In today’s fast-paced life, it’s easy to overlook planning for your financial future. Whether starting your career or well-established, managing money wisely is key to a stable and fulfilling life.

You’ve probably heard the term ‘financial planning’ countless times—on Instagram, from influencers, or in conversations. But what does it mean?

At its core, financial planning is a roadmap to manage future expenses and achieve your goals. For professionals, it’s more than just a buzzword—it’s a vital step toward securing your future. Let’s dive in!

The Importance of Financial Planning

Financial planning is the blueprint for long-term economic success, empowering you to align decisions with your goals, secure your future, and live on your terms. It’s not just about managing income but ensuring you don’t miss opportunities to achieve your dreams—retirement, a significant purchase, or building wealth.

Further Reading: Financial Planning And Its Importance For Millennials & GenZ

A recent FPSB study reveals that 80% of Indian consumers credit professional financial planning with improving their quality of life, while 75% feel more financially confident. A solid financial plan keeps you focused, reduces stress, and helps you make informed choices about your money.

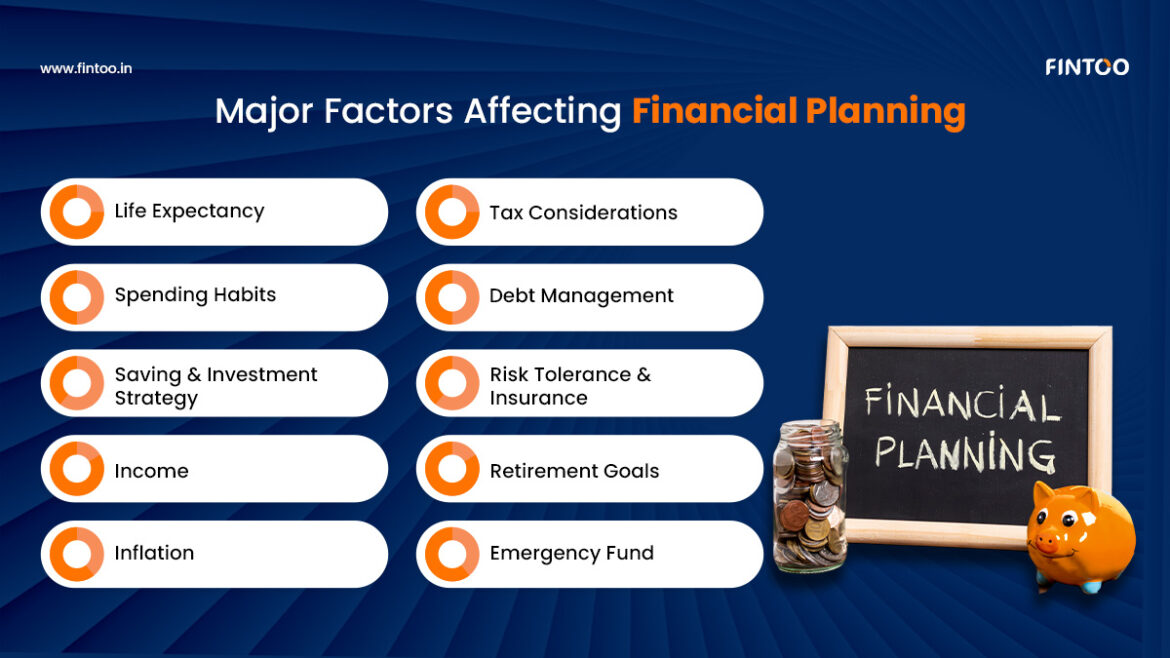

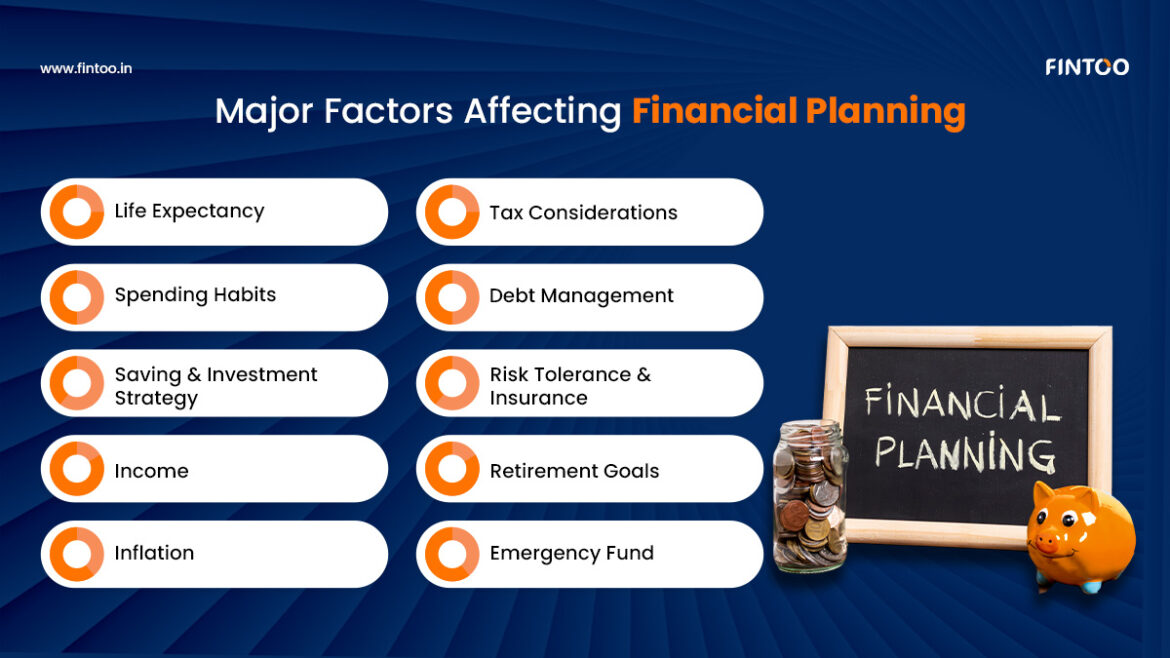

10 Major Factors Affecting Financial Planning:

Several key factors come into play when creating a financial plan. While each person’s financial journey is unique, understanding the significant elements influencing your financial decisions is essential for crafting a solid plan.

- Life Expectancy: One of the most critical factors in financial planning is how long your money needs to stay. Longer lifespans mean you’ll need to account for many years of retirement. Planning for longevity ensures that you don’t outlive your savings.

- Spending Habits: How you manage your expenses significantly affects your financial plan. Whether you live a frugal lifestyle or enjoy a more lavish standard of living, how much you spend will directly impact how much you need to save and invest.

