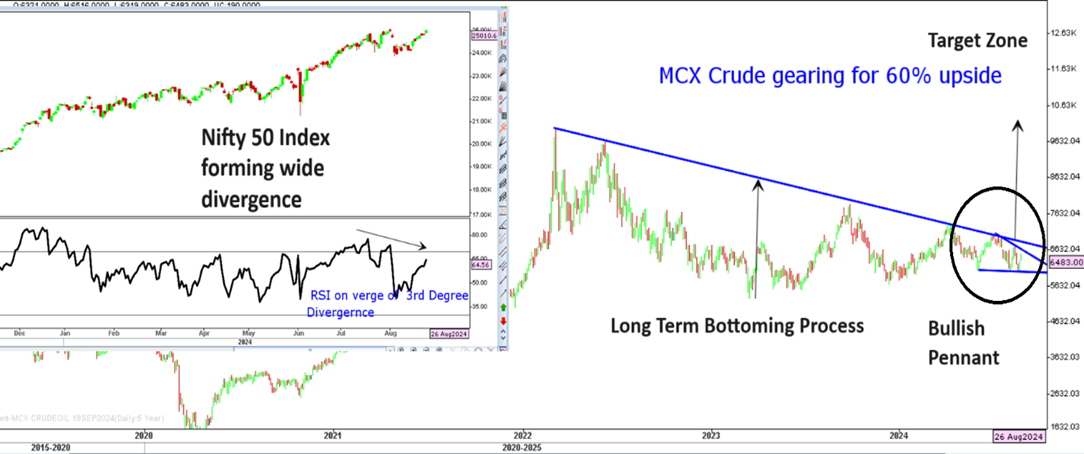

Market surged across the globe on Monday following comments from Fed in Jackson Hole which emphasized on rate cut and an accommodative monetary stance. Nifty managed to gain 0.8 pct while Bank Nifty continue to remain an underperformer. Crude prices have seen sharp reversal in the past few days and makes a strong case for a long-term breakout. A bullish pennant can be clearly seen in MCX Crude which has a potential to trigger larger upside breakout in the near term and this could be one of reason why Bank Nifty already going through an underperformance. For Nifty, resistance is seen at 25,200 while reversal is likely to be confirmed on weekly close below 24,750.

Nifty 50 with MCX crude Chart

Stocks to watch

Positive Read through

- Ultratech – Raises USD 500 mn through sustainability-linked financing.

- Zydus – Competitive impact in Asacol HD already factored into FY25 numbers.

- Exicom Tele – To avail Rs. 1.25 bn from Axis Fin, to utilise funds for acquisition of Aus-co Tritium.

- Brainbees Solution – SBI MF acquires 0.45 mn shares, stake in company rose above 5 pct.

- Coforge – Motilal Oswal Funds acquire additional 1.91 pct stake in co via block.

- Bondada Engg – Bags order worth Rs. 5.76 bn for solar projects.

- Ceigall – EBITDA jumped 65.1 pct, margin at 17.5 pct vs 13.4 pct YoY.

- HCLTech – Extends agreement with Xerox to drive innovation with al & digital engineering.

- Medi Assist – To acquire Paramount TPA for an enterprise value of Rs. 3.12 bn.

- Lemon Tree – Signs agreement for 80-room property in Ayodhya.

- Medplus – Warburg sold entire 11.35 pct stake via block, ICICI Pru, Singapore Government buyers.

- KPI Green Energy – Company arm wins orders for 13.30 MW solar projects.

- Solar stocks – By June 2024, India’s total installed solar capacity reached 87.2 GW.

- Jai Corp – Gets intimation of merger of promoter Pet Fibers with Mega Pipes.

- Raymond – Company targets CAGR of 12-15 pct/16-17 pct in sales/EBITDA, over FY24-28.

- Interarch Building – BOFA Securities Europe SA bought 0.13 mn shares at Rs. 1,287.75/share.

Negative Read through

- HUL – Gets tax demand order worth of Rs. 9.62 bn.

- GPT Infra – To raise up to Rs. 1.75 bn, Indicative price at Rs. 174.64/share.

- AU SFB – Fincare business sold 1.72 pct stake at Rs. 630/share via block, DSP MF buyer.

- PEL – Arm Piramal Capital and Housing Finance received Rs 4.66 bn order from IT department.

Financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 2499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the investor’s sole decision, and the company or its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.