Goods and Service Tax was a landmark act passed in the Parliament on 29th March 2017 and brought into effect on 1st July 2017. It was brought in order to unify several direct and indirect taxations while bringing in a comprehensive destination-based tax that supports federal tax contributions. In simpler terms, GST brought all the indirect taxes under one umbrella for the entire country. It also brought in a mechanism to share the taxes in an equitable manner with the states.

Since its inception, Goods and Service Tax collections have risen with every quarter. As recent as January 2022, the GST collection stood at Rs.1,40,986 crores which is the highest since its inception. It was a 15% growth on a year-to-year basis due to the pick-up in the economic activity and some firm anti-tax evasion measures employed by the government. It was the fourth month when GST collections surpassed the 1.30 lakh crore mark and the seventh time in a row when it crossed Rs.1 Lakh crore mark.

These significant numbers indicate that GST is a robust financial mechanism that has helped the nation’s economy swell up in recent times. The GST regime has seen several changes over the year which were the result of budget announcements and finance committee meetings.

In this article, we will cover the key GST changes in India which came into impact from 1st January 2022 as well as the changes suggested in the annual budget 2022.

Table Of Content

- GST changes in India are applicable from 1st January 2022

- GST changes impacting eCommerce websites and operators

- New tax treatment which come into effect from 1st January 2022

- Recovery of Self-Assessment Tax without the opportunity of difference between GSTR-1 and GSTR-3B

- Expansion of GST Commissioner’s powers

- Amendments in Section 129 and 130 of CGST Act, 2017

- Amendment related to input credit

- Mandatory Aadhar authentication for GST revocation and refund application

- Amendment of the definition of ‘supply’ under GST

- Withdrawal of GST exemption

- Changes announced to GST in Union Budget 2022

GST changes in India are applicable from 1st January 2022

Starting 1st January 2022, several key changes in Goods and Service Tax came into effect. These changes were the result of the amendments introduced in the Central Goods and Service Tax (CGST) Act, 2017 through the Finance Act, 2021. Other changes were brought in on the recommendation of the GST council in its 45th meeting held in September 2021. These GST changes focus on strengthening supplies and enforcement mechanisms, withdrawal of concessions, and introducing input credit restrictions.

The scope of these amendments also includes shifting the tax burden to eCommerce websites, restriction of input credit, enforcement of provisions, mandatory authentication of Aadhar for GST revocation and refund application, blocking of GSTR-1 for non-filing of GSTR 3B while empowering the GST commissioner to enforce these laws.

The major changes that come into effect from 1st January 2022 are as follows:

GST changes impacting eCommerce websites and operators

As far as the eCommerce websites and operators are concerned, the notification from the GST council dated 18 November 2021 amended a previous notification dated 28 June 2017. It:

Added a provision in entry 15 to the item (b) and (c) which brings a passenger transportation service that is mediated by an eCommerce platform in a non-air-conditioned contract carriage or stage carriage under the GST net.

Added a provision to entry 17 which brings transporting passengers by e-commerce platforms through auto-rickshaws has been made taxable. The auto-rickshaw service was not under GST earlier.

This means that the food aggregators or eCommerce platforms like Zomato, Swiggy, Ola, Uber, Rapido, and others will now have to pay taxes on restaurant services. This has come into effect since 1st January 2022. However, the restaurants are liable to pay taxes for the non-restaurant services and the liability lies with them.

Restaurant services can be understood as services that are provided by the eCommerce platforms for human consumption such as food or drink provided by a restaurant. This may include the restaurants, eating joints, mess, or canteens from where edible items are supplied to consumers who eat them outside of their premises.

This notification allows the food aggregator companies such as Zomato, Swiggy, and others to levy and collect GST at a 5% rate on the supply of restaurant services to people who want to access them through the eCommerce platform.