- Saving & Investment Strategy: The earlier and more effectively you start saving and investing, the more prepared you’ll be for the future. Investment returns can help accelerate wealth, and wise investments protect your money from inflation.

- Income: Your earnings provide the foundation for all your financial goals. Whether it’s growing your income through career advancements or diversifying sources of revenue, your income levels will affect your ability to save, invest, and achieve your financial objectives.

- Inflation: Inflation erodes the purchasing power of money over time as prices rise. A strong financial plan accounts for inflation, ensuring your wealth grows at a pace that outstrips it, preserving your buying power.

Further Reading: Rising Inflation And Its Impact On Stock Markets - Tax Considerations: Taxes are an inevitable part of your financial life. How you structure your investments, income, and withdrawals can significantly impact the amount of taxes you pay. Proper tax planning helps you keep more of your hard-earned money.

- Debt Management: The amount of debt you carry affects how much money you can allocate toward savings or investments. Effective debt management and strategic debt repayment are vital for long-term financial success.

- Risk Tolerance & Insurance: Understanding your risk tolerance and ensuring you’re perfectly insured for life, health, and property risks is crucial. It’s essential to balance risk and security to keep your financial plan solid even when life throws curveballs.

- Retirement Goals: Your vision for retirement, including where you’ll live, what kind of lifestyle you’ll maintain, and when you plan to retire, must be factored into your financial plan. Knowing your goals allows you to create a strategy to meet them.

- Emergency Fund: Life is unpredictable, and an emergency fund is your safety net. It ensures you have the funds for unexpected events without dipping into your long-term savings or investments.

What is Good Financial Planning?

