An income tax return (ITR) filing doesn’t have to be a worry. You don’t need to take help from an expert or continuously worry about deadlines. Today we can file taxes online. The process of filing taxes online is called E-filling. It is quite a simple task and E-filling can be done in just a few minutes from the comfort of your home or office.

As per Income Tax Act, 1961 every individual with an income (service or business) has to file ITR if they are not from exempt categories. The individual has to declare his/her income, expenses, tax deductions, investments, taxes, etc. This act makes it mandatory for a taxpayer to file an income tax return under various scenarios.

As per the regulations an income tax return is a form filed to report the annual income of a taxpayer. A taxpayer can also claim an income tax refund in case of excess tax payment while claiming tax deductions, etc. The refund process is issued in less than 3 weeks if you are using the online process. It is even faster if you choose direct deposit.

Before you start with ITR filing you must calculate your income as per the income tax law provisions applicable to you.

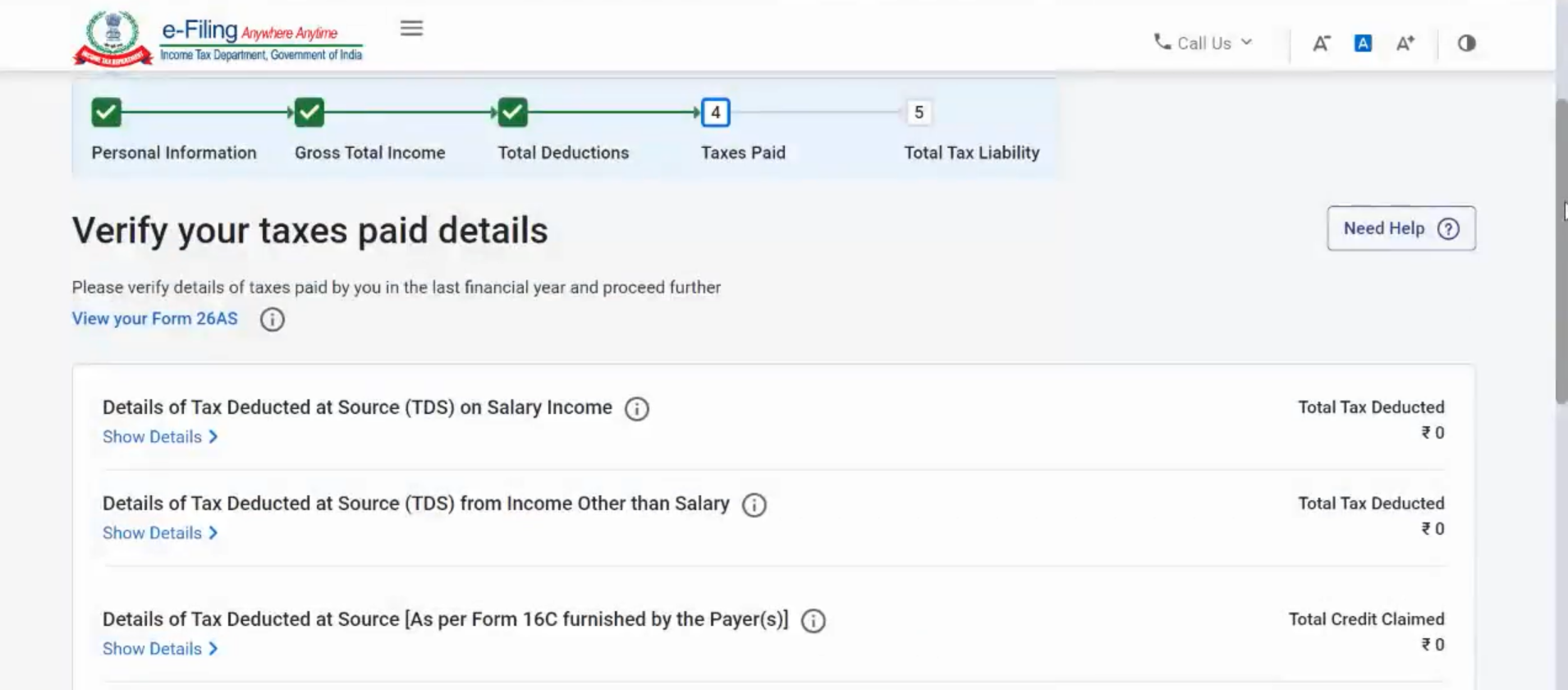

You must account for all different sources of your income like salary, shares, bonds and mutual funds, freelancing, receiving rent from property, and interest income. Then you can claim the deductions such as tax-saving investments under section 80C and so on. You should also account for credit for TDS, TCS, or any advance tax paid by you.

