Filing your Income Tax Return, paying your Advance Taxes, or knowing whether you are eligible for an Income Tax Return. Doing these tasks by yourself is equally confusing as it sounds and may also be really daunting, especially if you do not have the required knowledge or expertise, and are doing it for the first time.

But what if you have a single tool that can help you with all these things in a single place?

All you need to do is #AskFintoo

In this blog, we will navigate through Fintoo’s Chatbot and understand how to use the platform for tax advice, and help related to tax complications.

So, let’s understand how to make the best use of Fintoo’s Chatbot for your tax planning needs.

Steps to use the Fintoo Chatbot

Step 1:

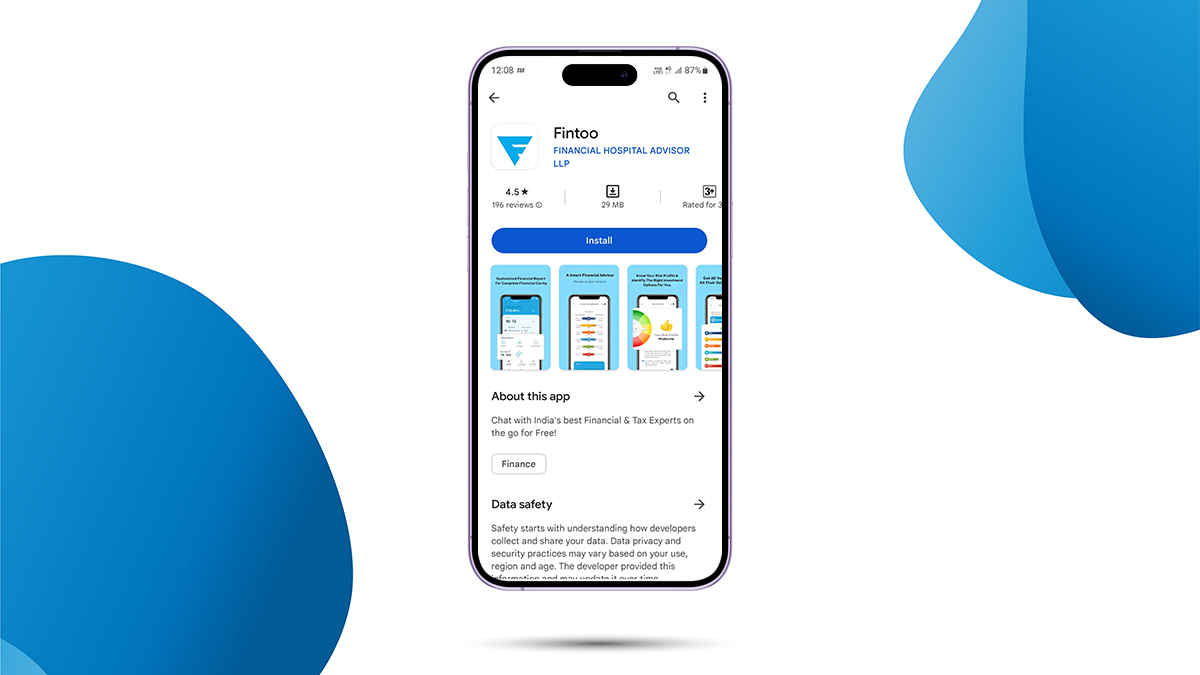

First, you will have to download the Fintoo app from the Apple Store or Google Play Store.

Once the app is downloaded, open it and get yourself registered by entering your name, number, and email address.

Step 2:

