I am planning to sell land. How can I save on tax?

Advance Tax Provisions – FFC episode 33

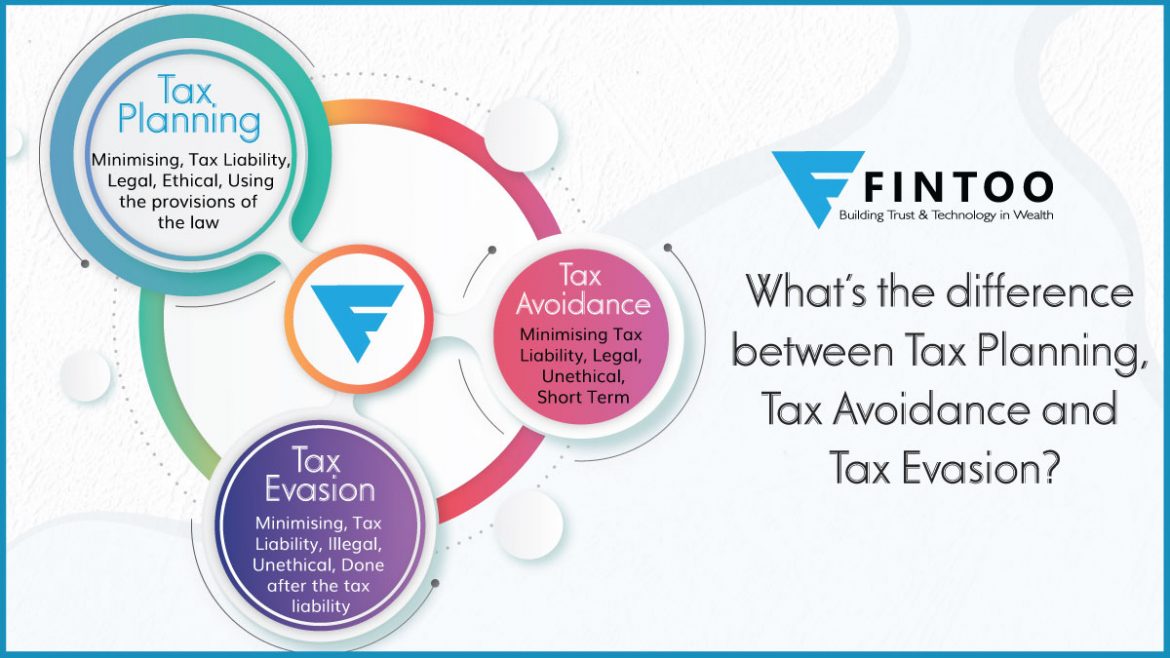

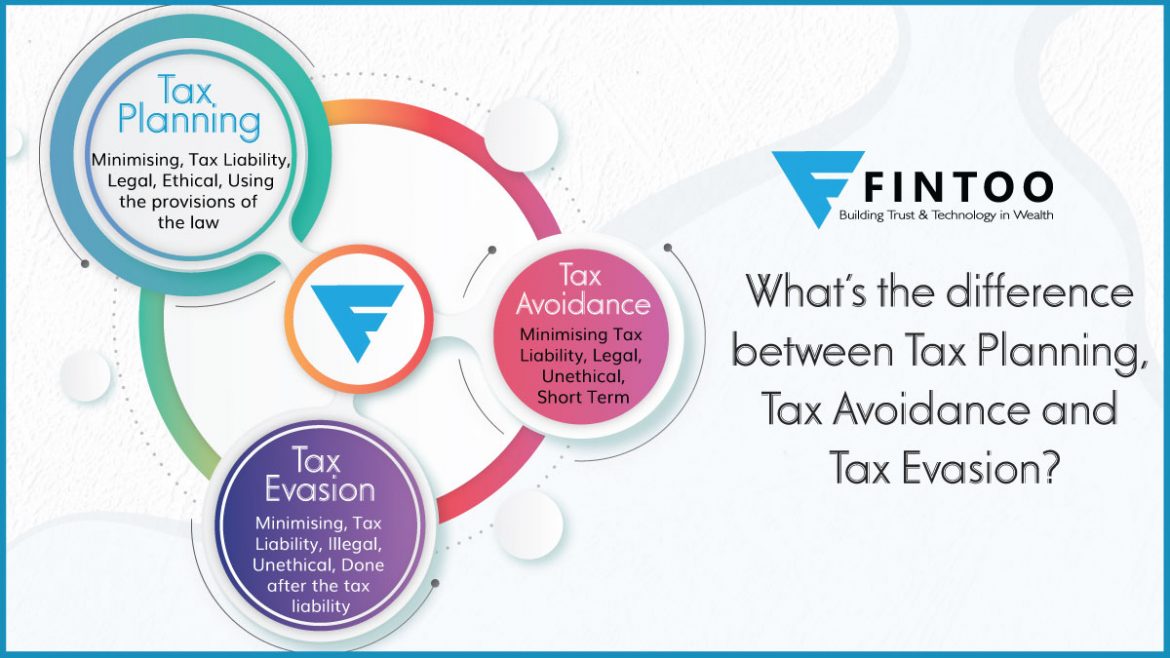

Difference Between Tax- Planning, Avoidance & Evasion

How to Save Income Tax? Tax Saving Guide.

Best Tax Saving Instruments to Maximise Your Corpus

TO AVOID UNNECESSARY TAXES, IT PLANNING.

Decoding Budget 2021

How to select a suitable Tax regime for Yourself?

Old vs New tax regime – Check what Mr. Shah opted for?