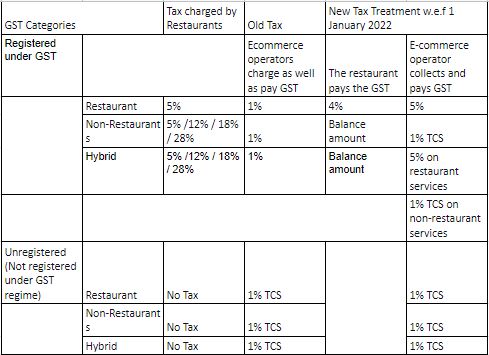

The following table gives a brief idea about the new tax treatment which come into effect from 1st January 2022:

Recovery of Self-Assessment Tax without the opportunity of difference between GSTR-1 and GSTR-3B

Another change in GST that came into effect on 1st January 2022 was the introduction of recovery of self-assessment tax without the opportunity of difference between GSTR-1 and GSTR-3B. Earlier this self-assessed tax was levied on the basis of the liabilities declared by the user in Section 39 but there used to be a lot of cases where consumers submitted fake billings.

In the amendment, it has been made sure to curb the practice of fake billing where sellers used to show higher sales in GSTR-1 which enabled them to claim the Input tax credit (ITC) but then showed lesser sales in GSTR-3B to lower their GST liability. This fraudulent activity needed to be checked and has been addressed properly in this amendment which came into force on 1st January 2022.

The amended section 75(12) of the CGST Act clarifies that “Notwithstanding anything contained in section 73 or section 74, where any amount of self-assessed tax in accordance with a return furnished under section 39 remains unpaid, either wholly or partly, or any amount of interest payable on such tax remains unpaid, the same shall be recovered under the provisions of section 79.”

Many businesses had this notion about this section was that there would be hostile attempts from the government side to recover the tax for even minor cases of mismatch. Keeping that in mind, the Central Board of Indirect Taxes and Customs (CBIC) issued guidelines on 7th January 2022 on recovery proceedings. The board clarified that taxmen would give ample time to businesses to help them understand the mismatch.

Expansion of GST Commissioner’s powers

Another change that came into effect was the expansion of the power of the Goods and Service Tax (GST) commissioners. A GST Commissioner is the head and final decision-making body regarding the levy of GST and Central Excise. The amendment empowers the commissioner to provisionally attach any property of the taxpayer or any other person who directly benefits from the transaction once the proceedings against them get initiated.

The amendment was issued vide Section 115 of the Finance Act, 2021 which has amended Section 83 (1) of the CGST Act. The amended reads as

The amendment believes that after the initiation of any financial proceedings against the taxpayer under Chapter XII, Chapter XIV, or Chapter XV and if the commissioner believes that it is important in the interest of the Government, he may order, in writing, to attach provisionally, any property which might include bank accounts, properties of the taxable person or any other person directly benefitting from the transaction under section 1A of Section 122 of the GST Act, 2017.

Against this amendment also, many experts expressed concern that it may be misused to coerce taxpayers into depositing tax demands without following the due processes. This amendment may also get challenged in a court on grounds of constitutional validity where a person’s own judgment might lead to consequences.

Amendments in Section 129 and 130 of CGST Act, 2017

There have also been changes in sections 129 and 130 of the Central Goods and Service Tax Act, 2017. These amendments further work to empower the taxing authorities and allow them detention of goods during their movement as well as confiscation if required.

The amendment to section 129 delinks it with section 130 and makes it a complete code in itself. With this, the penalty is payable to 200%. This amendment has also deleted the provision that allowed the provisional release of detained under while under investigation.

The amendment also specifies the time limit for selling or disposing of seized goods or conveyance while adding a clause that there would be no penalty without giving the proper opportunity of hearing.

There have also been changes in section 130 which rationalizes the penalties that can be imposed in case the goods need to be confiscated.

Another amendment has been done to section 107(6) vide section 116 of the Finance Act 2021. It states that no appeal shall be filed against an order under subsection (3) of section 129 of the CGST Act unless a sum equal to 25% of the penalty has been paid by the appellant.

