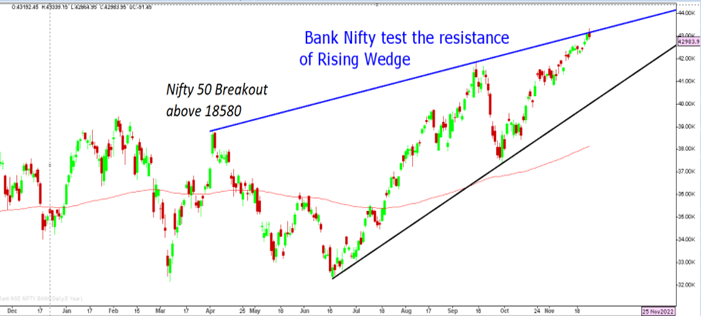

Markets for the week ended 1% higher mainly on the back of sharp gains in the technology sector thus helping Nifty 50 to close exactly at the 18513 mark with India VIX closing at a 52-week low. The lower reading ideally should act as a catalyst for a major breakout towards 19800 in Nifty 50 but with Bank Nifty testing the resistance of the “Rising wedge”, it becomes necessary for prices to pierce the resistance line and trigger short covering. This would be only possible if the Nifty 50 is able to cross above 18580 levels in any single day.

On the downside, the major risk of derailment of the current up move can come from USDJPY moving below the 138 mark or Nifty 50 closing for the week at 2% or lower. An ideal strategy would be to initiate fresh longs above 18580 with a 2.4% stop loss thereafter.

Nifty Bank

Stocks to watch

Positive Read through

- Max Financial gets IRDAI nod to acquire residual 5% stake held by Mitsui Sumitomo in Max Life.

- HDFC Life- IRDA approves merger of Exide Life with Co.

- Hero MotoCorp to increase prices of up to Rs 1500 effective Dec 01.

- Tata Motors, Ashok Leyland – Govt vehicles older than 15 yrs will be scrapped.

- Paytm in focus as RBI has asked the management to resubmit an application for the payment aggregator license within 120 days.

- L&T Finance- completes divestment of its mutual fund business.

- JK Cement- Begins cement grinding capacity of 2 mtpa at Hamirpur unit.

- SBI Cards- added 3.39 lakh cards, up 19% YoY and up 2.3% MoM.

- Zydus Life- receives tentative USFDA nod for Levothyroxine sodium injection.

- Indigo- Aviation Minister gives nod to wet lease aircraft for a period of 6 mths.

Negative Read through

- IEX announces buyback for Rs 98 cr at Rs 200 per sh.

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the investor’s sole decision, and the company or any of its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.