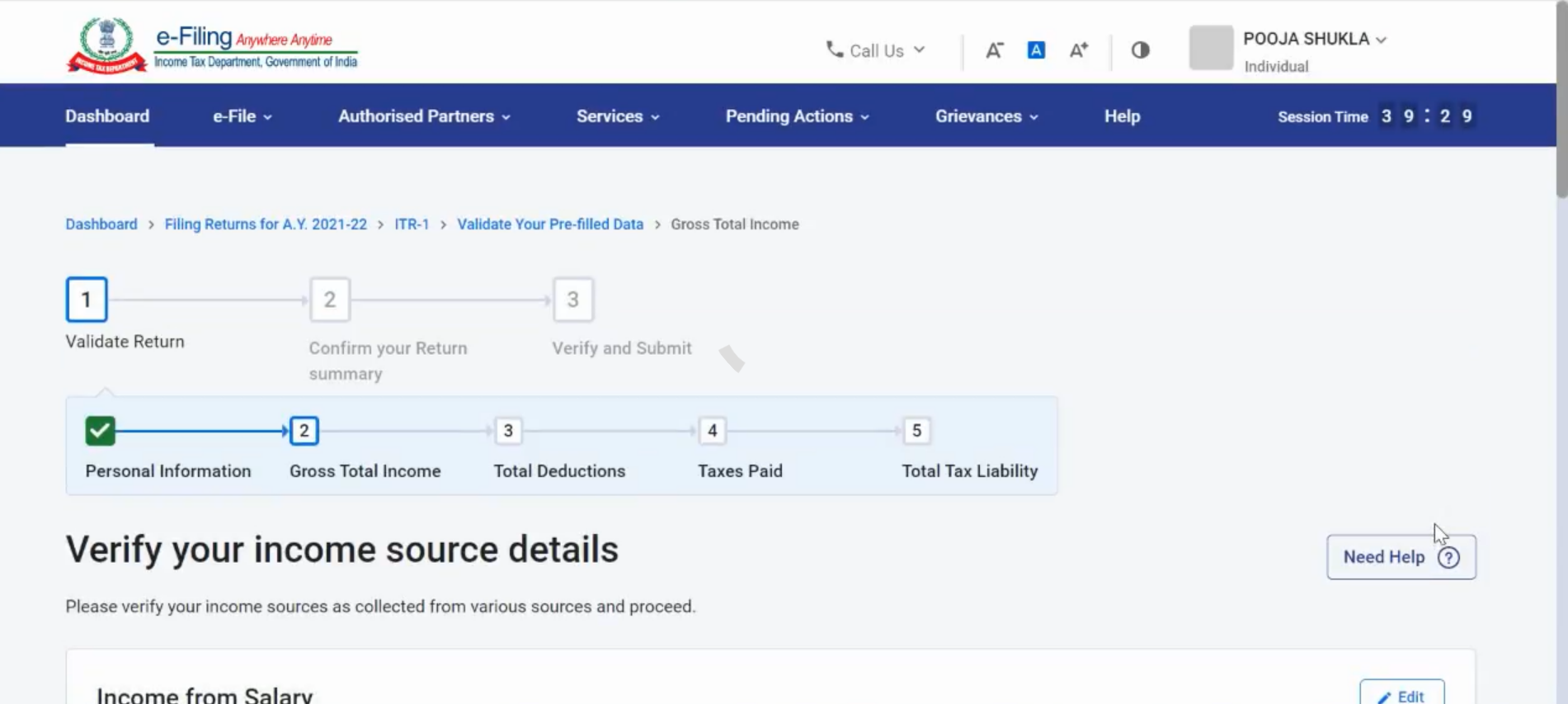

Below are the steps for online ITR Filing. These steps will make the E-filling process simpler:

