Markets witnessed wider swings on Wednesday with Nifty declining over 250 pt in initial trade but managed to recover to finally end with losses of 100 pts. The rise in India VIX suggests that the market could remain under pressure for the next few days and a breach below 24,170 could trigger larger decline towards 23,700 in the coming days.

Results Today – TCS

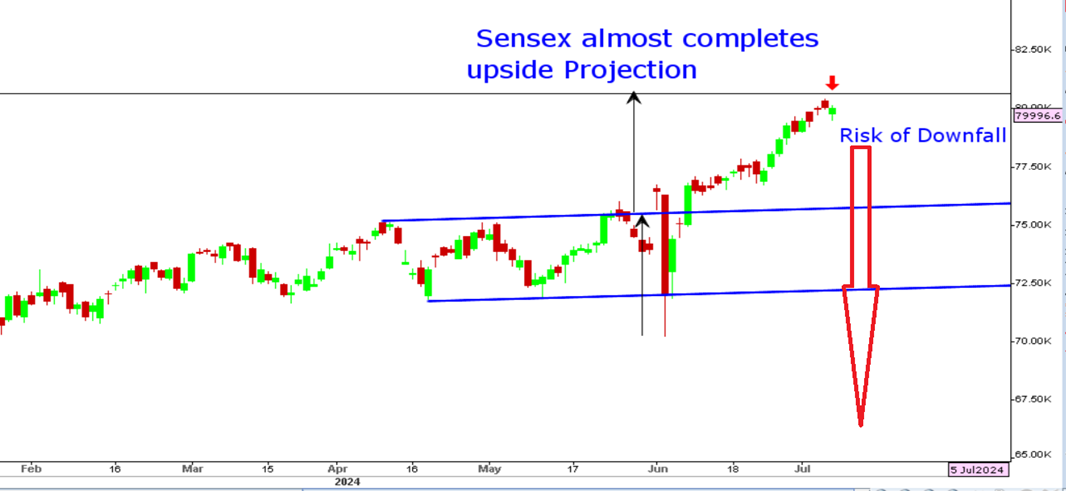

Sensex Chart

Stocks to watch

Positive Read through

- Glenmark pharma – To exit Glenmark Life, to sell 7.8 pct holding via OFS.

- Zydus Life – US FDA nod for Sacubitril & Valsartan tablets, market size USD 5.5 bn.

- IRCTC – Delhi metro QR code- based tickets can be booked on its website & app.

- IRB Infra – June toll revenue jumped 35 pct, Q1 sales grew 32 pct YoY.

- Shalby – Gets 30-year lease for Asha Parekh Hospital in Santacruz, Mumbai.

- Tata Elxsi – CC sales grew 2.4 pct vs estimates of 2-2.3 pct, margin slipped 150 bps QoQ.

- JTL Ind – Q1 sales grew 2 pct, EBITDA rose 12 pct YoY.

- Yes Bank – Moody’s affirms rating, outlook raised to positive from stable.

- Oriental Rail – Secured orders worth Rs. 193.4 mn from Rail Coach Factory.

- Sula Vineyards – Q1 net sales growth at 9.7 pct, own brands sales grew 2.7 pct.

- Satin Credicare – Company gets EURO 15 mn debt funding from Austria’s OeEB.

- MOS Utility – Company unit MOS Logconnect Pvt ltd, partners with India post to revolutionize postal services nationwide.

- Bajaj Healthcare – Approves raising up to Rs 1.37 bn via preferential issue of shares.

Negative Read through

- Glenmark Life – Glenmark Pharma prices company OFS at Rs. 810 share, 7 pct discount to CMP.

- GE Power – To sell hydro business to GE Power and Gas business to GE Renewable.

- Kesoram Ind – Subdued results, margin fell more than 200 bps YoY.

Financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 2499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the investor’s sole decision, and the company or its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.