When it comes to investing in the stock market, it is always better to become a long term investor rather than becoming a trader. It is relatively highly risky to do intraday trading or trade in futures and options. As an investor, one should focus on creating long term wealth through equity markets and not just short term gains which are based merely on chance. We all understand that gambling only works when luck is on your side. So why get into all that and expose your money to greater chances of loss.

The stock market is no doubt an amazing investment avenue to create wealth if used in the right way. One needs to make informed decisions regarding financial investments. When we say stock market, it does not only mean Indian Stock Market. Investing in stocks is like investing in companies that you have confidence that will grow in the future. This means not only Indian companies but also international stocks have a great scope in growth when it comes to stock investing.

What are the goods and services you use on a daily basis?

Think about watching movies on Netflix, placing orders on Amazon, using an Apple’s iPhone or the most used search engine – Google. All these companies are based internationally and are listed on international stock exchanges.

Don’t you want to invest in these companies, the product/services of which you are using intensively on a regular basis?

So, in keeping with the view of going global, let us see some benefits of investing internationally.

Global Diversification

This is one of the most important benefit of all as there is a tendency of investing a major part of the portfolio in Indian/ domestic equity market. Investors usually ignore the benefits of diversification into the international equity market owing to unfamiliarity. In India, approximately 99% of investors invest only in Indian stock market which indicates resistance to invest globally.

Another fact is that India accounts for only 3% of the global market capitalization. It means even if you think you are diversifying your money among different sectors, you are only being exposed to a tiny part of what the world is offering.

The major problem with restricting yourself to only domestic markets is that it raises your portfolio’s concentration risk of investing in just one economy.

The strategy should be to diversify your investments across nations whose market cycles are not perfectly correlated. As we all know, there is volatility in stock markets. Thus, it is recommended to not make all your investments in a particular region.

If your money is spread out among various countries, then an economic crash in one country won’t affect other investments. A globally diversified portfolio helps you take advantage of market cycles in different countries and better manage the risk.

Related Article: 10 Tips to Raise Equity Investment in 2020-21

Some of the other benefits are:

- More options to invest: Investing in global markets will open a plethora of different stocks to invest in. With proper research, one can shortlist the stocks. Currently, many equity investment opportunities are in sectors that are not available on Indian stock exchanges. These sectors include Consumer Internet such as Facebook, E-commerce giants such as Amazon, Consumer brands such as Nike, and Payments such as Visa and MasterCard.