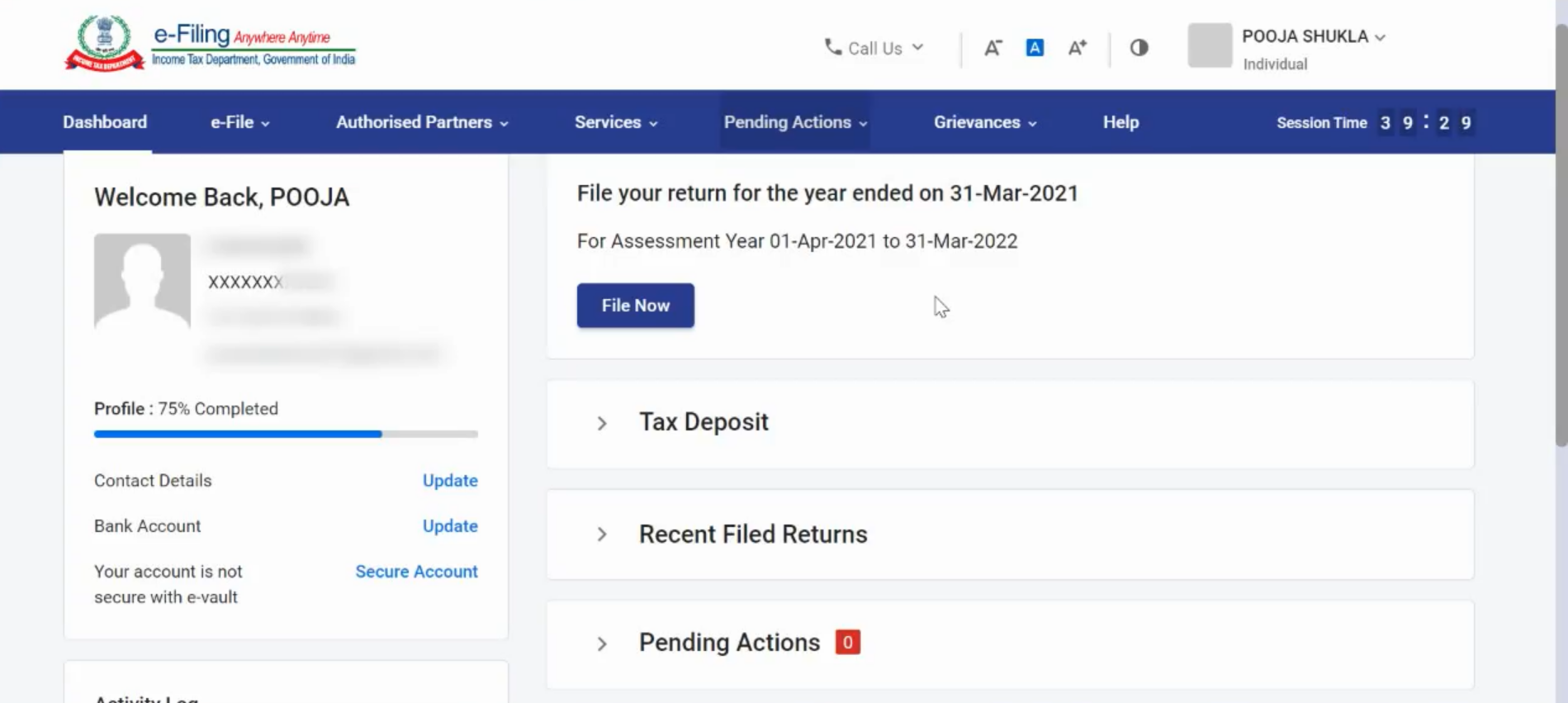

Step 1: Login And Register

Login to the government’s income tax department portal http://www.incometaxindiaefiling.gov.in/home for filling income tax returns online. Use your Permanent Account Number (PAN) to register yourself. Your PAN will become your user ID.

Step 2: Provide contact information

Enter your email ID and phone number. OTP will be sent to you to verify your details. Enter the OTP on the portal to confirm verification.