Good financial planning isn’t about following a one-size-fits-all strategy—it’s about creating a personalized roadmap that considers your unique circumstances, goals, and economic aspirations. A good financial plan:

- Aligns with your goals: Whether buying a house, retiring early, or paying for education, a well-crafted financial plan addresses what matters most to you.

- Provides clear guidance: A good plan outlines actionable steps, timelines, and strategies to achieve your goals. It’s easy to follow and adaptable when necessary.

- Incorporates risk management: A solid plan accounts for potential risks, including market fluctuations, inflation, or unexpected life events. Insurance, diversification, and an emergency fund are critical to manage these risks.

- Is flexible: Life circumstances change, and an excellent financial plan allows for adjustments. Your plan should adapt as your career progresses, your family grows, or your financial situation evolves.

Good financial planning isn’t a one-time event. It’s an ongoing process that needs regular updates and tweaks to align with your life’s changing needs.

Further Reading: Financial Planning for Beginners

How Can Fintoo Assist You as a Financial Advisor?

Steering the world of personal finance can feel overwhelming—especially considering so many variables. That’s where Fintoo comes in. As a financial advisory service provider, Fintoo offers expert guidance that simplifies the complexities of factors affecting financial planning and helps you create a comprehensive strategy to meet your goals. Here’s how Fintoo can assist you:

- Personalized Financial Strategy: Fintoo understands that everyone’s financial journey is unique. Their team takes the time to understand your circumstances and goals before designing a custom plan tailored to you. Whether you want to build wealth, a retirement plan, or protect your assets, we craft a plan that works for you.

- Expert Guidance on Investments: With an in-depth understanding of market trends, asset classes, and risk management strategies, We help you make intelligent investment decisions that align with your risk tolerance and long-term objectives.

- Tax Optimization: Fintoo helps you navigate tax laws and strategies to minimize tax liabilities, keeping more of your wealth for your future.

- Retirement Planning: Planning for a comfortable retirement is one of the most critical aspects of financial planning. We assist you in setting retirement goals and creating a savings and investment plan that ensures you won’t run out of money when you stop working.

- Debt Management: If debt is a barrier to your financial success, We can help. Whether tackling high-interest debt or managing loans strategically, they’ll help you build a path to financial freedom.

- Regular Reviews and Adjustments: Fintoo doesn’t just create a plan and walk away. We offer ongoing reviews and adjustments to ensure your plan remains relevant as your life evolves. From income changes to market fluctuations, they’re with you every step of the way.

- Risk Management: Fintoo helps identify risks that could derail your financial goals and provides solutions like insurance and diversification to safeguard your wealth.

- Goal-Oriented Approach: Whether buying your dream home, funding your children’s education, or leaving a legacy for future generations, Fintoo works with you to define your goals and develop a strategy to achieve them.

Start Your Financial Planning Today!

With expert guidance from a trusted financial advisor like Fintoo, you can stay on track, make informed decisions, and confidently pursue your financial dreams. The sooner you start, the more opportunities you create to grow wealth.

Click the button to book a 15-minute complimentary consultation with our financial advisor and take the first step towards a secure financial future!

Final Thoughts

In today’s world, effective financial planning is necessary for anyone looking to achieve financial security and build lasting wealth. By understanding the factors affecting financial planning that impact your financial journey, you can create a strategy that reflects your goals, priorities, and lifestyle.

Frequently Asked Questions

1. What is financial planning?

Financial planning involves assessing your financial situation, setting goals, and creating budgeting, saving, investing, and risk management strategies.

2. What factors influence financial planning?

Key factors include income, expenses, debts, taxation, lifespan, and investment choices.

3. How do family responsibilities affect financial planning?

Increasing family responsibilities raise living, education, and healthcare costs, impacting savings, insurance, and long-term financial goals.

4. How do tax policies impact financial planning?

Tax policies influence investment returns, retirement planning, and income distribution, requiring adjustments for tax-efficient strategies.

5. How can I optimize my financial planning?

Regularly review and adjust your savings and investments based on changing financial goals. A financial advisor like Fintoo can help you create a personalized strategy.

6. What strategies can improve financial planning?

Create a budget, review goals, diversify investments, build an emergency fund, and seek expert advice from professionals like Fintoo for better financial decisions.

Related Posts

Stay up-to-date with the latest information.