Markets managed to post gains on Tuesday to help Nifty close above 24,400 with maximum gains attributing to Auto sector while India VIX surged more than 5%. In the past few days, India VIX has already rallied from 12.5 to 14.5 thus increasing the risk of a correction. However, the larger correction may only be triggered if Nifty 50 breaks the 24,170 mark. On the upside, the upper range of 24,700-24,900 still remains active till the time 24,170 is not violated on a weekly closing basis.

Results Today – Tata Elxsi

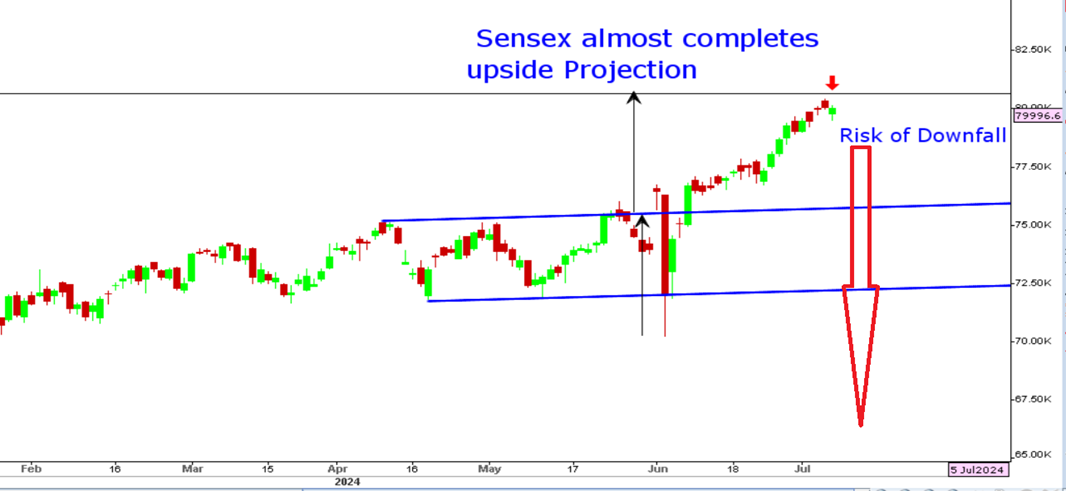

Sensex Chart

Stocks to watch

Positive Read through

- JSW Steel – Q1 production fell by 4 pct YoY, India capacity utilisation at 87 pct.

- Adani Ports – Lol for 30-year concession period for berth no. 13 at Deendayal Port.

- Infosys – Bags 5-Year order from sector alarm, an affiliate of KKR.

- Havells – Announces expansion with an investment of Rs. 3.75 bn at Alwar.

- Mankind – Hema CIPEF may sell 0.9 pct equity via block deals, issue price at Rs.2,061/sh.

- Delhivery – CPPIB may exit company, to sell 3.2 pct equity at offer price of Rs. 378-389/sh.

- KIMS – Acquires 200-bed ‘Queen’s NRI Hospital in Vizag for Rs. 750 mn.

- RVNL – Gets Rs. 1.87 bn order from Maharashtra Metro Rail.

- Shilpa Medicare – Raichur API unit gets GMP certificate from Brazilian regulator.

- KDDL – Approval of Buyback through Tender offer route at Rs 3700/Sh.

- Waaree Renewable – Secures 412.5 MW solar project in Rajasthan.

- BPCL/IOC – Russia has offered the scheme reduction of transaction fees on the oil imports.

- Ashiana Housing – Looks to expand to Mumbai, Delhi NCR, Bengaluru amid real estate boom.

- HG Infra – Company and Ultra Vibrant Solar Energy ink deal for projects worth Rs 4.65 bn.

Negative Read through

- Delta Corp – Posted weak Q1, Sales fell by 30 pct, margins slipped to 17 pct Vs. 37 pct YoY.

- Marathon Nex – Q1 area sold fell by 45 pct, Sales value down by 46 pct YoY.

Financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 2499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the investor’s sole decision, and the company or its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.