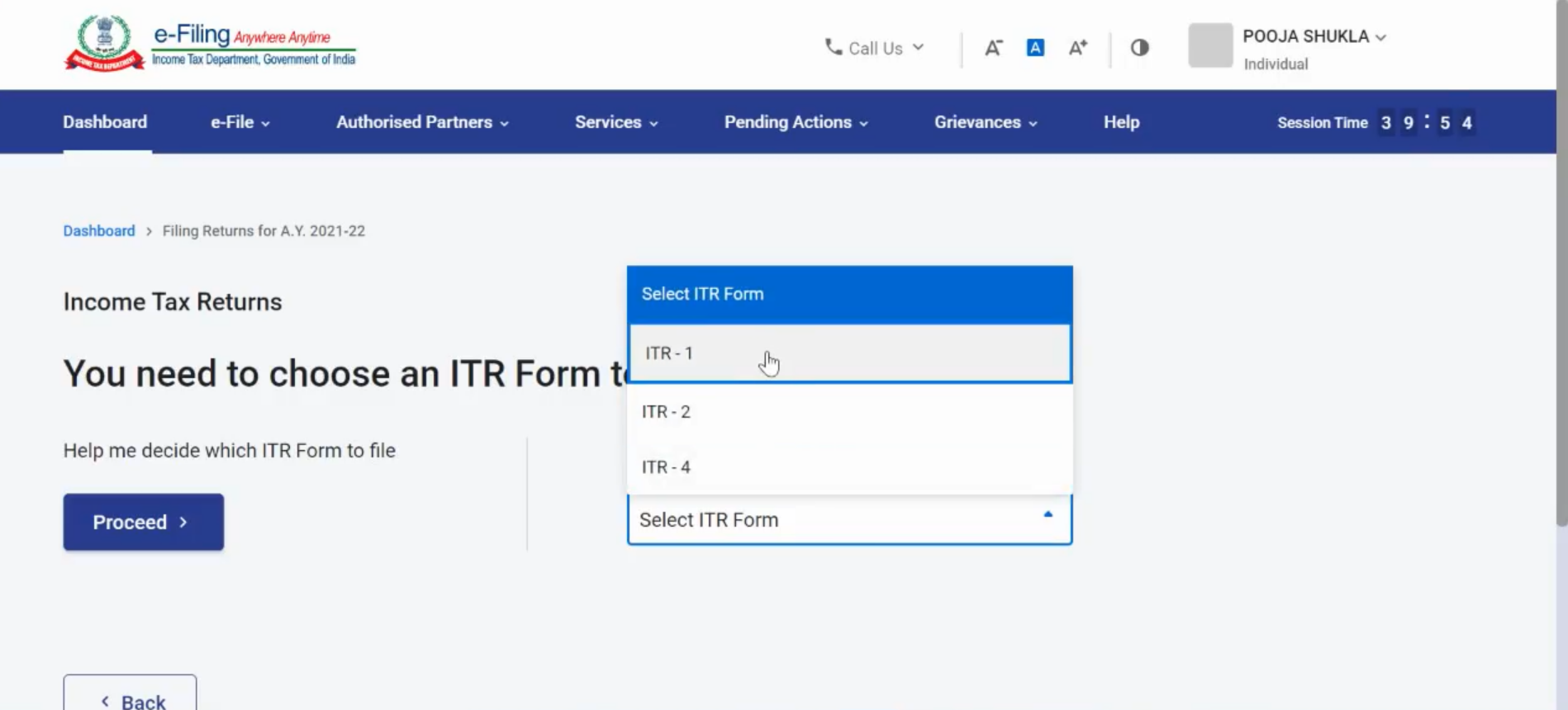

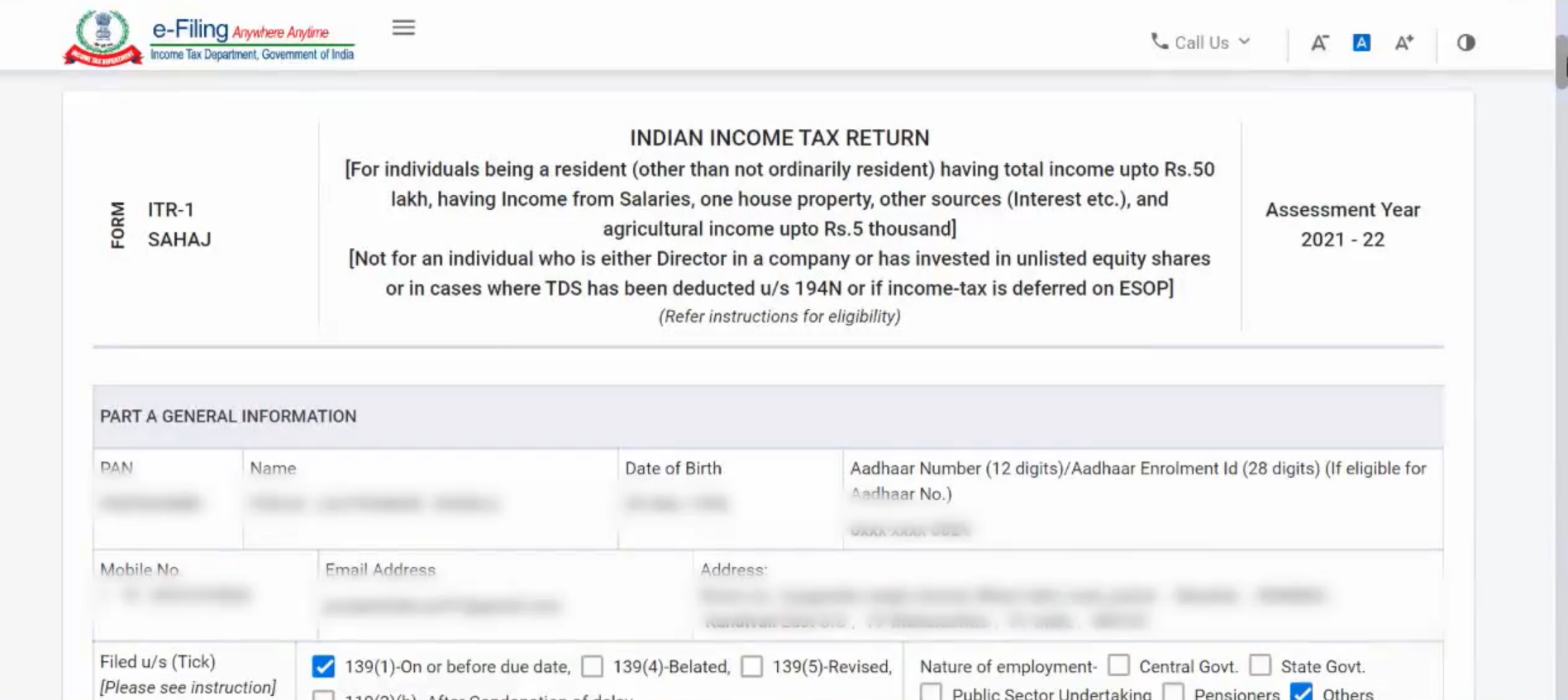

Step 3: Download The ITR Form Relevant To You

Choose the correct form. The online ITR portal has only 2 forms available – ITR 1 and ITR 4

