The rat race of life has made us believe that we are constantly competing with our neighbors.

Your neighbor bought an expensive car?

You wonder why you can’t have one?

Your neighbor moved to a posh locality?

You start to wonder why you can’t do the same?

These thoughts stem from the hustle culture that promotes work over life in our attempts to improve our standard of living. It is not impractical to desire to upgrade your quality of life. However, in the melee, you should try and not miss out on your present, nor should it be so stressful that it negatively impacts your investment choices. Therefore, it becomes important to understand the market before making a decision.

Let us guide you through one such investment option that might lessen your burden and help you achieve your financial dreams. Among the various investment schemes, India’s flourishing economy has opened the way for the equity market. Even though equity mutual funds have gained popularity, they are still infamous for the market risks they entail.

This causes people to become hesitant while investing. However, a thorough research and understanding of the market can help you dodge a few avoidable risks. It could also give you great inflation-adjusted returns in the long term.

So, let’s deconstruct the concept of equity mutual funds to help you find the investment technique that best fits your financial goals.

What is equity fund?

Equity mutual fund is an investment scheme that invests its assets in the stocks of different companies that are listed on the stock exchange. Since equity mutual funds comparatively provide higher returns than deposits or debt funds, they also carry a higher risk depending on the market condition.

The AMC (Asset Management Company) assigns a fund manager who manages and controls the funds. As they are experts and have adequate knowledge of the market, they can easily manage multiple investments at a time. With an aim to fetch better returns, fund managers invest in different companies having varying market capitalization.

Now that we have mentioned what is equity fund, let’s understand how to select one according to your requirements.

How to select the best equity mutual fund?

Selecting it could be confusing as there are 550+ schemes to choose from. Also, there are around 44 AMFI registered fund houses in India offering more than 2500 mutual fund schemes. But by following these two steps, you will be able to decide which one is most suitable for you.

