge – Consolidated sales growth expected in mid-to-high single digit

- Federal Bank – Signs bancassurance partnership with Bajaj Allianz Life Insurance

- Adani Wilmar – Q1 volume growth 13 pct YoY, strong growth in food volume will persist

- Signature Global – Q1 pre-sales up 255 pct YoY, collections jumped 102 pct YoY

- Shilpa Medicare – Analyst call today to discuss business update with respect to CDMO

- KPI Green Energy – Signs 50MW hybrid power purchase deal with Gujarat Urja Vikas Nigam

- PCBL – Gets patent for invention titled hybrid carbon black grade comprising graphene.

- NLC India – Bags 2nd commercial coal mine block at Machakata Odisha

- JM Fin – Board approves acquisition of 42.99 pct stake in JMFCSL for 12.82 bn

- PC Jewellers – PNB approves Company’s one time settlement proposal

Negative Read through

- Indusind Bank – weakest QoQ loan growth in 12 Qtrs, deposits grew 3.6 pct QoQ

- Titan – Jewellery domestic operations grew 8 pct YoY

- BOB – Weakest deposit & advances growth in 12 Qtrs, advances fell 1.7 pct QoQ

- J&K Bank – Business growth weaker than industry, deposits fell 1.6 pct QoQ

- Union Bank – Growth weaker than industry levels, loses market share YoY & QoQ

- Nykaa – Consolidated sales growth to be 22-23 pct YoY, fashion sales growth around 20 pct

- Tata Steel – New labour government working on a better deal for the port talbot steelworks’

- Coffee Day Enterprises – Company reports total default of Rs 4.34 bn.

- Apcotex Industries – Taloja plant operations disrupted due to heavy rainfall.

Financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 2499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the investor’s sole decision, and the company or its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.