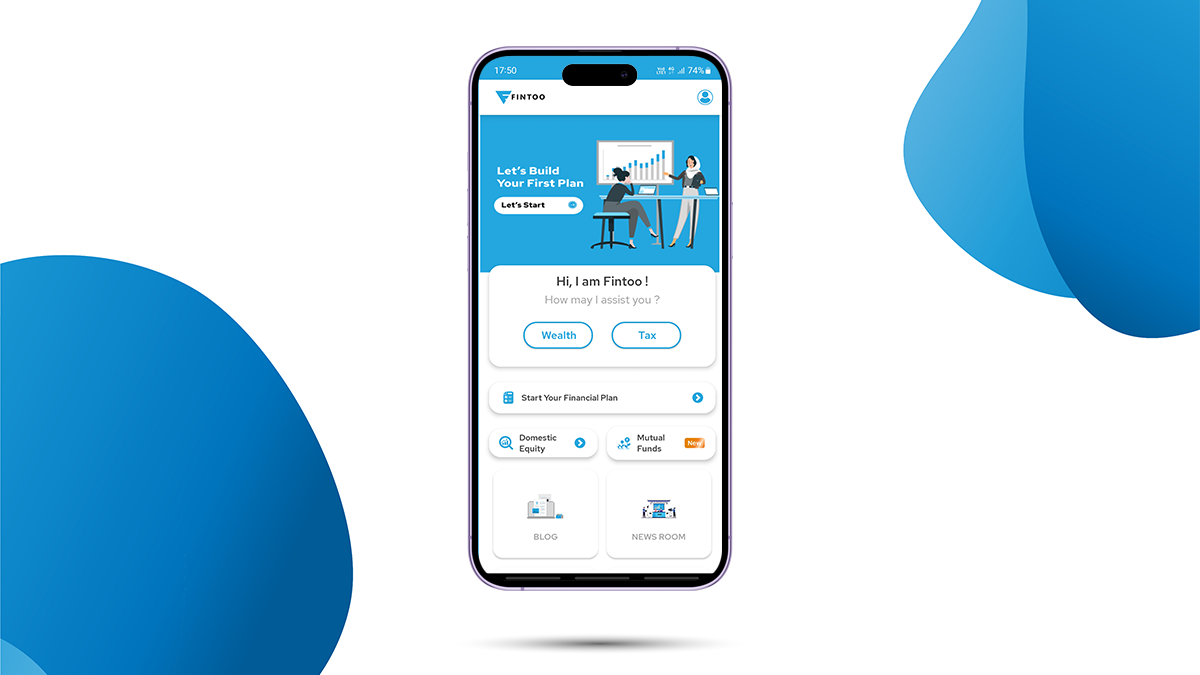

The homepage will say “Hi, I’m the Fintoo assistant. How may I assist you?” with two options for wealth and tax. Click on Tax.

Step 3:

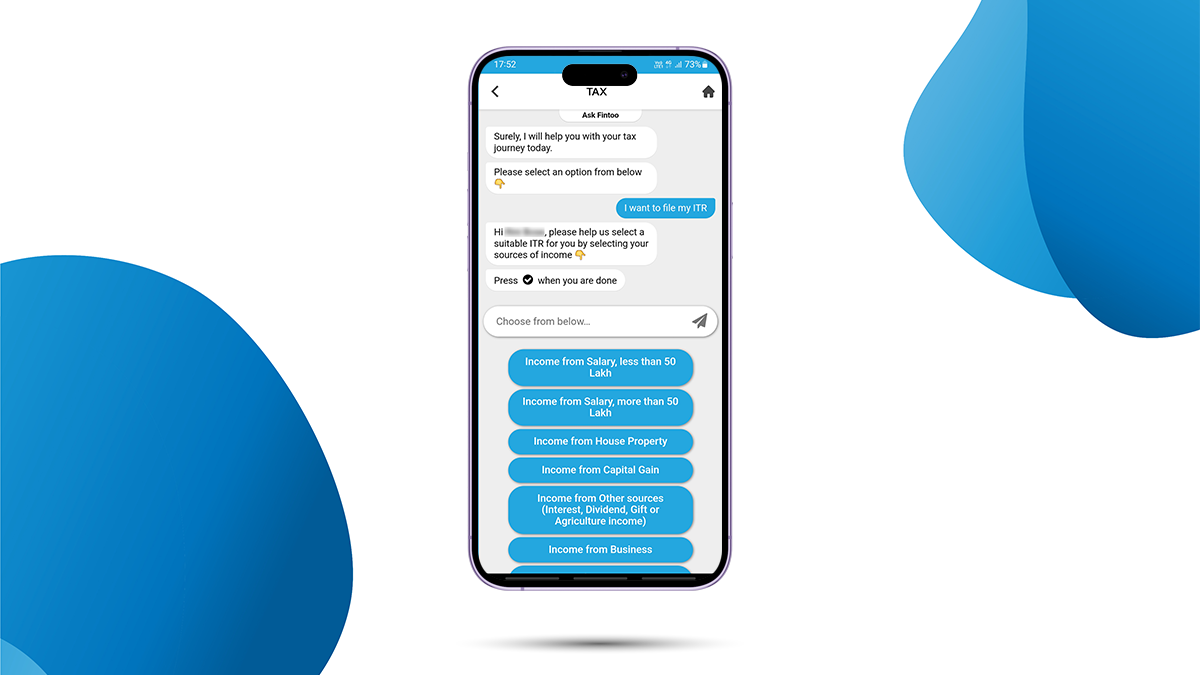

You will get a note from Fintoo, asking you to choose from a few options.

