How to Check Income Tax Refund Status Online?

ITR Filing Online Process Step-By-Step

Advance Tax Provisions – FFC episode 33

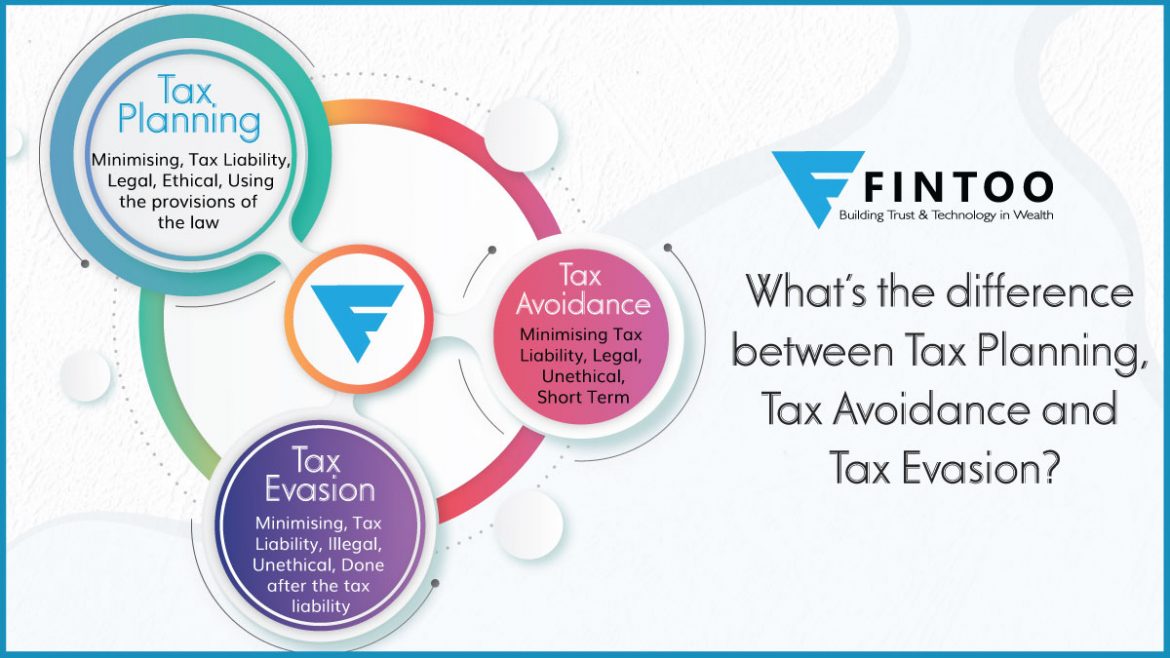

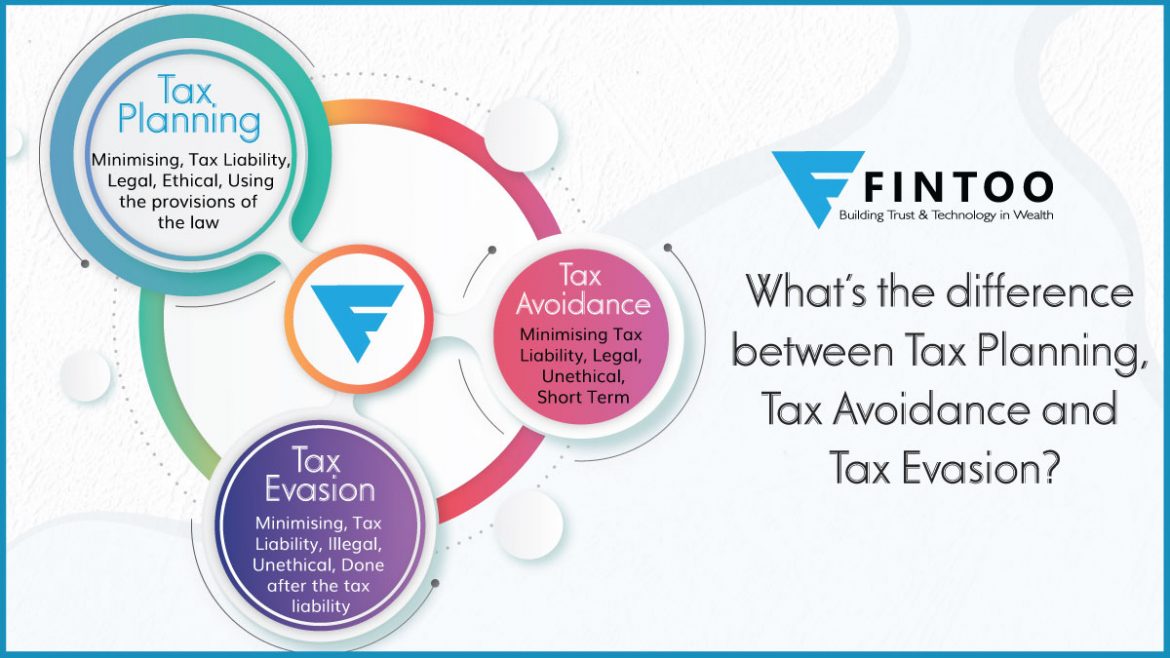

Difference Between Tax- Planning, Avoidance & Evasion

TO AVOID UNNECESSARY TAXES, IT PLANNING.

ULIPs with an annual premium above ₹2.5 lakh to be taxed

What Happens If You Forget To File Your ITR?

How To Find Out Which ITR Form To Fill?

5 Major Types of Taxes We Pay In India