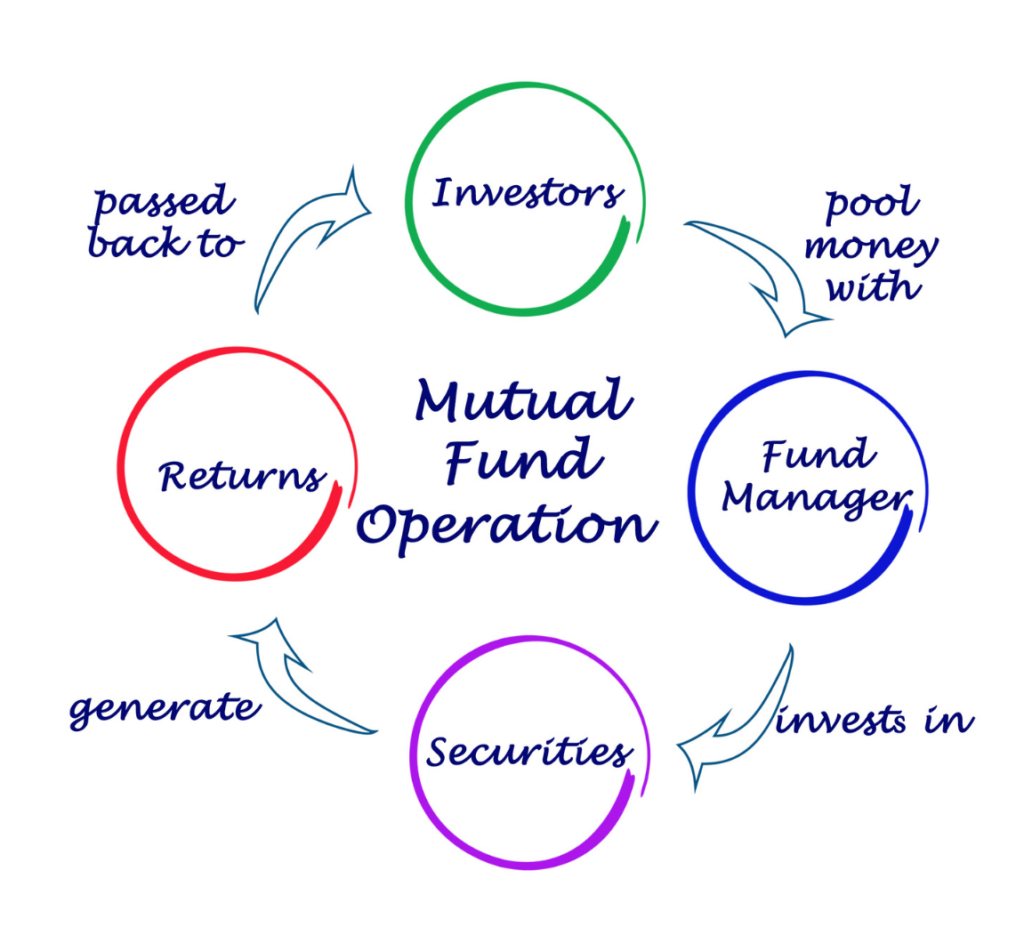

- More ways to invest: There are also many ways by which you can invest globally. These are direct stock investments, ETFs, and mutual funds. On one hand, mutual funds are the easiest way for investors to have international exposure. On the other hand, it takes a little more advanced knowledge to invest in ETFs.

- Mutual Fund route: One of the compelling reasons to invest globally is “It is very simple”. It is convenient to do so easily through mutual funds. You can opt for this route if you are a comparatively conservative investor. Fund houses offer international funds where you can leverage the expertise of global fund managers. Many Indian fund houses have schemes like fund of funds that invest in overseas equities. You can invest in these funds like any other mutual fund. You can also invest via the SIP route, with a minimum of Rs. 500 per month.

- Protection/Insurance – No need to worry about the safety of your money invested in international markets. When investing abroad, many financial institutions are able to protect your investments. For example, if you are looking to invest in US markets, Securities Investor Protection Corporation provides insurance to your account up to $5,00,000. Please note that it is not applicable to general losses in the stock market.

- Confidentiality– Global investments come with confidentiality concerns about your finances. International financial institutions are not legally required to divulge your monetary details to anyone. So you can consider your information to be safe at all times.

- More Growth – It is expected that your portfolio will show better growth when exposed to international stocks. The combination of Indian and international stocks will work best in your favor. There is an increased return potential in overseas investments.

- Currency Risk – Another reason is to take advantage of the depreciating currency. It is a good idea to have a globally diversified portfolio. As it is suggested to diversify your portfolio among different economies, internationally diversified portfolios will also be exposed to different currencies from country to country.

- Tax-efficient – Attractive tax incentives are offered by many countries across the world to foreign investors. These incentives are subject to strengthen other country’s investing environments as well as attract outside wealth. These incentives or benefits differ from country to country.

- Lower and better-managed Risk – Another crucial argument in favor of global investing is that different markets have different risk levels. Developed markets tend to have a lower risk. Also, one should be aware that different markets behave differently. Thus, it offers the scope of returning better risk-adjusted returns.

Related Article : 4 Important Financial ratios to check before Investing

Conclusion

In today’s world of interconnectivity, nothing seems to be out of reach in the world. You can buy from any part of the world even if you are in the remotest corners of the globe. But when it comes to investing, why do we resist going global? Adding a global flavour to your current investments will truly diversify your portfolio, unlike a portfolio that has invested 100% into Indian markets that only provides partial diversification.

Having said all of the above, it is highly recommended to consult a financial advisor to get a learned understanding of various global economies and markets. This way you will make informed global investments, which is always better than the “All eggs in one basket” approach. Start Diversifying! Start investing!

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning without any cost on: http://bit.ly/Robo-Fintoo

To Invest and keep regular track of your portfolio download: Fintoo App Android http://bit.ly/2TPeIgX / Fintoo App iOS http://apple.co/2Nt75LP‘

Disclaimer: The views shared in blogs are based on personal opinion and does not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the sole decision of the investor and the company or any of its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.