Click on ‘I want to file my ITR.

Step 4:

It will then ask you to select your salary bracket and source of income. Choose the suitable option and click on the tick mark to move forward.

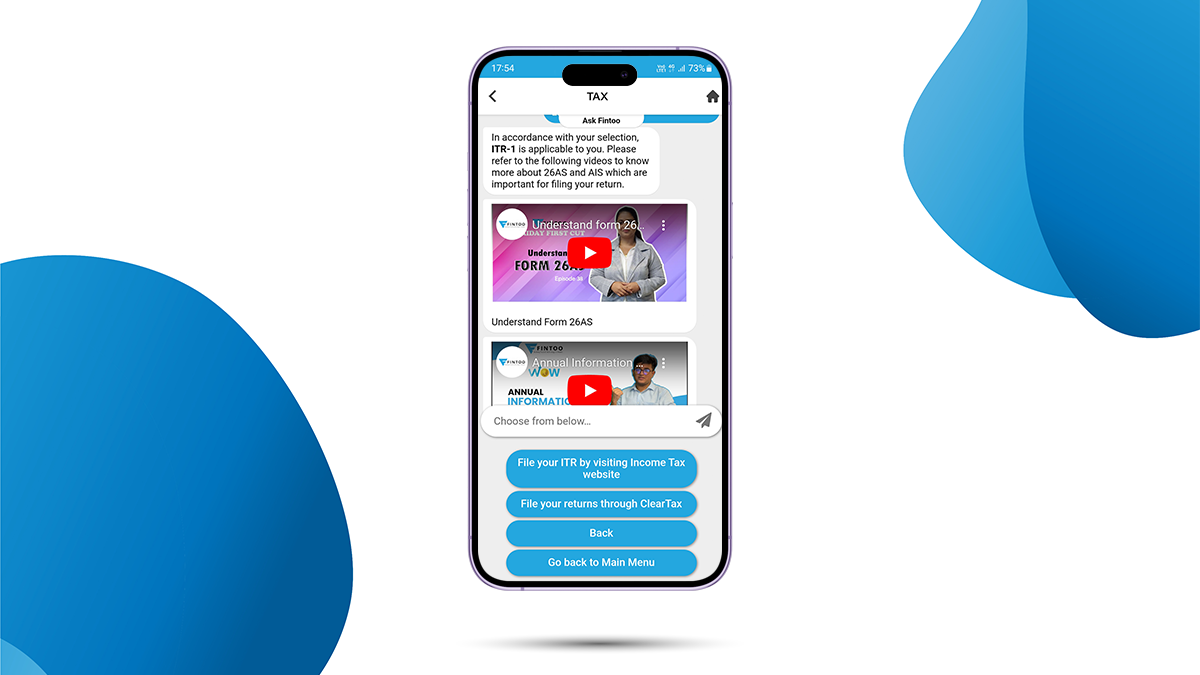

The Chatbot will tell you which ITR form is suitable for you, based on the selected option. Moreover, it will tell you to watch two videos to know about Form 26 AS and AIS statements in detail.