Amendment related to input credit

Another amendment that came into force from 1st January 2022 was the one related to input credit. This amendment has been made vide section 109 of the Finance Act, 2021. It inserts the new clause (aa) to section 16(2) of the CGST Act, 2017.

This clause introduces a new condition for the taxpayer to avail of the GST credit. The clause states that the input credit on an input side invoice or debit note can be availed only when details of such invoice or debit note have already been furnished by the supplier in their outward supplies i.e. GSTR-1 document. Such details should also be communicated to the recipient of such invoice or debit note.

The amendment also states that the five percent limit which is mentioned under Rule 36(4) has been rendered irrelevant as the recipient would not be able to take any ITC if the same is not reflected in the recipient’s GSTR2B.

Mandatory Aadhar authentication for GST revocation and refund application

Another amendment that came into force on 1st January was the mandatory Aadhar authentication for GST revocation and refund application. This amendment has made it mandatory for the registered person to undergo Aadhar authentication for the purposes listed below:

- Filing of application for revocation of cancellation of registration in Form GST REG-21 under Rule 23 of the CGST Act, 2017.

- Filing of refund application in Form RFD-01 under Rule 89 of the CGST Act, 2017.

- Refund of the IGST paid on goods exported out of India under Rule 96 of CGST Act, 2017.

The registered person can undergo Aadhar authentication or e-KYC verification by accessing the Dashboard on the GST Portal and then moving to My Profile where they need to click on the Aadhar authentication status.

Amendment of the definition of ‘supply’ under GST

The amendment that came into force from 1st January 2022 also broadened the definition of ‘supply’ under the Goods and Service Tax. It includes the supply of goods or services or both between any person to its members or constituents or vice versa for consideration.

Withdrawal of GST exemption

The notification which came out on 18 November 2021 amended entries 3 and 3A o the previous notification dated June 28, 2017. This amendment omits the words “governmental authority or a government entity.

Entry 3 and 3A provided GST exemptions for pure services as well as supply of composite services to governmental authority or a government entity where the value of goods did not exceed 25%. The various entities which could be termed as a governmental authority or government entity were:

- Smart City project agencies

- City development authorities

- Government controlled universities

- State-owned power utilities

- State-owned industrial development

- Public sector undertakings

- Authorities like NHAI etc

All these changes were brought into effect from 1st January 2022 under the Goods and Services Tax Act, 2017.

Changes announced to GST in Union Budget 2022

There were quite a few changes announced to Goods and Service Tax by the finance minister while presenting the Union Budget 2022 on 1st February 2022. These changes will be brought into effect after the notification from CBIC. Some of the changes that were made through the Union Budget 2022 are

- Changes to provisions of Input Tax Credit (ITC) – Under changes to ITC, a new clause (ba) was added to subsection (2) of section 16 which stated that ITC for any supply can be availed only if it is not restricted via communication under section 38 or GSTR2B to the registered person.

- Changes to cancellation of GST registration by officers – The Budget 2022 amended section 29 and states that the GST registration will be cancelled by the officer if:

If a taxpayer has not filed GSTR-4 for a financial year by 30th of April of the following financial year.

- Extension of time limit for issuance of credit notes up to 30th of November following the end of the financial year.

- Changes in furnishing details of outward supplies

- Revamp of section 38 on ITC Claims

- Changes to the provisions regarding furnishing of GST returns

- Modification to Section 41 and removal of Section 42, 43 and 43A

- Changes in the utilisation of balance available in the electronic credit ledger

- Changes to the provision of claiming refund of unutilised ITC

Also Read About Other Tax-Related Changes In Union Budget 2022

Goods and Service Tax Act 2017 is an evolving act that regularly takes into account the compliance factor for ease of doing business and filing taxations. Over its age of 5 years, there have been several major and minor changes that have been done both by the union budget as well as the financial acts.

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning without any cost on: http://bit.ly/Robo-Fintoo

Disclaimer: The views shared in blogs are based on personal opinion and does not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the sole decision of the investor and the company or any of its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.