All you need to know about Tax saving under section 80C

Advance Tax Provisions – FFC episode 33

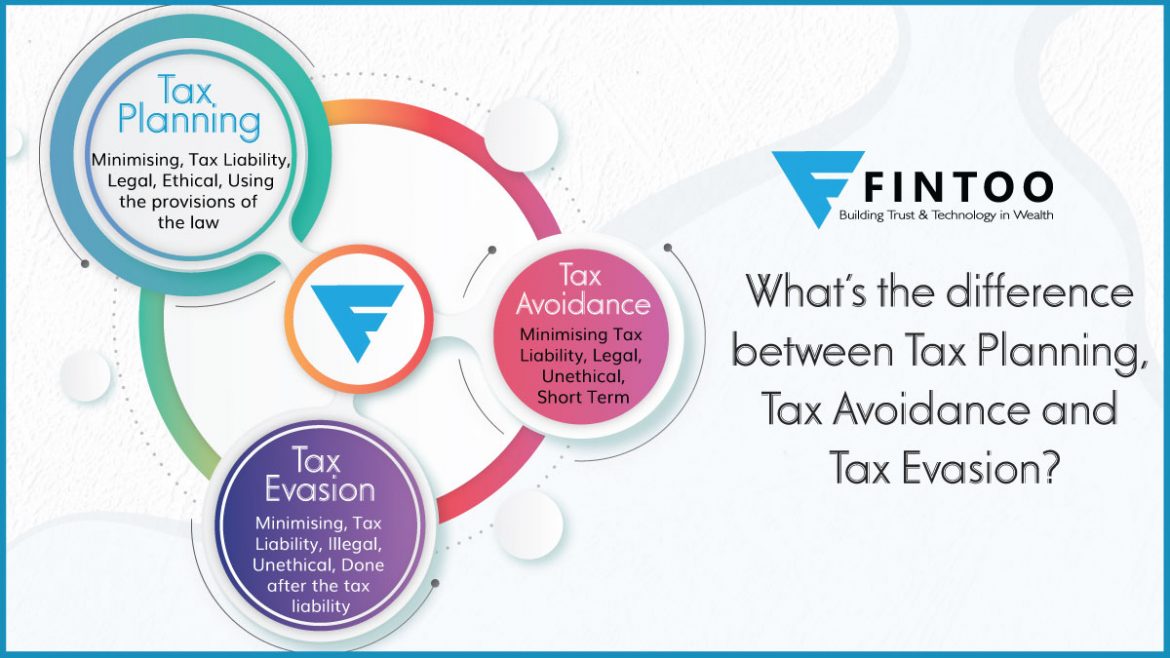

Difference Between Tax- Planning, Avoidance & Evasion

How to Save Income Tax? Tax Saving Guide.

Best Tax Saving Instruments to Maximise Your Corpus

TO AVOID UNNECESSARY TAXES, IT PLANNING.

Tax Planning And The Different Tax Saving Tools.

10 Income Tax Return Filing Tips To Remember

Saving Tax On Long Term Capital Gain