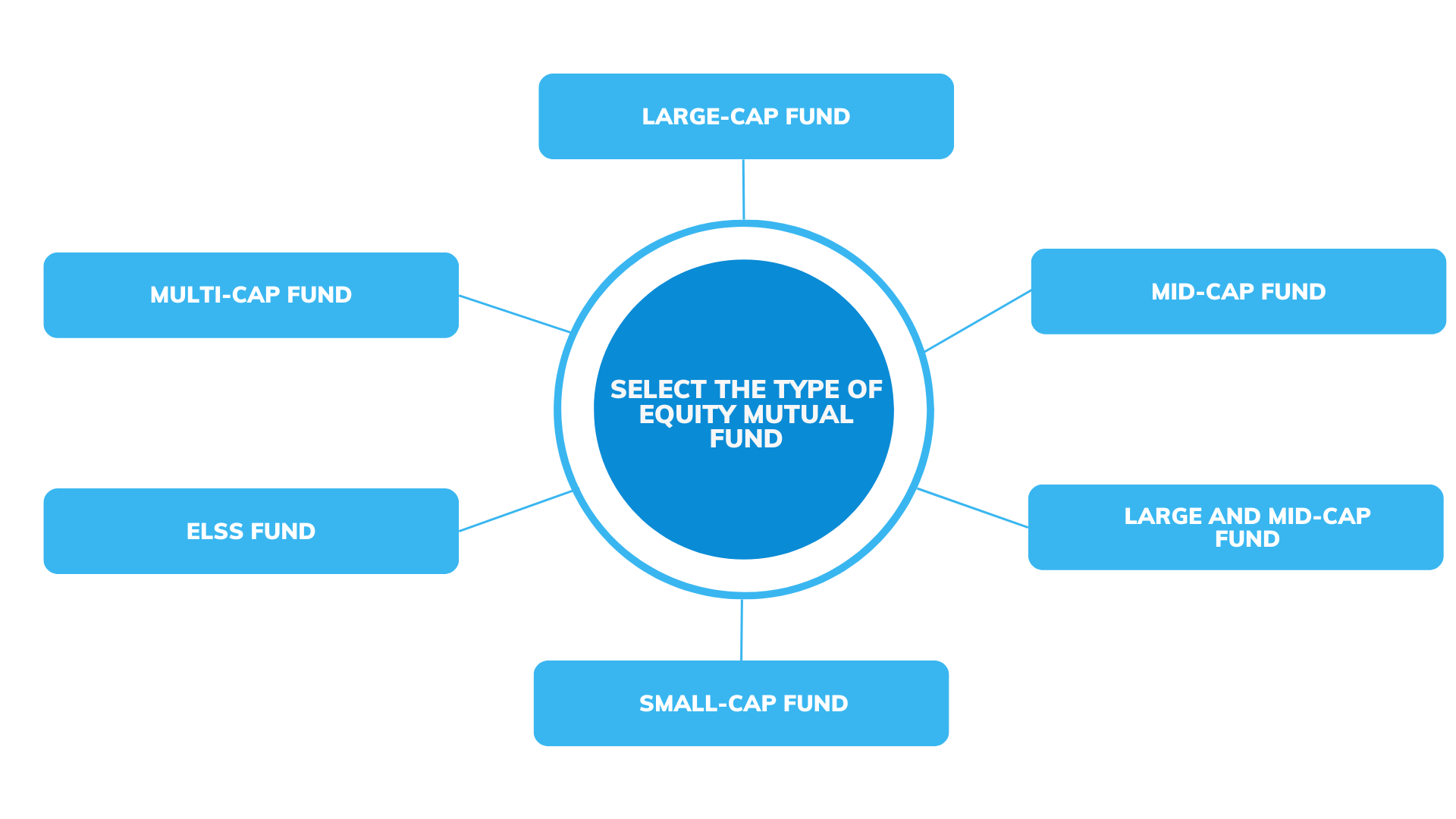

Step one: Select the type of equity mutual fund

There are a total of 11 different types of equity mutual funds. The common ones based on market capitalization are namely;

Large-cap fund:

These funds invest 80% of their assets in the equity shares of large-cap companies. In other words, the top 100 companies with respect to market capitalization. They focus on investing in companies having moderate risk and minimum fluctuations. Large-cap funds provide more stability than mid-cap or small-cap funds.

Mid-cap fund:

These funds invest 65% of their assets in the equity shares of mid-cap companies i.e., the top 101-250 companies with respect to market capitalization. They provide better returns than large-cap funds but are also subjected to more volatility.

Large and Mid-cap fund:

These funds are a combination of large and mid-cap funds. They invest 35% each in the assets of large and mid-cap companies (35% in the top 100 companies and 35% in the top 101-250 companies with respect to market capitalization). These funds try to give the best of both worlds by offering sufficient returns at lower volatility.

Small-cap fund:

These funds invest 65% of their assets in the equity shares of small-cap companies i.e. 125 and below companies, with respect to market capitalization. They offer great returns but are highly volatile.

Multi-cap fund:

These funds provide a diversified portfolio by investing in large-cap, mid-cap, and small-cap companies. Earlier, the fund managers would proportionately invest according to their expertise and speculation. However, SEBI has mandated that multi-cap funds must invest 25% in each fund with effect from 31st January 2021.

ELSS Fund:

Equity Linked Savings Scheme is a tax-saving fund. Under Section 80C of the Income Tax Act, they offer tax exemption of up to Rs. 1.5 lakh a year. These funds invest in equity instruments and have a lock-in period of three years. At the end of the third year, the income that you will earn from this fund will be considered as LTCG (Long Term Capital Gain) which will be applicable to a 10% tax (if it is above Rs. 1 Lakh)