ITR-1 is also known as Sahaj Form. It is for a person with an income of up to Rs. 50 lakhs.

ITR-4 Form is for those taxpayers who have opted for the presumptive income scheme as per Section 44AD, Section 44ADA and Section 44AE and whose income is not more than Rs 50 lakh.

Click on ‘Download’ to get the form you need to fill.

Step 4: Upload Form 16

Your employer issues form 16. It gives a validation that TDS has been deducted and deposited. Click on upload your Form 16. Once the upload is successfully completed, click on OK to confirm.

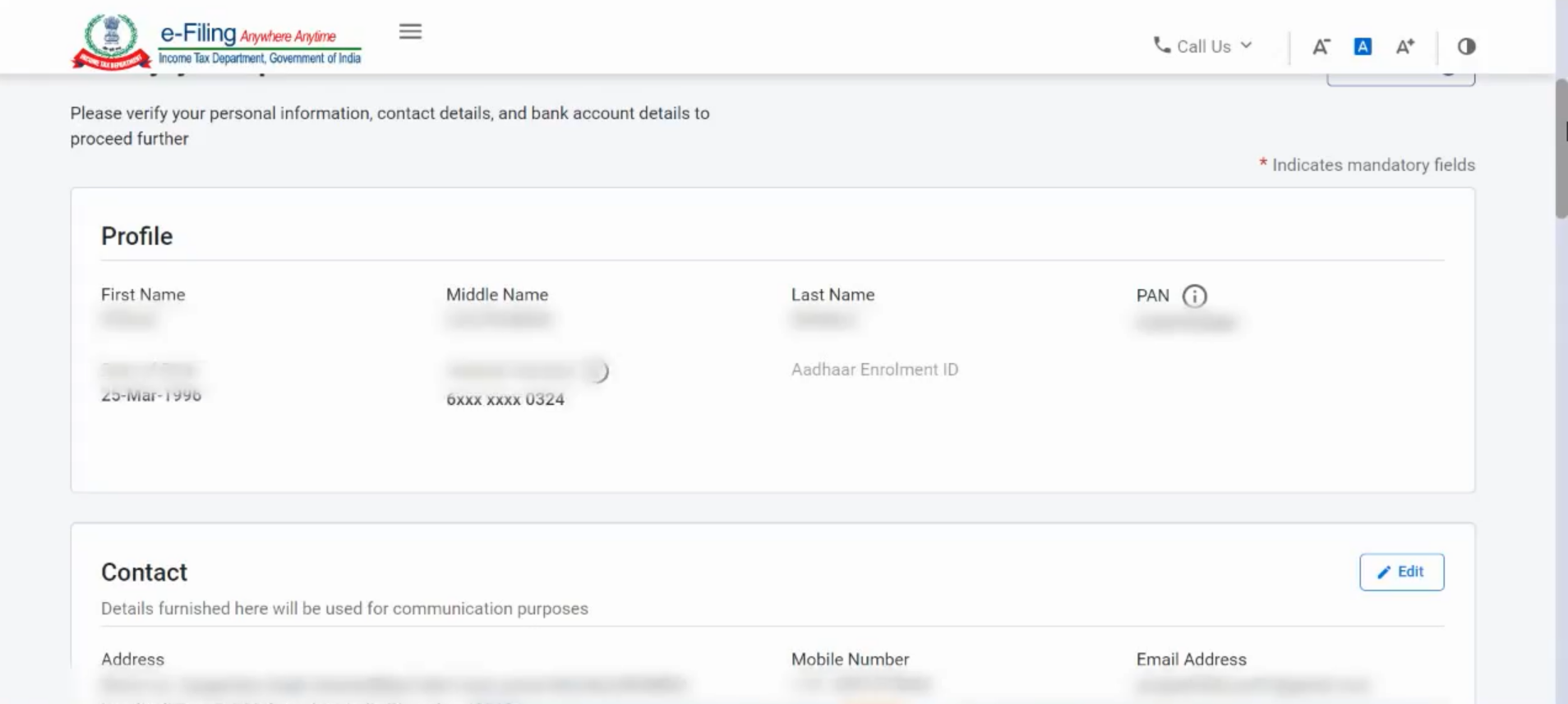

Step 5: Confirm Your Personal Details

Your personal details will automatically be uploaded on the portal when you upload form 16. You need to enter some details such as Date of birth, Father’s name, Mobile Number etc. as the same is not available in Form 16. Click on ‘submit’ after entering all the details.