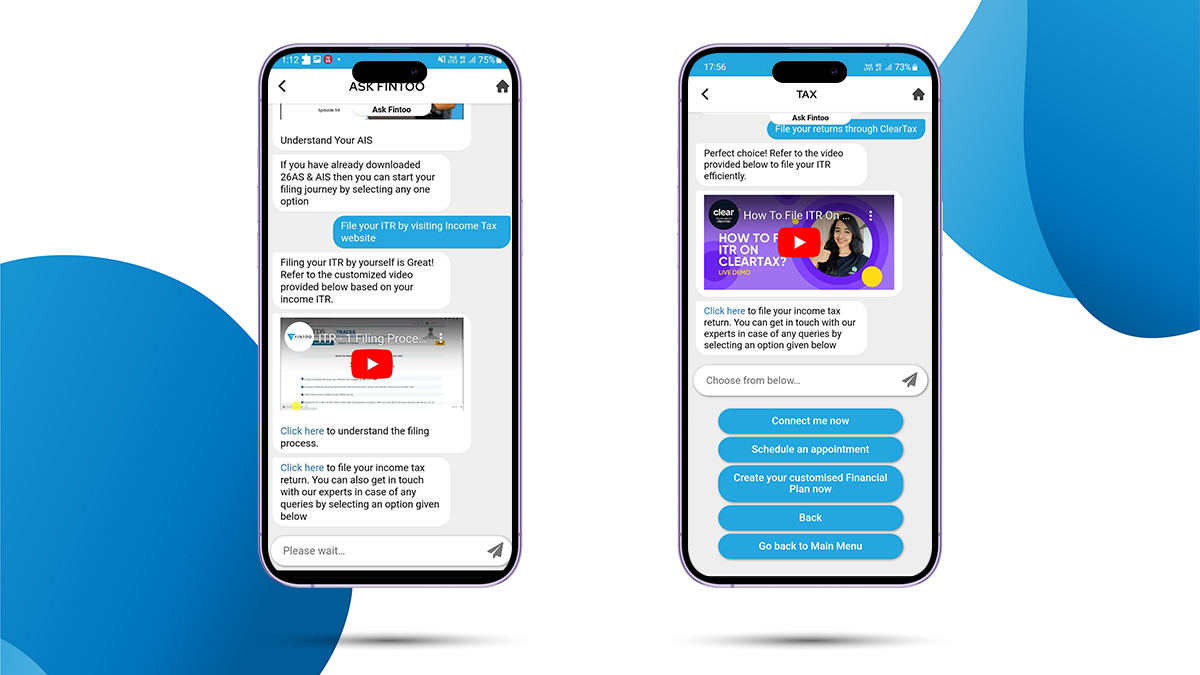

Step 5:

If you wish to file your ITR from the official Income Tax Portal, the Chatbot will redirect you to the ITR website. It will also suggest a video explaining the detailed process of filing your ITR from the Income Tax Portal.

Or, if you wish to file your Income Tax Returns from the ClearTax portal, you can select ‘File your returns through ClearTax.’ The Chatbot will show you a step-by-step detailed video on the process of filing your ITR through ClearTax.

Step 6:

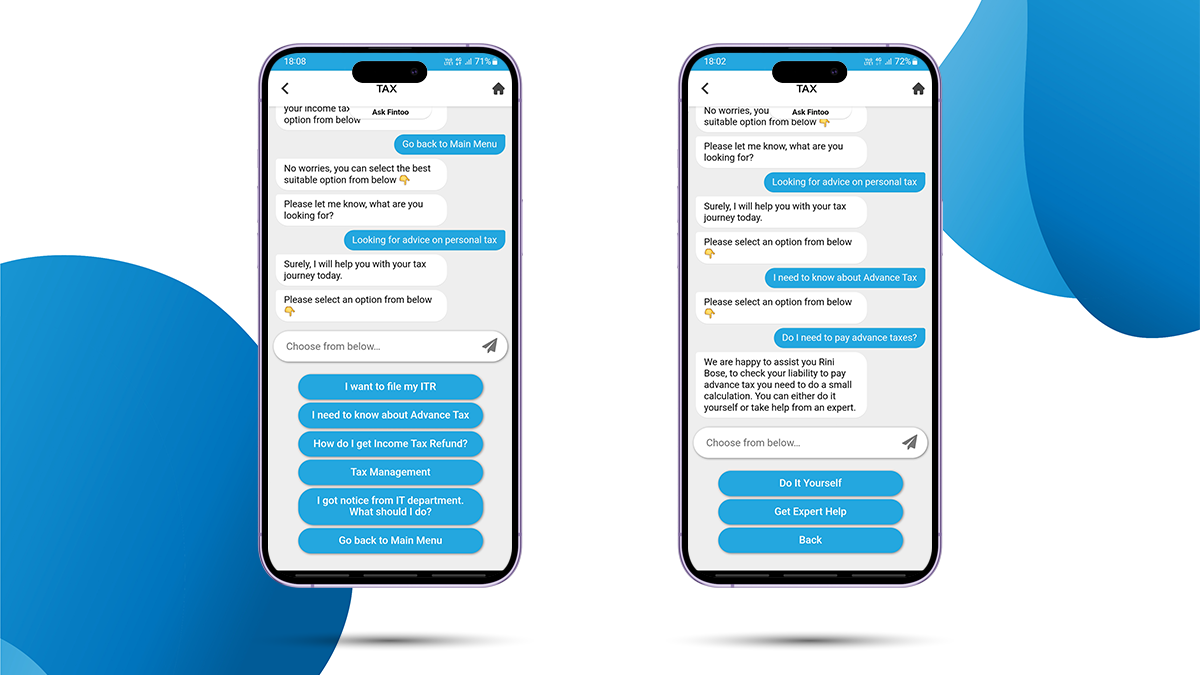

Now, if you need assistance to know more about Advance Tax, go back to the main menu and select ‘Looking for advice on personal tax’. Then, click on ‘I need to know about Advance Tax.

The Chatbot will ask you to choose from suitable options like, I need to know about Advance Taxes, How do I get Income Tax Refund? etc. Click on I need to know about Advance Tax.

Next, if you click on Do I need to pay Advance Tax?

You will get an option of Do it yourself, which will give you a link that will take you to a calculator where you can fill in the details related to your income, and deductions after which you will get whether you are liable to pay Advance Tax or not.

In case you need advice from a tax expert, click on expert help and click now to get in touch with our tax experts or you can schedule a future appointment depending upon a convenient date and time. Our experts will contact you to help you file your income tax or assist you in relation to Advance Tax.

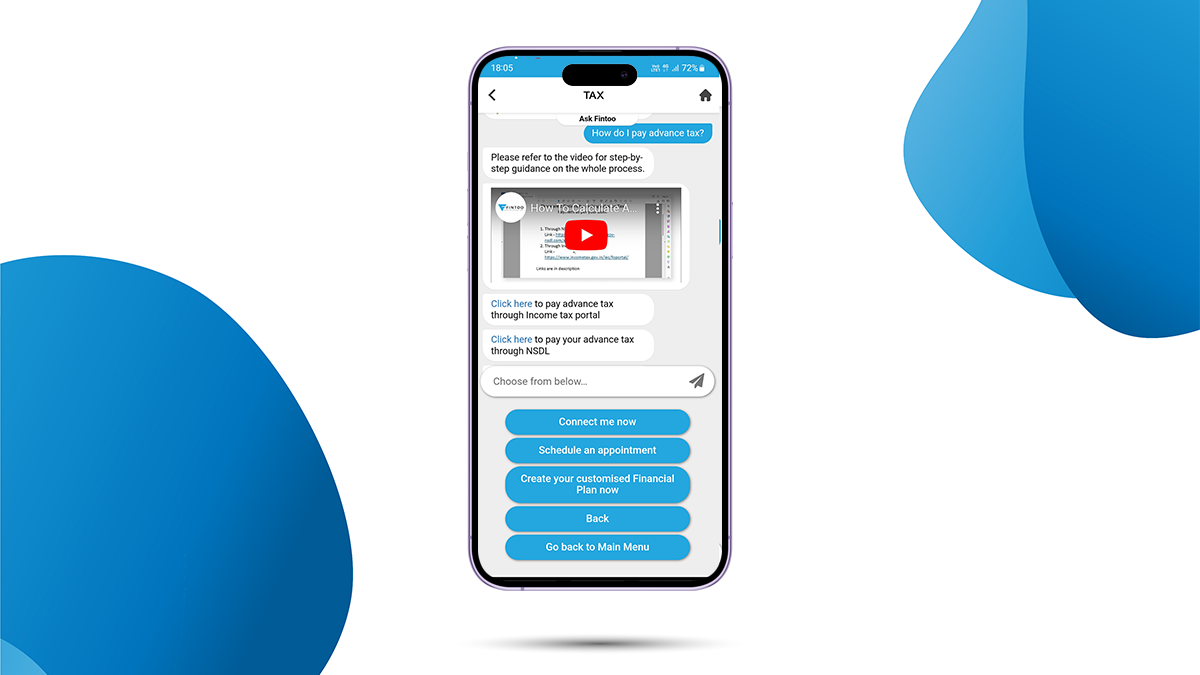

Step 7:

The second option under Advance Tax will tell you if you want to know how you can pay Advance Tax. Click on How do I pay Advance Tax? The Chatbot will redirect you to a reference video along with 2 options to pay your Advance Tax i.e., through the Income Tax Portal or through the NSDL portal. You can click depending upon your preferred option and pay your Advance Taxes.

