Are Target Maturity Funds An Alternative To Bank FDs?

5 Personal finance trends to consider in 2023

P2P Lending Decoded

7 Key Differences Between UPI and e-RUPI

Things To Do At The Start Of The Financial Year

Union Budget 2022 Highlights – Economy, Digital assets, Infrastructure and more

The Four Pillars of Personal Finance

Wealth Habits – Learn, Unlearn and Relearn

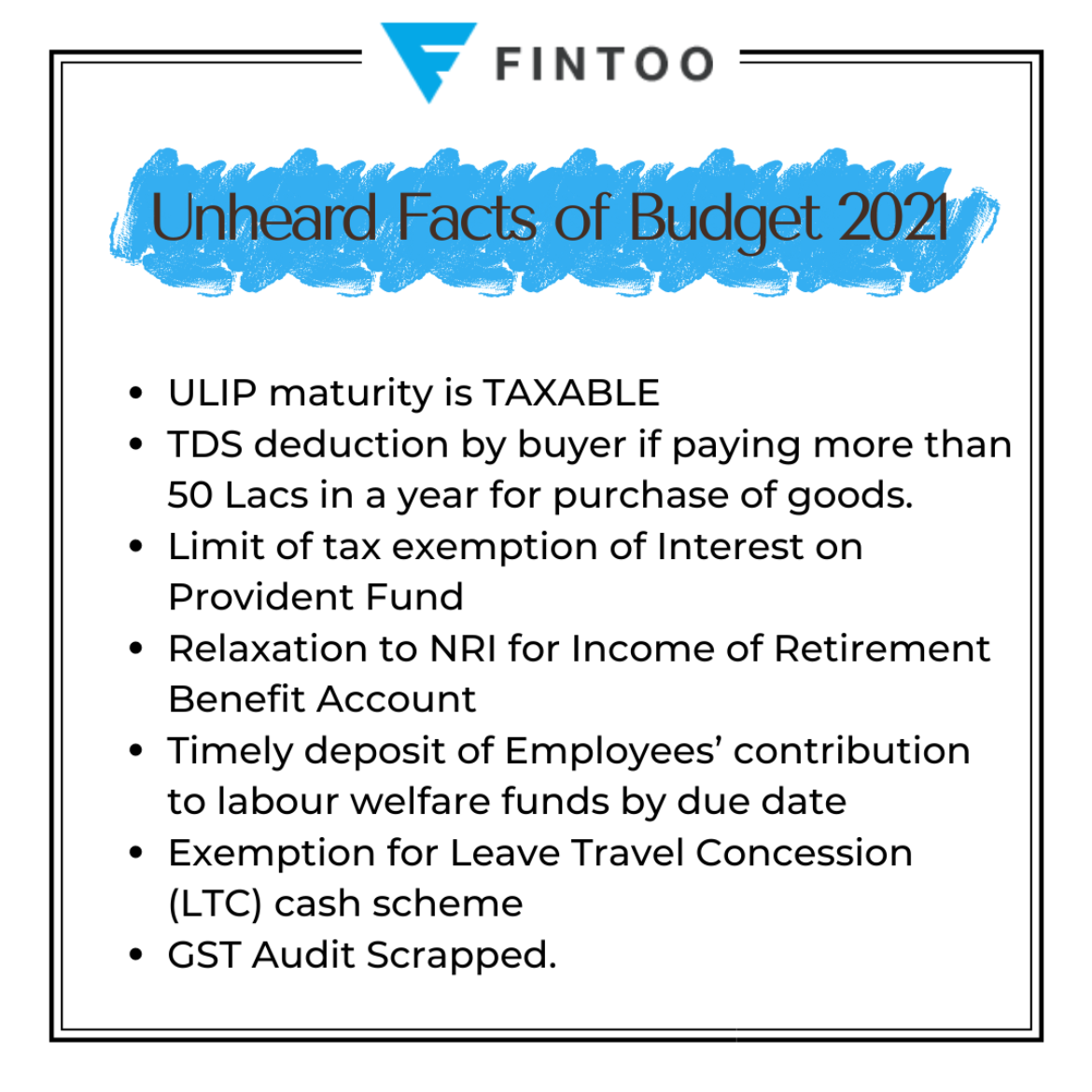

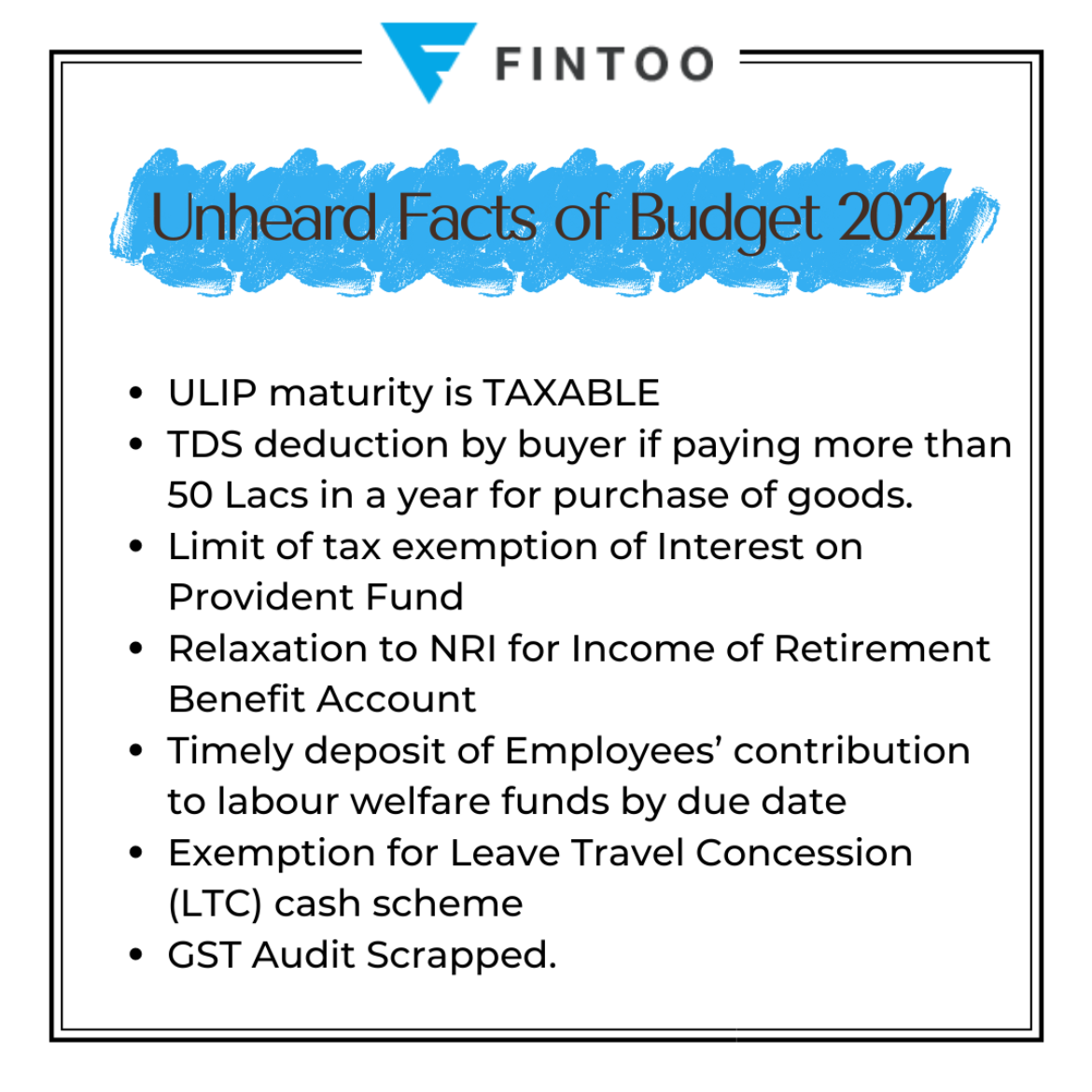

Unheard Facts of Budget 2021