Step 6: Cross-Checking

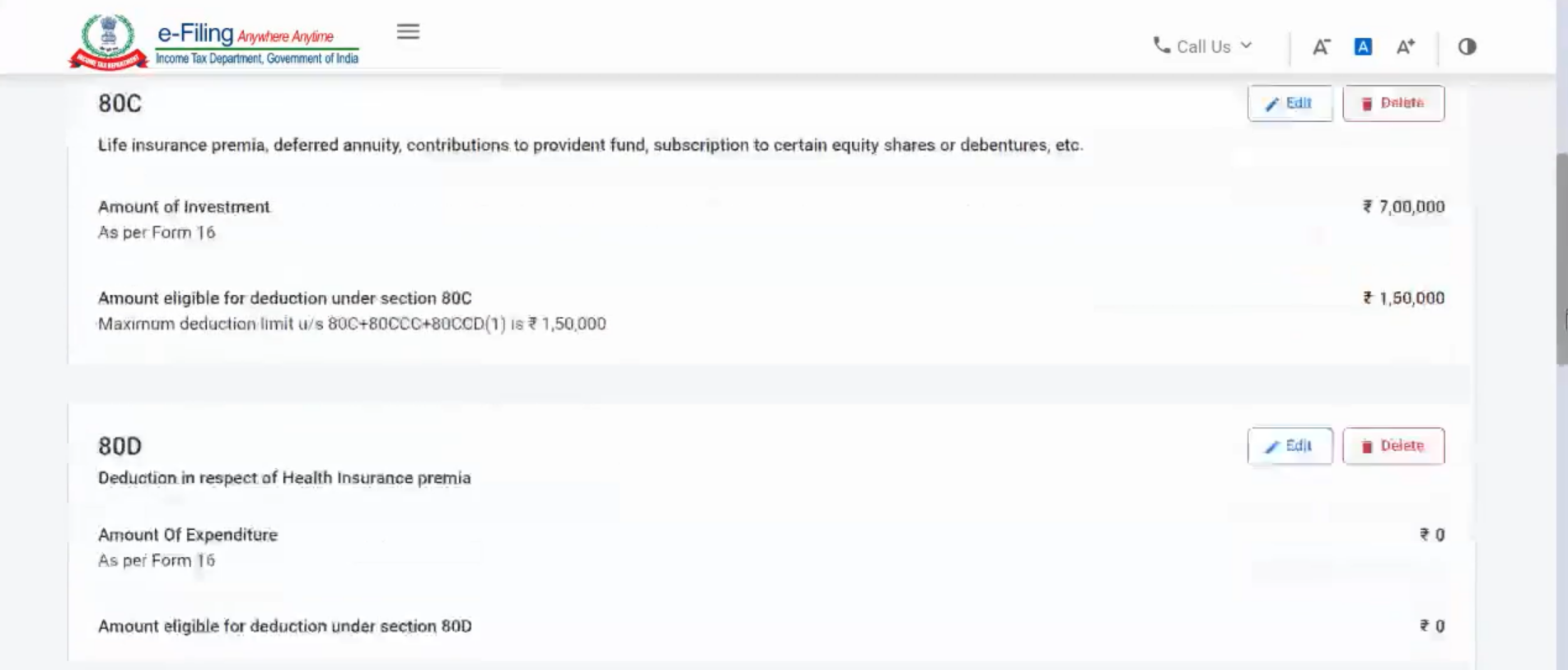

Check the data filled in by you. On the basis of Form 16 uploaded, the software will automatically fill the salary details along with other details of tax-saving deductions such as Mediclaim, contribution to PPF, donations to charitable trusts, life insurance premium, etc.

Step 7: Select Nationality

As per your nationality select the most accurate information. You will find options like -Indian Resident, Non-Resident Indian (NRI) or Not Ordinary Resident (NOR).

In case of any question, click on Help. It will guide you with relevant information.

Step 8: Enter Account Details

Provide details of all the Savings and Current Accounts in India. You will be shown a final summary of your return.

Step 9: Confirm Your Information

You will find a summary of your details. Cross-check your personal details, salary etc and click on submit.

Documents Required To ITR Filing

It is important to collect all documents before you start will ITR Filing process. It will help you calculate the taxes and deductions and be useful while uploading. The documents that you should keep handy are:

1. PAN card

2. Aadhar Card

3. Salary slips

4. Bank and post office savings account passbook, PPF account passbook

5. Form-16 – TDS certificate issued to you by your employer to provide details of the salary paid to you and TDS deducted on it, if any Interest certificates from banks and post office.

There are different types of form16 depending on your occupation.

· Form-16A, if TDS is deducted on payments other than salaries such as interest received from fixed deposits, recurring deposits etc. over the specified limits as per the current tax laws

· Form-16B from the buyer if you have sold a property, showing the TDS deducted on the amount paid to you

· Form-16C from your tenant, for providing the details of TDS deducted on the rent received by you, if any

6. Form 26AS – your consolidated annual tax statement. It has all the information about the taxes deposited against your PAN