So, that was all about Advance Taxes, knowing whether you are liable to pay Advance Taxes, and how you can pay Advance Taxes from the NSDL portal or from the Income Tax Portal.

Step 8:

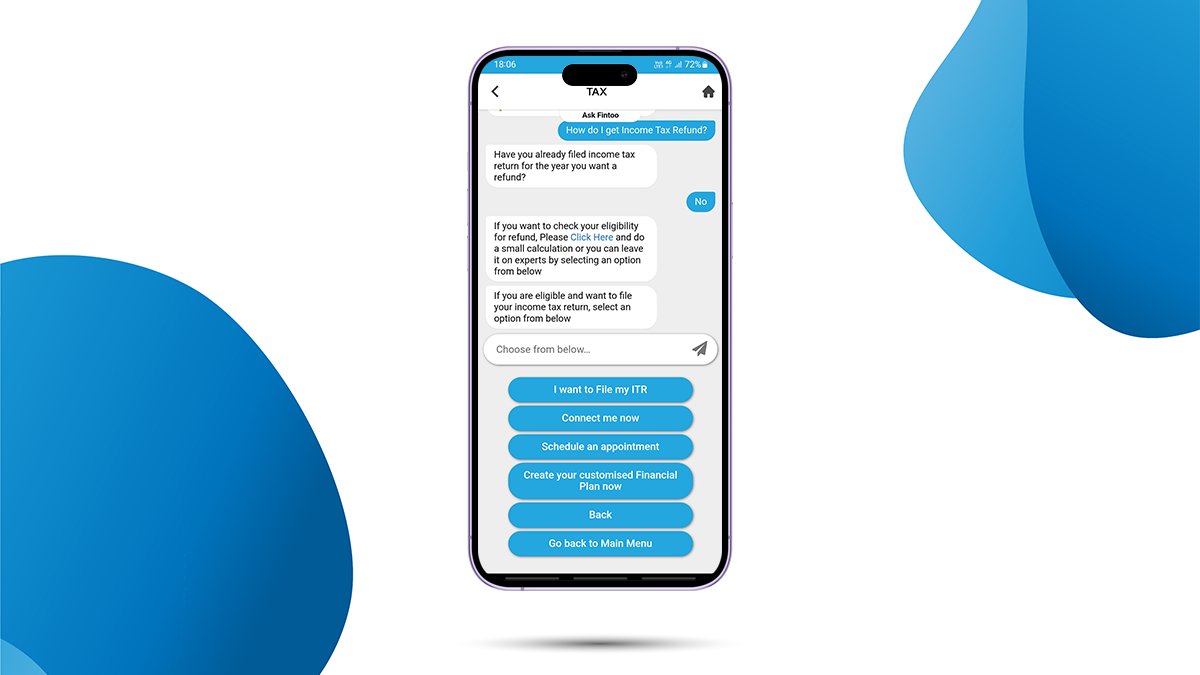

Now, if you wish to get details related to your Income Tax Refund, click on How do I get the Income Tax Refund? The Chatbot will ask you to check your eligibility.

So, if you want to calculate your eligibility for the Income Tax Refund for the upcoming financial year, select No and our Chatbot will redirect you to a calculator.

After following the steps, the Chatbot will tell you whether you are eligible for an Income Tax Refund for that financial year or not.

Step 9:

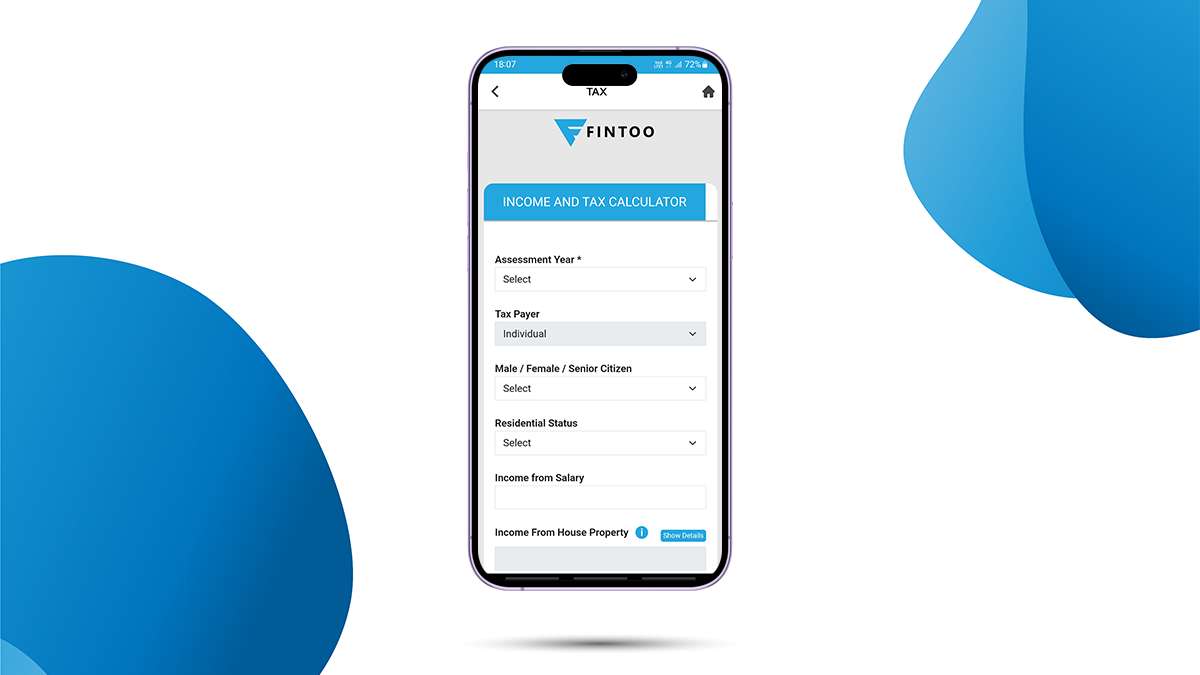

Once you’ll click the link to the calculator, you can enter your income details, deductions, capital gains, house rent, category of the taxpayer, types of income, etc., Once you’ve entered all these details, you will get to know whether you are eligible for an Income Tax Return or not.

Step 10:

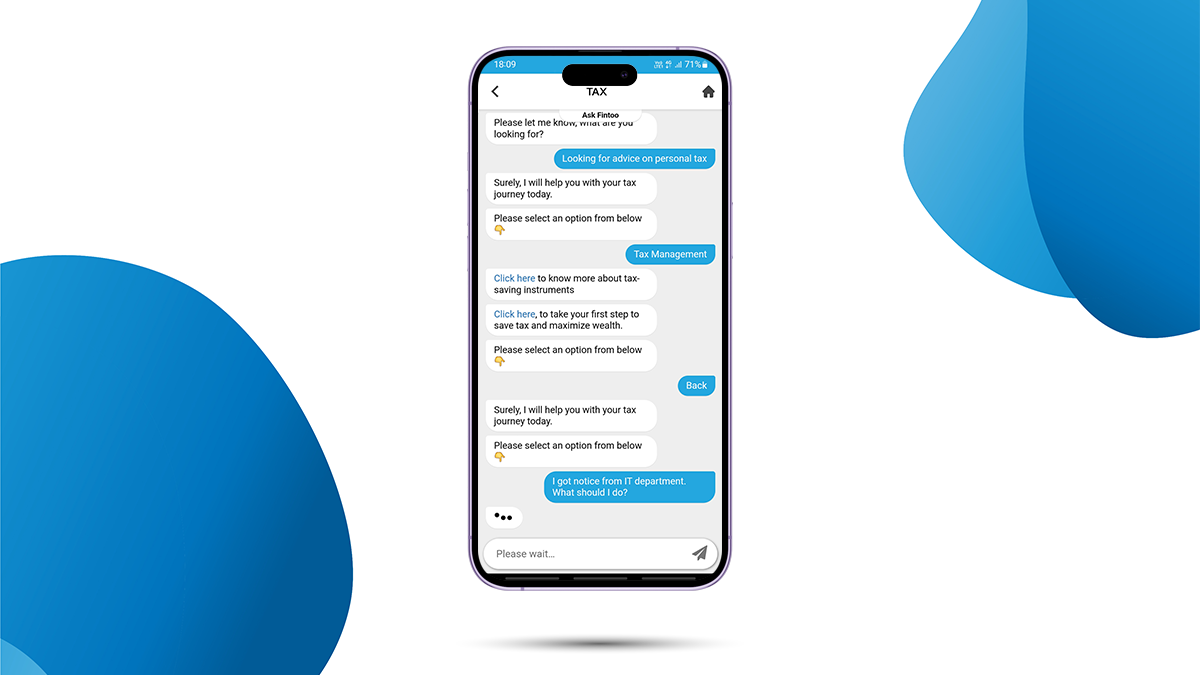

Now, the fourth option on our Fintoo Chatbot tells you about tax management. If you wish to know how you can save your taxes and which deductions and exemptions can you use to save your taxes, go back to the main menu and click on Tax Management.