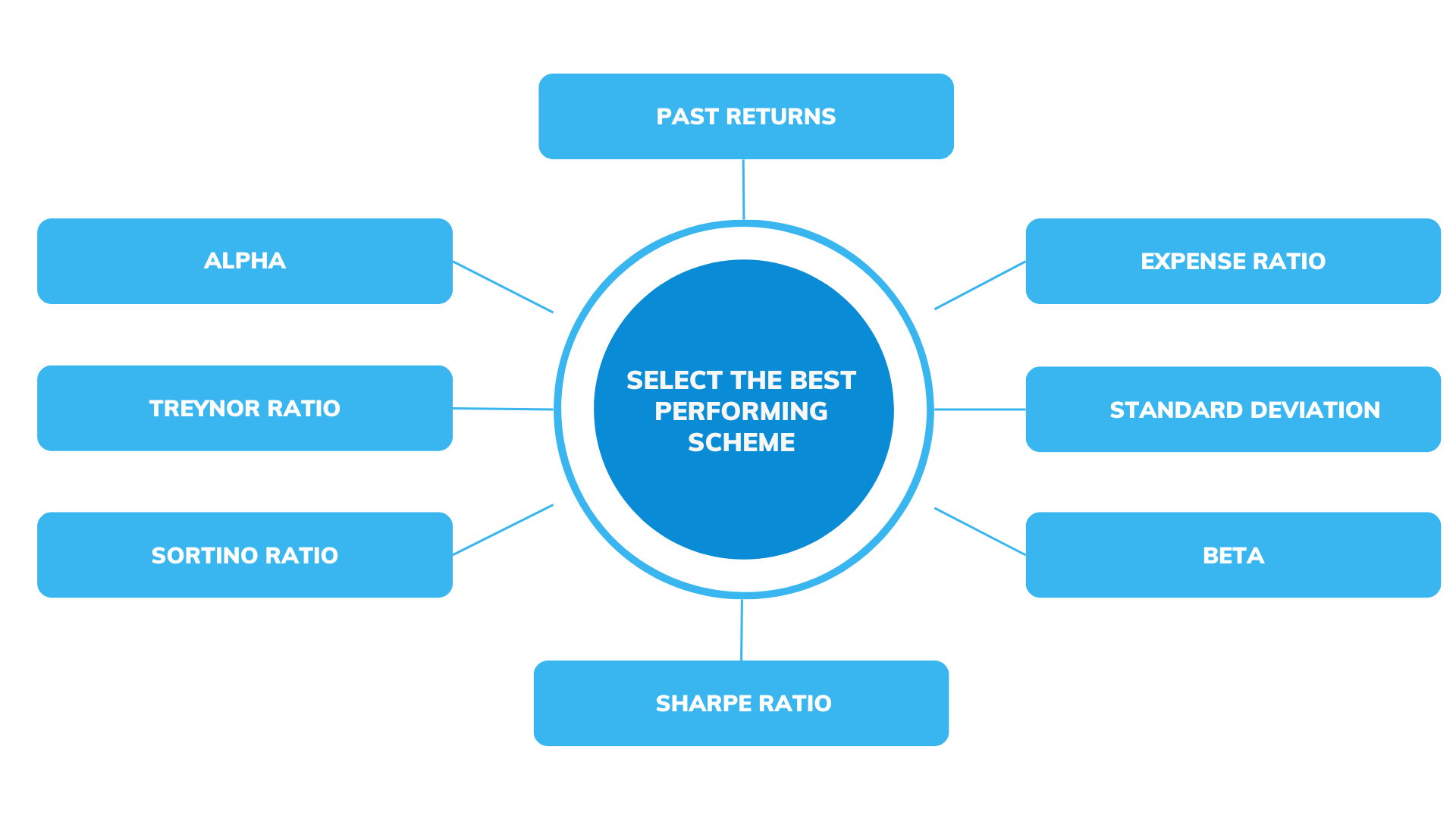

Step two: Select the best performing scheme

These are the parameters you need to check before selecting an investment scheme. They will help determine how successful an investment could be during risks and market fluctuations.

Past Returns:

Make sure to analyze the past returns (CAGR) in comparison to its peers, the benchmark, and category average.

A benchmark is an index against which you can measure the performance of a mutual fund. It compares the difference between the long-term returns against the target of the mutual fund. For instance, if an equity fund uses Sensex as its benchmark, the returns of the mutual fund will be compared to the performance of Sensex.

According to SEBI, it must use the TRI (Total Return Index) indices as the benchmark for their performance. Performance against peers and category means that you need to carry out a comparison between the performance of companies that are in the same sector or industry and also between the type of mutual fund scheme like large-cap, mid-cap, etc.

Choose the equity mutual funds that beat all these criteria at a consistent rate.

Expense Ratio:

It is a fee charged by the AMC for managing and administering your investments. Remember that direct mutual funds have no distribution commission and hence have a lower expense ratio than the regular ones. Overall, lower the expense ratio, better the net returns.

Standard Deviation:

It is a tool to measure the deviation of a fund’s returns by comparing it to its average returns based on the fund’s past performance. It indicates the volatility of the fund. A lower standard deviation is always a preferred choice.

Beta:

A Beta conveys how sensitive a mutual fund is in terms of the ups and downs of the market. The beta is taken as 1. A beta higher than 1 indicates higher volatility and a beta lower than 1 denotes lower volatility. For people having a low or medium risk appetite, a fund having a lower beta value is desirable.

Sharpe Ratio:

It shows the returns generated per unit of a risk. A Sharpe ratio above 1 is considered as an excellent value. It is calculated by comparing the returns generated by the mutual fund to that of a risk-free asset. These excess returns are viewed as the revenue inflow earned for the extra risk taken. Therefore, a higher Sharpe ratio indicates better risk-adjusted returns for the mutual fund.

Sortino Ratio:

It is a statistical tool that measures the performance of an investment according to the downside risk, unlike Sharpe ratio (which measures both upward and downward fluctuation)

While the Sharpe ratio uses standard deviation in the denominator, a Sortino ratio uses downside deviation.

Treynor Ratio:

Your investments are broadly subjected to namely two types of risks, company risk, and market risk. A Treynor ratio is another tool similar to the Sharpe ratio except it only takes market risks into account instead of total risk and uses beta as the denominator. The funds with a higher Treynor ratio are always better than the ones with a lower Treynor ratio.

Alpha:

Alpha indicates the performance of a mutual fund against its benchmark index. A negative alpha means that the performance was below satisfactory. Hence, you should only select an equity mutual fund that has a positive alpha.

Conclusion:

Investing in equity mutual funds is beneficial if you plan on staying for the long term. But the decision to invest in equity or not ultimately depends on your risk tolerance, goals, and preferences.

However, if you still have doubts and are unsure whether equity mutual funds are apt for your desires and objectives, you should try reaching out to a financial advisor. They will aid your financial needs by offering their expertise to manage your wealth and monitor all your investments securely. Having expert assistance will give you assurance while investing in equity mutual funds or any other investment schemes that deem fit.

Make sure to follow the investment path that leads you to your financial target.

Disclaimer: The views expressed in the blog are purely based on our research and personal opinion. Although we do not condone misinformation, we do not intend to be regarded as a source of advice or guarantee. Kindly consult an expert before making any decision based on the insights we have provided.

Related Posts

Stay up-to-date with the latest information.