a) TDS deducted by your employer

b) TDS deducted by banks

c) TDS deducted by any other organisations from payments made to you

d) Advance taxes deposited by you

e) Self-assessment taxes paid by you

7. Tax saving investment proofs: Proofs to claim deductions under section 80D to 80U (health insurance premium for self and family, interest on education loan), Home loan statement from the bank.

Check ITR status online

You can check the status of your E-filling form online. You will see the status of ITR as verified all details filled and checked. The status will change to ITR processed after processing your form.

After the form is processed you can check the different stages by following these steps.

1. After logging into the e-filing website by entering credentials – PAN no. as your ID and your password.

2. Click on Login

3. Click on the option ‘View Returns/Forms

4. Select the select income tax returns and assessment year from the dropdown menu

5. After this click on the status of your filing (whether only verified or processed) will be displayed on the screen.

Filling ITR annually is mandatory. If you miss the deadline, a fine will be issued to you. The late fee of up to Rs 10,000 will be levied on you depending on your delay. However, if your income is below the taxable limit then you won’t have to pay it even if you file after the deadline.

Must Read – How to Save Income Tax? Tax Saving Guide.

Related Article: How To Find Out Which ITR Form To Fill?

Start e-Filing Fill in the details and our Income Tax Filing experts will get in touch with you. Hassle-Free Online Income Tax Return Filing with Fintoo! visit – https://bit.ly/3gUwIS3

To get started with personalized Automated financial planning visit – http://bit.ly/Financial-Planning-Tool

Disclaimer: The views shared in blogs are based on personal opinion and does not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the sole decision of the investor and the company or any of its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.