It will guide you to two detailed blogs about tax-saving instruments and the step-by-step process to save taxes and maximise your in-hand income. You can click on either of the options to redirect to our knowledge section.

Step 11:

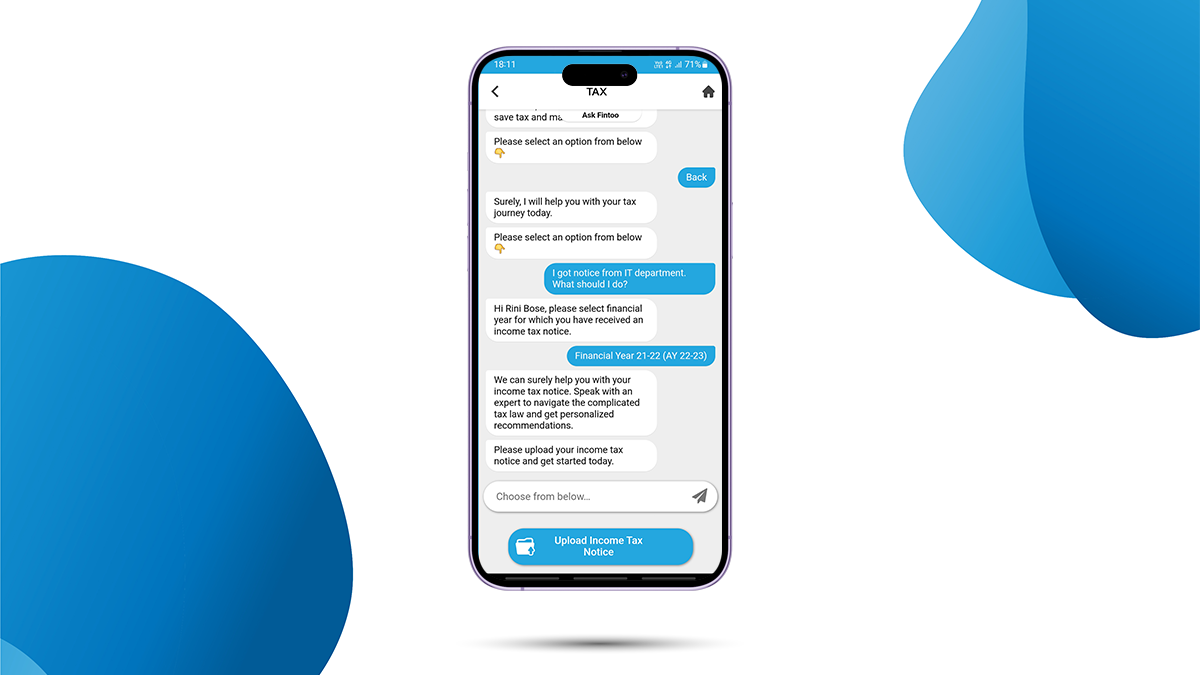

If you wish to know about any income tax notice that you have got from the IT department then you can click on ‘I got notice from IT department. What should I do?’ The Chatbot will ask you to enter the relevant financial year and upload your Income Tax Notice for further assistance.

Conclusion:

So, this is how you can use Fintoo’s Chatbot to know how to file your income tax return, know more details on Advance Tax, check your eligibility for your income tax return, and learn how to manage your taxes. You can also check out our website www.fintoo.in to get a first-hand experience of our Chatbot and get all your queries addressed.

And remember, if you face any difficulty, you can get in touch with the tax experts and get the best solution for all your tax-related questions.

Disclaimer: The views expressed in the blog are purely based on our research and personal opinion. Although we do not condone misinformation, we do not intend to be regarded as a source of advice or guarantee. Kindly consult an expert before making any decision based on the insights we have provided.